Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.10 12:08

Forex Weekly Outlook January 12-16

Inflation data in the UK and the US, US retail sales, PPI and

employment data, Philly Fed Manufacturing Index and Consumer sentiment

are the main events on Forex calendar. Here is an outlook on the

highlights of this week.

Last week, NFP report was better than expected showing a job gain of

252K in December. The solid increase indicates further strengthening in

the US economy. The Unemployment rate fell 0.2% to a 6-1/2 year low of

5.6%, beating forecasts for a 5.7% reading. However, average hourly

earnings which showed a 6 cents increase in November, dipped 5 cents in

December. Long-term unemployed continued to shrink in December, but

the labor force participation rate fell to 62.7% from 62.9% in

November. Will wage growth in the US labor market continue improve in

the coming months?

- UK inflation data: Tuesday, 9:30. UK consumer prices plunged to a twelve year low of 1% in November, reaching half the BoE’s inflation target. The reading was worse than expected caused by a sharp and continuous decline in oil prices. However the low oil prices were positive for consumers, boosting spending and supporting UK growth. The Bank’s monetary policy committee said in its November inflation is likely to fall below 1% in early 2015. UK consumer prices are expected to increase by 0.7%.

- US retail sales: Wednesday, 13:30. U.S. consumer spending edged up in November amid the holiday shopping season, boosted further by lower gasoline prices. Meanwhile, retail sales excluding automobiles, gasoline, building materials and food services rose 0.6% after an unrevised 0.5% gain in October. Economists expected core sales to rise a mere 0.1% last month. The shopping spree accelerated growth in the fourth quarter. Retail sales are expected to gain 0.2%, while Core sales are predicted to increase by 0.1%.

- Australian employment data: Thursday, 0:30. Australia’s unemployment edged up to 6.3% in November as more people looked for jobs. Economic activity weakened by sluggish Chinese demand. However the Australian job market added 42,700 positions in November, much better than the 13,700 increase posted in the prior month and the 15,000 addition forecasted by analysts. This rise suggests improvement in the Australian labor market. Policymakers are preparing for further easing measures in case the weakness in the job market and domestic demand continues. Economists expect job growth to increase by 5,300 while the Unemployment rate is expected to remain unchanged at 6.3%.

- US PPI: Thursday, 13:30. Producer Price Index fell 0.2% in November prompted by lower oil prices, following a 0.2% gain in the prior month. Analysts expected a smaller decline of 0.1%. On an unadjusted basis, producer prices increased 1.4% for the 12 months ended November, the slowest 12-month increase since February 2014. Core producer prices, excluding food and energy remained unchanged after a 0.4% rise in November. Producer Price Index is expected to drop 0.3% this time.

- US Unemployment claims: Thursday, 13:30. The number initial claims for unemployment benefits declined last week by 4,000 to 294,000 amid a sharp decrease in dismissals. Strong consumer spending had a positive effect on the labor market, despite a weakening in global economy. The four-week moving average a more solid measure of labor market trends, remained below the 300,000 mark for the 17th straight week. Jobless claims is expected to reach 299,000 this week.

- US Philly Fed Manufacturing Index: Thursday, 15:00. Factory activity in the U.S. mid-Atlantic region plunged to 24.5 in December from 40.8 in the previous month, indicating slower activity. New orders fell to 15.7 from 35.7. Employment conditions weakened to 7.2, down from 22.4 marking the lowest level since April. Philly Fed Manufacturing Index is predicted to reach 20.3 this time.

- US Inflation data: Friday, 13:30. U.S. consumer prices registered their biggest decline in nearly six years in November amid a slide in gasoline prices. Consumer Price Index plunged 0.3%, following flat reading in October. On a yearly base CPI increased 1.3% the smallest gain in nine months, after posting a 1.7% rise in October. While inflation declines, the US job market continues to strengthen including a big gain in weekly earnings. Meanwhile, Core CPI excluding food and energy prices gained 0.1% following a 0.2% rise in the previous month. The rise suggests oil prices are the main cause for the sharp declines. Analysts expect consumer prices to dip 0.3% while Core prices are expected to increase 0.1%.

