Market Condition Evaluation based on standard indicators in Metatrader 5 - page 99

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.01.09 15:04

2015-01-06 00:30 GMT (or 02:30 MQ MT5 time) | USD - Non-Farm Employment Changeif actual > forecast (or actual data) = good for currency (for USD in our case)

USD - Non-Farm Employment Change = Change in the number of employed people during the previous month, excluding the farming industry. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity

==========Total nonfarm payroll employment rose by 252,000 in December, and the unemployment rate declined to 5.6 percent, the U.S. Bureau of Labor Statistics reported today.

Job gains occurred in professional and business services, construction, food services and drinking places, health care, and manufacturing.

Employment in professional and business services rose by 52,000 in December. Monthly job gains in the industry averaged 61,000 in 2014. In December, employment increased in administrative and waste services (+35,000), computer systems design and related services (+9,000), and architectural and engineering services (+5,000).

Employment in accounting and bookkeeping services declined (-14,000), offsetting an increase of the same amount in November.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.01.09

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 46 pips price movement by USD - Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.01.15 08:18

2015-01-15 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Employment Change]if actual > forecast (or actual data) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity

==========

Australia Jobless Rate Slips To 6.1% In December

The unemployment rate in Australia came in at a seasonally adjusted 6.1 percent in December, the Australian Bureau of Statistics said on Thursday.

That beat expectations for 6.3 percent, and it was down from the revised 6.2 percent in November.

The Australian economy added 37,400 jobs to 11,679,400 in December - well above forecasts for 5,000 following the gain of 42,700 jobs in the previous month.

The increase in employment was driven by increased full-time employment for both females (up 23,300) and males (up 18,200). The increase in full-time employment was marginally offset by a fall in part-time employment, down 4,100.

The participation rate was 64.8 percent, topping expectations for 64.7 percent - which would have been unchanged.

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2015.01.15

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 80 pips price movement by AUD - Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.01.16 12:03

Trading the News: U.S. Consumer Price Index (CPI) (based on dailyfx article)

A marked slowdown in the U.S. Consumer Price Index (CPI) may trigger a short-term squeeze in EUR/USD should the development dampen the Federal Open Market Committee’s (FOMC) scope to normalize monetary policy sooner rather than later.

What’s Expected:

Despite expectations for a rate hike in mid-2015, the Fed may sound increasingly cautious and preserve its highly accommodative policy stance beyond schedule as the central bank struggles to achieve its mandate for price stability.

Nevertheless, improved business confidence paired with the pickup in economic activity may limit the downside risk for price growth, and the stickiness in core inflation may heighten the appeal of the greenback as a growing number of central bank officials show a greater willingness to normalize monetary in 2015.

How To Trade This Event Risk

Bearish USD Trade: U.S. CPI Slips to Annualized 0.7% or Lower

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bullish USD Trade: Inflation Report Exceeds Market Forecast- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- EUR/USD remains at risk for a further decline as long as the RSI pushes deeper into oversold territory.

- Interim Resistance: 1.1840-50 (50% expansion)

- Interim Support: 1.1500 pivot to 1.1565 (weekly low)

Impact that the U.S. CPI report has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

AUDUSD M5: 12 pips price movement by USD - CPI news event:

EURUSD M5: 13 pips price movement by USD - CPI news event:

The U.S. Consumer Price Index (CPI) slowed to an annualized rate of 1.3% from 1.7% in October on the back of falling energy prices, with the core rate of inflation narrowing to 1.7% from 1.8% during the same period. Indeed, subdued price pressures raise the risk of seeing the Fed further delay its first rate hike, but it seems as though the central bank will normalize monetary policy in 2015 as the committee anticipate the drop in oil prices to have an positive impact on the real economy. Despite the initial tick higher in EUR/USD, the dollar remained resilient against its European counterpart as the pair slipped below the 1.2400 handle during the North American trade to end the day at 1.2343.

