Market Condition Evaluation based on standard indicators in Metatrader 5 - page 93

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

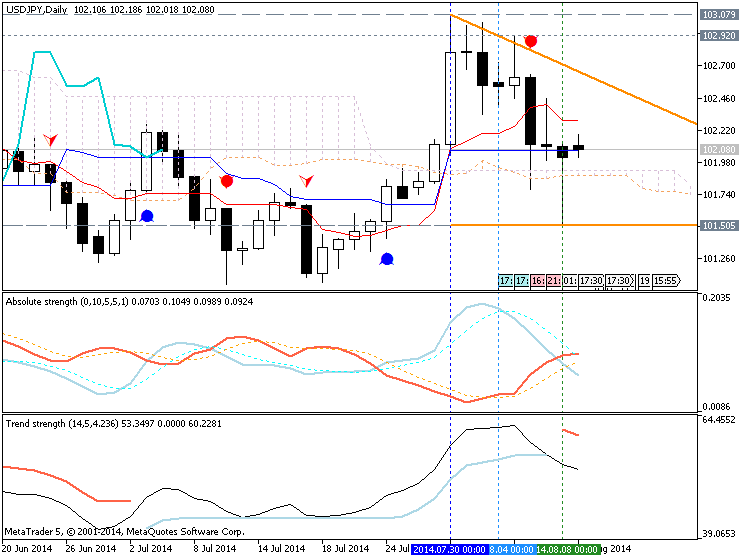

newdigital, 2014.08.11 13:10

Yen off highs as geopolitical tensions ease, sentiment fragile (based on reuters article)

Yen retreats from Friday's highs as safety demand slows

Markets still keeping a wary eye on geopolitical developments

The yen eased versus the dollar on Monday, having backed off from peaks hit late last week as a slight relaxation in geopolitical tensions dampened demand for the safe-haven Japanese currency.

The dollar inched up 0.1 percent to 102.17 yen, having bounced off Friday's two-week trough of 101.51. The euro edged up 0.1 percent to 136.91 yen , well off an 8-1/2 month low of 135.73 set on Friday.

News on Friday that Russia was ending military drills near the Ukrainian border helped U.S. stocks post their best one-day gain since March.

Asian shares were last up 0.9 percent, regaining some footing after having suffered their biggest weekly fall in nearly five months last week.

In a further boost to risk sentiment, Israel and the Palestinians agreed on Sunday to an Egyptian proposal for a new 72-hour ceasefire in Gaza starting at 2100 GMT.

"The conclusions from the weekend are that conflicts are cooling, and the risk-off events of the past two weeks may see upside risk as de-escalation spreads across the conflicts," said Evan Lucas, strategist at IG in Melbourne.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.08.13 06:50

Trading the News: Bank of England (BoE) Inflation Report (based on dailyfx article)

The Bank of England’s (BoE) Inflation report is likely to heavily influence the near-term outlook for the GBP/USD as the central bank looks to move away from its easing cycle.

What’s Expected:

Why Is This Event Important:

Indeed, the updated forecasts for growth and inflation is likely to spur increased volatility in the British Pound, but we would need to see Governor Mark Carney show a greater willingness to normalize monetary policy in 2014 for the GBP/USD to resume the upward trend carried over from the previous year.

Sticky inflation paired with the ongoing improvement in the labor market may spur a greater dissent within the Monetary Policy Committee (MPC), and the GBP/USD may carve a key low in August should the fresh batch of central bank rhetoric boost interest rate expectations.

Nevertheless, the BoE may introduce a more relaxed approach in normalizing policy amid the ongoing slack in the U.K. economy, and the GBP/USD may face a larger decline over the remainder of the month if Governor Carney adopts a more neutral tone for monetary policy.