- US Prelim UoM Consumer Sentiment: Friday, 14:55. U.S. consumer sentiment surged in December to a near eight-year high amid improved earnings and better job prospects. Consumer sentiment edged up to 93.8 from 88.8 in November. The survey’s one-year inflation expectation rose to 2.9 percent from 2.8 percent, while its five-year inflation outlook also rose to 2.9 percent from 2.6 percent last month. Economists expect consumer sentiment to rise further to 94.2 this time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.11 13:53

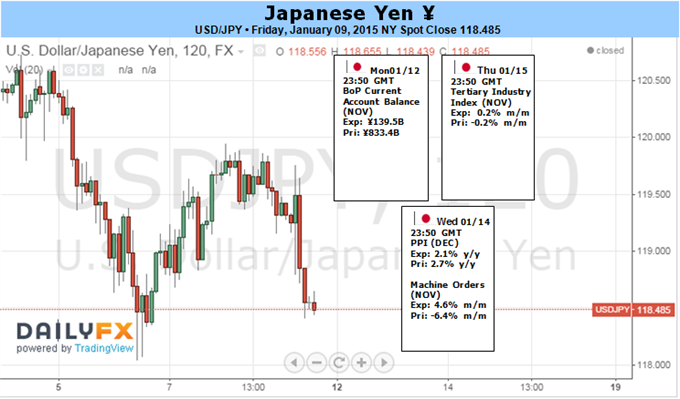

USDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Japanese Yen: Bullish

- Japanese Yen could continue higher versus the US Dollar

- Caution urged as USDJPY tests key trendline support

The Japanese Yen snapped a multi-week losing streak for the US Dollar as it rallied noticeably off of recent lows. A slowdown in global economic event risk may produce smaller moves ahead, but we’re watching key levels on the USDJPY as the risk of a larger JPY correction grows.

Traders sent the Japanese currency near fresh multi-year lows into the final trading days of 2014, but an important bounce in the New Year suggests conviction in the JPY-short trade (USDJPY-long) has faded. Price action seems remarkably similar to what happened exactly 12 months ago: the USDJPY topped on the first trading day of 2014 on its way to a four percent correction. A comparable move would send the Dollar to ¥115 before a resumption in the overall uptrend.

A relatively quiet week in both Japan and the US nonetheless suggests traders may wait until the following week’s highly-anticipated Bank of Japan policy meeting to force big Yen moves. Yet traders should keep a close eye on USDJPY price action as it trades at potentially significant price support, and a break below month-to-date lows near ¥118 could force a larger move towards December’s trough at ¥115.60.

A strong correlation between the Japanese Yen and the Nikkei 225/US S&P 500 tells us the next big USDJPY move could coincide with equity market turmoil. An important drop in the S&P Volatility Index (VIX) shows that few fear any such tumbles, but market conditions can and do change quite quickly.

Overall outlook for the Dollar and Japanese Yen in 2015 make a USDJPY-long position one of our favorite trades of the year. Yet a year is a long stretch of time in trading markets, and prices do not move in straight lines. We are cautious on fresh USDJPY-long positions given clear risk of a larger short-term correction—particularly ahead of the Bank of Japan meeting on January 20.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.13 08:56

Japan Eco Watchers' Current Index Rises More Than Expected In December (based on rttnews article)

A measure of people's assessment of the Japanese economy improved in December after worsening in the previous two months, survey figures from the Cabinet Office showed Tuesday.

The current index of the economy watchers survey rose by 3.7 points to 45.2 in December from 41.5 in November. Economists had forecast the index to rise to 44.0.

A reading above 50 suggests optimism and a score

below 50 indicates pessimism. The latest increase was the first in three

months.

Meanwhile, the outlook index climbed to 46.7 in December from 44.0 in the prior month. It was the highest score since September, when it was at 48.7.

Marcel Thieliant, a Japan economist at Capital Economics noted that the strong rebound in the Economy Watchers Survey in December stands in stark contrast with other business surveys which mostly weakened last month.

The economist said he would place more weight on small business confidence and the PMIs, which on balance worsened at the end of last year and remain consistent with falling industrial output.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.14 08:14

USD/JPY Lower (based on benzinga article)

The U.S. Dollar is trading lower against Japan's Yen in afternoon trading. Some market chatter is looking ahead to the Bank of Japan next week and is expecting the BOJ to cut Japan's core CPI forecast to 1.5 percent from 1.7 percent.