MetaTrader Trading Platform Screenshots

USDJPY, M5, 2015.01.16

MetaQuotes Software Corp., MetaTrader 5

USDJPY M5: 44 pips price movement by USD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

newdigital, 2013.01.30 08:15

It was good entry today for 3 Stoch MaFibo, EURUSD M1 (about this system - see first page of the thread): price crossed SMA with 3 stoch indicators as a confirmation, and it was first profit level. By the way, first profit level is just 10 or 12 pips in profit only.

Forum on trading, automated trading systems and testing trading strategies

Gold is Reaching at 1270

newdigital, 2013.07.01 21:04

How can we know: correction, or bullish etc (in case of using indicator for example)?

well ... let's take AbsoluteStrength indicator from MT5 CodeBase.

bullish (Bull market) :

bearish (Bear market) :

ranging (choppy market - means: buy and sell on the same time) :

flat (sideways market - means: no buy and no sell) :

correction :

correction in a bear market (Bear Market Rally) :

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.01.20 08:14

Trading Video: Monetary Policy Speculation Heats EURUSD Early this Week (based on dailyfx article)

Though the ECB rate decision is still days away and the Fed meeting is more than a week out, policy speculation is generating heavy seas in the FX market. Between the steady rise in capital market activity levels and an increase in the frequency of outlier events these past months, investors across asset classes are growing more sensitive to their exposure should sentiment suffer a more systemic collapse. Moving forward, the Euro, Dollar, risk theme and Chinese GDP are items to keep a close eye on. We discuss these tides' influence on the market in today's Trading Video.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.01.20 11:20

2015-01-20 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Retail Sales]if actual > forecast (or actual data) = good for currency (for CNY in our case)

[CNY - Retail Sales] = Change in the total value of sales at the retail level. Tends to have a muted impact because the Chinese economy is not heavily reliant on consumer spending.

==========

China Dec Retail Sales Growth Quickens Unexpectedly

Chinese retail sales growth quickened unexpectedly in December, figures from the National Bureau of Statistics showed Tuesday.

Retail sales rose 11.9 percent year-over-year in December following the 11.7 percent rise in November. Economists had expected sales to increase at the stable rate of 11.7 percent.

On a month-over-month basis, retail sales grew 1.01 percent in December after the 0.90 percent climb in November.

In the January to December period, sales advanced 12 percent over the corresponding period of the previous year.

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2015.01.20

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 49 pips price movement by CNY - GDP and CNY - Retail Sales news events

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.01.20

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 9 pips price movement by CNY - GDP and CNY - Retail Sales news events

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.01.21 06:51

Q & A About CHF (based on dailyforex article)

Q: What actually happened last Thursday?

A: The SNB (Swiss National Bank) made an announcement that caused the CHF (Swiss Franc) to suddenly soar in value. The extent and speed of the price rise had never happened before to a major global currency, although there were similar incidents involving the CHF in 2011 and the GBP (British Pound) in 1992. The size and speed of the change meant that most banks effectively stopped buying or selling the CHF for several minutes, which had all kinds of bad effects (more on that later).

Q. What was it exactly that the SNB announced?

A: The SNB announced that they were no longer going to support a cap of the value in the CHF against the Euro. For more than 3 years, they would intervene to make sure the CHF was worth no more than 1.2 Euros. It is relatively easy for a central bank to keep their own currency weak, but it was getting harder for them to do it, as the price kept testing 1.20 and the Euro has been weakening dramatically over several months. The SNB announcement took the market by surprise, as although there was a logical risk this could happen, as recently as a few days ago the SNB publicly declared that they had no intention of abandoning the policy, which now can be seen to be a clear lie. By the way, the SNB also announced a negative interest rate of 0.75%, meaning depositors have to pay for the privilege of holding deposits in CHF. This would usually tend to weaken a currency, at least in the short term.

Q: Why did the SNB Abandon the Cap?