The USD/JPY is trading weak and for the most part is reacting to moves in the U.S stock market. The USD/JPY pair is trading at 117.96, down 0.37.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video January 2015

newdigital, 2015.01.14 08:10

USD/JPY hits 117.0, Gold above $1240, Crude slumps to $44 on demand fears CMC Markets 13th JanForum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.14 18:05

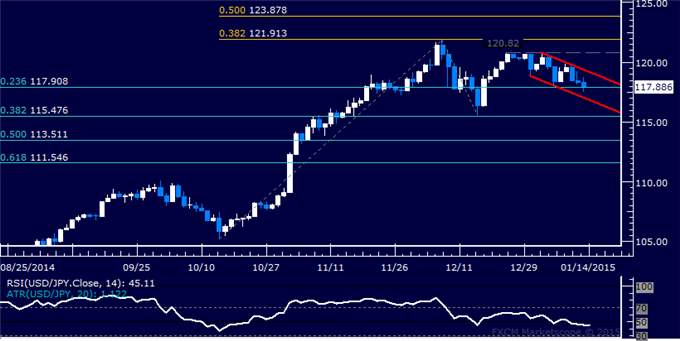

USD/JPY Technical Analysis: Support Below 118.00 Pressured (based on dailyfx article)

| Resistance | Support |

|---|---|

| 119.16 | 117.91 |

| 120.82 | 116.87 |

| 121.91 | 115.48 |

The US Dollar is testing the bottom of now-familiar range support below the 118.00 figure against the Japanese Yen once again. Near-term support is at 117.91, the 23.6% Fibonacci retracement, with a break below that on a daily closing basis exposing falling channel support at 116.87. Alternatively, a reversal above channel top resistance at 119.16 opens the door for a test of the December 23 high at 120.82.

Prices are too close to support to justify entering

short from a risk/reward perspective. On the other hand, the absence of a

defined bullish reversal signal suggests that taking up the long side

is premature. With that in mind, we will remain flat for now.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video January 2015

newdigital, 2015.01.15 10:51

Euro Range in Focus- USD/JPY Downside Targets Remain Favored

EUR/USD may continue to face range-bounce prices ahead of the European Central Bank (ECB) policy meeting as market participants look for a QE announcement.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.15 20:51

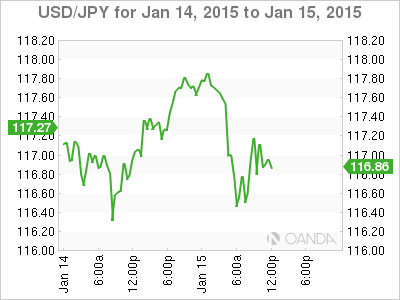

USD/JPY Technical Analysis: Yen Touches 1-Month High (based on dailyfx article)

- USD/JPY Technical Strategy: Flat

- Support: 116.64, 115.48, 113.51

- Resistance: 117.91, 118.96, 120.82

The US Dollar edged lower for a fourth consecutive day against the Japanese Yen,

dipping to the lowest level in a month. A daily close below falling

channel floor support at 116.64 exposes the 38.2% Fibonacci retracement

at 115.48. Alternatively, a reversal above the 23.6% Fib retracement at

117.91 opens the door for a test of channel top resistance at 118.96.

Risk/reward considerations argue against entering short with prices in close proximity to support. On the other hand, the absence of a defined bullish reversal signal suggests taking up the long side is premature. We will remain flat for now, waiting for a more actionable opportunity to present itself.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.16 09:20

USD/JPY - Yen Posts Gains As U.S. Unemployment Claims Jumps (based on seekingalpha article)

The Japanese yen continues to move higher, as the pair trades in the

high-116 range on Thursday. On the release front, Japanese Core

Machinery Orders improved to 1.3%, but this was well below expectations.