A: There are different interpretations of the SNB’s action so all explanations are controversial. They said that they no longer feel the CHF is as overvalued as it was, so maybe they did not feel that they had to hold the market back so much. However they have also said that they did not expect the CHF to rise by 15% right away. A deeper explanation would be that with the recent strong fall in the value of the Euro, which is by far the currency most strongly linked by trade to the CHF, it was becoming increasingly difficult and expensive for the SNB to keep the CHF as weak as the Euro, so they acted to abandon a position that was becoming untenable. Many have speculated that the SNB were expecting the ECB (European Central Bank) to announce a program of Quantitative Easing (QE) later this week, which might well push the value of the Euro down even further, and at a rapid rate. If the cap had still been in effect, they would probably have had to have spent a lot of their reserves buying Euros with CHF.

Q: What will it mean for the price of the CHF going forward?

A: It is hard to say. Usually when the value of a currency moves strongly up or down quite quickly by this kind of amount, it continues to move in the same direction for a few more weeks or months at least. However, there is some feeling that the move has gone far enough, and that the SNB might act to cap the CHF again at the latest market price, so it may not continue to increase. In any case, it is quite likely that in the short-term, the CHF will swing up and down with high volatility.

Q: What will it mean for the prices of other currencies?

A: The move on Thursday seemed to cause some volatility in other currencies, but that has gone at the time of writing, with nothing but the CHF moving by very much. It could be argued that now that cash can flow into the CHF, it might weaken the rise of the USD a little.

Q: Why did Forex traders and brokers lose so much money?

A: Usually, currencies fluctuate in value by very small amounts, far less than stocks, for example. The Forex market is also usually extremely liquid. This means that traders can place tight stop losses and trade with high margin, in the knowledge that if their stop loss is hit, they will usually not have to pay any slippage. Unfortunately in this kind of case, the price blew right past almost every stop loss without stopping, so traders and brokers could not execute any trade exits until the price of all CHF pairs had moved by far more than 1,000 pips. This meant that instead of exiting at stop losses such as 50 pips of loss, emergency exits had to be made at more than 1,000 pips or more. With leverage, most traders in any kind of short CHF trade would have had their entire deposits wiped out. In fact, many traders suffered losses beyond that, and are now facing negative account balances, which brokers may or may not be able or willing to chase. As for brokers losing money, there are two reasons for this: some brokers hedge their clients’ trades in the real market, where they also experienced the same problems even more strongly than their own clients did, meaning they could not pass on their clients’ losses. The second reason is that anyone who was in a long CHF trade with a broker, would have made a lot of money, and the balance of these trades may not have been covered by the losses of the losers, as the losers would have mostly negative account balances.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.01.21 18:45

2015-01-21 09:30 GMT (or 11:30 MQ MT5 time) | [GBP - Unemployment Rate]if actual < forecast (or actual data) = good for currency (for GBP in our case)

[GBP - Unemployment Rate] = Percentage of total work force that is unemployed and actively seeking employment during the past 3 months. Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Unemployment is also a major consideration for those steering the country's monetary policy.

==========

"Comparing September to November 2014 with June to August 2014, the number of people in employment increased by 37,000 (to reach 30.80 million), the number of unemployed people fell by 58,000 (to reach 1.91 million) and the number of people not in the labour force (economically inactive) aged from 16 to 64 increased by 66,000 (to reach 9.09 million)."

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2015.01.21

MetaQuotes Software Corp., MetaTrader 5

GBPUSD M5: 74 pips price movement by GBP - Unemployment Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.01.22 11:05

Trading the News: European Central Bank (ECB) Interest Rate Decision (based on dailyfx article)

EUR/USD may face fresh monthly lows over the next 24-hours of trade as the European Central Bank (ECB) is widely expected to announce more non-standard measures to further mitigate the risk for deflation.

What’s Expected:

Why Is This Event Important:

Despite headlines for a EUR 50B/month asset-purchase program, the details surrounding the new initiative may play a greater role in driving EUR/USD especially as the Governing Council struggles to achieve its one and only mandate for price stability.

However, the ECB may provide limited details and make an attempt to buy more time as President Mario Draghi struggles to produce a unanimous vote within the Governing Council, and we may see a more meaningful rebound in EUR/USD should the central bank disappoint.

How To Trade This Event Risk

Bearish EUR Trade: ECB Unveils Open-Ended QE Program

- Need red, five-minute candle following the policy announcement to consider a short EUR/USD trade

- If market reaction favors a short Euro trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish EUR Trade: Governing Council Attempts to Buy More Time- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

Potential Price Targets For The ReleaseEURUSD Daily

- Despite the string of closing prices above the 1.1500 handle, downside targets remain favored for EUR/USD as the RSI retains the bearish momentum and holds in oversold territory.

- Interim Resistance: 1.1720 (23.6% retracement) to 1.1740 (161.8% expansion)

- Interim Support: 1.1458 (January low) to 1.1500 pivot

Impact that the ECB rate decision has had on EUR/USD during the last meeting(1 Hour post event )

(End of Day post event)

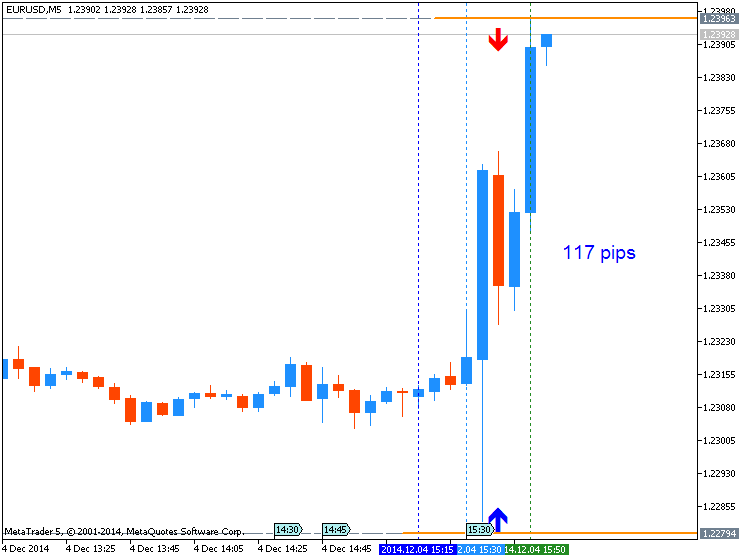

EURUSD M5: 117 pips range price movement by EUR - ECB Press Conference news event

As expected, the European Central Bank (ECB) kept the benchmark rate at the record low of 0.05%, but announced it would consider a broad-based asset purchase program which could including sovereign debt next month in order to achieve a EUR 1T expansion in its balance sheet. At the same time, the ECB also lowered its economic outlook of the euro-area, with the central bank lowering its 2014/2015 forecasts for growth and inflation. Despite the dovish remarks, the Euro strengthened after the statement as the ECB further delays the QE program, with EUR/USD closing the day at 1.2376.MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.01.22

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 62 pips price movement by EUR - Interest Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.01.23 04:21

Video: ECB Move Drives EURUSD to 11-Year Low, EURJPY On the Edge (based on dailyfx article)

The monetary policy ranks provided the markets another large injection with the news that the ECB was following its largest counterparts down the path of QE. The response for the Euro was decisive as EURUSD marked its worst daily tumble in over three years on the way to the lowest exchange rate since 2003. This pair will be particularly important to monitor moving forward as we gauge the net influence of stimulus as well as its relative effectiveness. With EURUSD, we now pair the most accommodative central bank (ECB) pitted against the most hawkish (Fed). Will the European authority be effective - even through the upcoming Greek election? Will the FOMC maintain its drive towards a mid-2015 hike next week? Meanwhile, the net impact of global stimulus on speculator interest may be better reflected in a pair like EURJPY. With new stimulus upgrade and a high-level sensitivity to risk trends, a 135 break can signal a broader tide change. We talk big themes, upcoming event risk and well-placed currency pairs in today's Trade Video.