Later today, Japan will release Tertiary Industry Activity. The markets

are expecting a gain of 0.3%. In the US, Unemployment Claims was

unexpectedly weak, jumping to 316 thousand. PPI posted a decline of

0.3%, matching the forecast. The Empire State Manufacturing Index rose

to 10.3 points and we’ll get a look at the Philly Fed Manufacturing

Index later in the day.

| S3 | S2 | S1 | R1 | R2 | R3 |

|---|---|---|---|---|---|

| 113.64 | 115.56 | 116.69 | 117.94 | 118.69 | 119.83 |

US employment numbers slipped on

Thursday, as Unemployment Claims surprised with a reading of 316

thousand. This was well above the estimate of 299 thousand and was the

highest reading since June 2014. However, the first full week of the

year often shows a spike in claims, since holiday workers are dismissed,

resulting in a higher number of claims. Earlier in the week, JOLTS Jobs

Openings climbed to 4.97 million, easily beating the forecast of 4.86

million. This is the indicator’s highest level since January 2001. The

strong employment numbers are a welcome result of the robust economy, as

the deepening recovery fuels demand for more workers. The health of the

labor market is an important component of any decision to raise

interest rates, so upcoming employment releases will be under the market

microscope as the Fed mulls when to raise interest rates.

Earlier in the week, US retail sales caught the markets off guard with sharp declines in the December readings. Core Retail Sales came in at -1.0%, while Retail Sales followed suit with a loss of 0.9%. Both key indicators recorded their worst showings since May 2010. However, retail sales were solid in the past two months, so the numbers for Q4 will be in positive territory.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.16 12:03

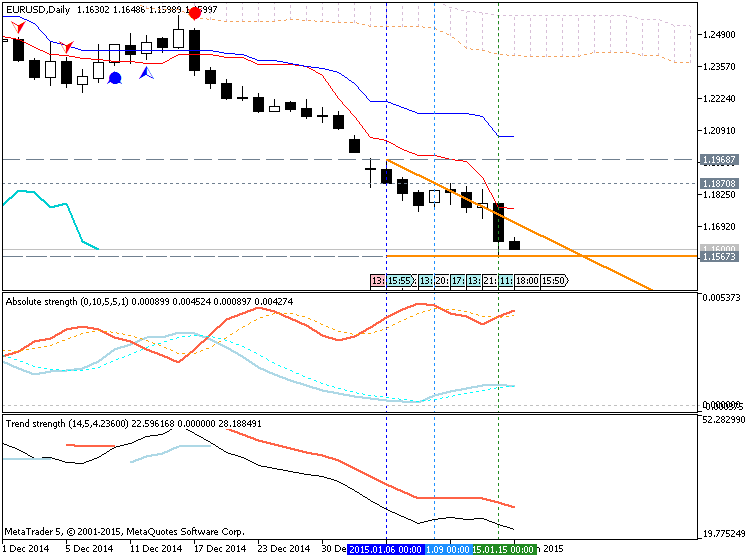

Trading the News: U.S. Consumer Price Index (CPI) (based on dailyfx article)

- U.S. Consumer Price Index (CPI) to Mark Slowest Pace of Growth Since 2009.

- Core Rate of Inflation to Hold at Annualized 1.7% for Second Month.

A marked slowdown in the U.S. Consumer Price Index (CPI) may trigger a

short-term squeeze in EUR/USD should the development dampen the Federal

Open Market Committee’s (FOMC) scope to normalize monetary policy sooner

rather than later.

What’s Expected:

Despite expectations for a rate hike in mid-2015, the Fed may sound

increasingly cautious and preserve its highly accommodative policy

stance beyond schedule as the central bank struggles to achieve its

mandate for price stability.

Nevertheless, improved business confidence paired with the pickup in

economic activity may limit the downside risk for price growth, and the

stickiness in core inflation may heighten the appeal of the greenback as

a growing number of central bank officials show a greater willingness

to normalize monetary in 2015.

How To Trade This Event Risk

Bearish USD Trade: U.S. CPI Slips to Annualized 0.7% or Lower

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

EUR/USD Daily Chart

- EUR/USD remains at risk for a further decline as long as the RSI pushes deeper into oversold territory.

- Interim Resistance: 1.1840-50 (50% expansion)

- Interim Support: 1.1500 pivot to 1.1565 (weekly low)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| NOV 2014 |

12/17/2014 13:30 GMT | 1.4% | 1.3% | -116 |

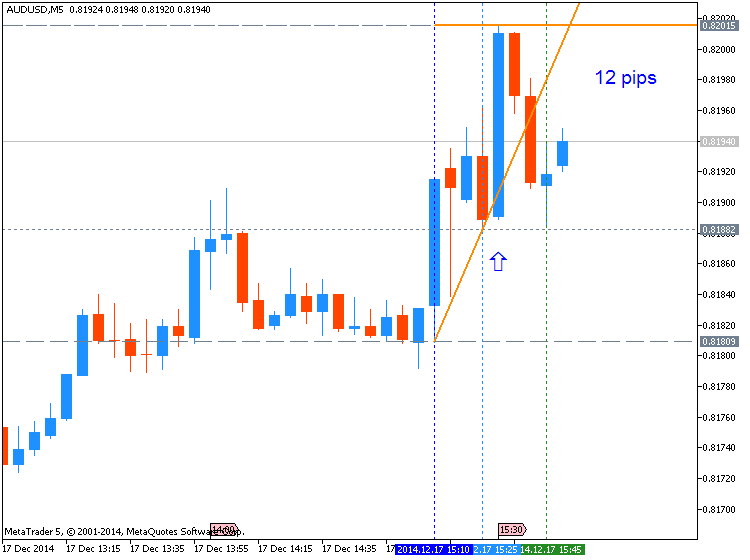

AUDUSD M5: 12 pips price movement by USD - CPI news event:

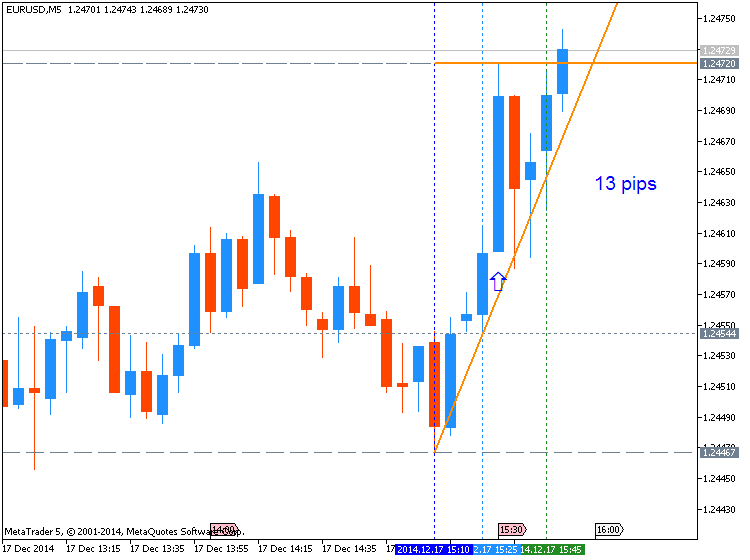

EURUSD M5: 13 pips price movement by USD - CPI news event:

The U.S. Consumer Price Index (CPI) slowed to an annualized rate of 1.3%

from 1.7% in October on the back of falling energy prices, with the

core rate of inflation narrowing to 1.7% from 1.8% during the same

period. Indeed, subdued price pressures raise the risk of seeing the Fed

further delay its first rate hike, but it seems as though the central

bank will normalize monetary policy in 2015 as the committee anticipate

the drop in oil prices to have an positive impact on the real economy.

Despite the initial tick higher in EUR/USD, the dollar remained

resilient against its European counterpart as the pair slipped below the

1.2400 handle during the North American trade to end the day at 1.2343.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

USDJPY M5: 44 pips price movement by USD - CPI news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bullish with the secondary correction started on open bar:

W1 price is on primary bullish with the correction started in the middle of December last year.

MN price is on bullish market condition which was stopped by 121.83 resistance.

If D1 price will break 118.05 support level so the bearish breakdown will be continuing

If D1 price will break 120.74 resistance level so it will be the market rally

If not so we can see the flat within the bearish market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDJPY price movement for this coming week)

2015-01-12 23:50 GMT (or 01:50 MQ MT5 time) | [JPY - Current Account]

2015-01-13 05:00 GMT (or 07:00 MQ MT5 time) | [JPY - Economy Watchers Sentiment]

2015-01-14 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Retail Sales]

2015-01-14 23:50 GMT (or 01:50 MQ MT5 time) | [JPY - Core Machinery Orders]

2015-01-15 23:50 GMT (or 01:50 MQ MT5 time) | [JPY - Tertiary Industry Activity]

2015-01-16 13:30 GMT (or 15:30 MQ MT5 time) | [USD - CPI]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDJPY price movement

SUMMARY : bullish

TREND : correction