How To Trade This Event Risk

Bullish GBP Trade: BoE Sees Scope to Raise Benchmark Interest Rate in 2014

- Need green, five-minute candle following the statement to consider a long British Pound trade

- If market reaction favors buying sterling, go long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: Governor Carney Talks Down Rate Expectations- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBPUSD Daily

- Interim Resistance: 1.7200 Pivot to 1.7220 (100.0% expansion)

- Interim Support: 1.6697 (June low) to 1.6730 (61.8% expansion)

Impact that the BoE Inflation Report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

The Bank of England (BoE) struck an improved outlook for the U.K. economy and said that spare capacity has ‘narrowed’ somewhat, but the fresh batch of central bank rhetoric did little to boost interest rate expectations as Governor Mark Carney argued that there needs to be a further reduction in the economic slack before the Monetary Policy Committee (MPC) can start to normalize monetary policy. The British Pound struggled to hold its ground following the statement, with the GBP/USD dipping below the 1.6800 handle, and the sterling continued to weaken during the U.S. trade as the pair ended the day at 1.6764.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.08.13

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 86 pips price movement by GDP - BoE Inflation Report news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.08.13 15:12

2014-08-13 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

if actual > forecast = good for currency (for AUD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity

==========

U.S. Retail Sales Unexpectedly Flat In July

Retail sales in the U.S. unexpectedly came in unchanged in the month of July, according to a report released by the Commerce Department on Wednesday.

The Commerce Department said retail sales were virtually unchanged in July after edging up by 0.2 percent in June. Economists had been expecting another 0.2 percent increase.

Excluding a modest drop in auto sales, retail sales inched up by 0.1 percent in July compared to a 0.4 percent increase in the previous month.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.08.13

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 50 pips price movement by USD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.08.14 10:41

2014-08-13 23:50 GMT (or 01:50 MQ MT5 time) | [JPY - Core Machinery Orders]

if actual > forecast = good for currency (for JPY in our case)

[JPY - Core Machinery Orders] = Change in the total value of new private-sector purchase orders placed with manufacturers for machines, excluding ships and utilities. It's a leading indicator of production - rising purchase orders signal that manufacturers will increase activity as they work to fill the orders.

==========

Japan Core Machine Orders Climb 8.8% In JuneCore machine orders in Japan gained 8.8 percent on month in June, the Cabinet Office said on Thursday - worth 745.8 billion yen.

The headline figure was well shy of forecasts for an increase of 15.3 percent following the record 19.5 percent decline in May.

On a yearly basis, core machine orders dipped 3.0 percent - also missing expectations for an increase of 3.0 percent following the 14.3 percent contraction in the previous month.

The total number of machinery orders, including those volatile ones for ships and from electric power companies, added 17.1 percent on month and 30.3 percent on year in June to 2,545.1 billion yen.

Manufacturing orders gained 6.7 percent on month but fell 1.3 percent on year to 302.4 billion yen in June, while non-manufacturing orders added 4.0 percent on month and lost 4.1 percent on year to 444.1 billion yen.

Government orders plummeted 24.0 percent on month and gained 6.4 percent on year to 276.6 billion yen. Orders from overseas surged 62.8 percent on month and 87.5 percent on year to 1,422.6 billion yen. Orders from agencies added 3.1 percent on month and 7.9 percent on year to 104.1 billion yen.

For the second quarter of 2014, core machine orders tumbled 10.4 percent on quarter and 0.4 percent on year.

For the third quarter of 2014, core machine orders are forecast to rise 2.9 percent on quarter but fall 2.3 percent on year to 2,348.4 billion yen.

MetaTrader Trading Platform Screenshots

USDJPY, M5, 2014.08.14

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5 : 24 pips price movement by JPY - Core Machinery Orders news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.08.15 10:01

Trading the News: UoM Consumer Sentiment (adapted from dailyfx article)

A rebound in the U. of Michigan Confidence survey may generate a bullish reaction in the U.S. dollar (bearish EUR/USD) as it raises the outlook for growth and inflation.

What’s Expected:

Why Is This Event Important:

A pickup in household sentiment may spur a larger dissent within the Federal Open Market Committee (FOMC) as central bank officials look for a stronger recovery in the second-half of the year, and the Fed may show a greater willingness to normalize monetary policy sooner rather than later as the committee turns increasingly confident in achieving the dual mandate for full-employment & price stability.

Higher wage growth paired with marked rebound in 2Q GDP may prop up household confidence, and an upbeat U. of Michigan print may heighten the bullish sentiment surrounding the U.S. dollar as the Fed looks to move away from its easing cycle later this year.

However, the slowdown in private sector credit along with the recent weakness in household consumption may warn of a further decline in consumer sentiment, and another unexpected decline in the confidence survey may trigger a near-term correction in the greenback as it drags on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: U. of Michigan Survey Climbs to 82.5 or Higher

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Consumer Sentiment Continues to Disappoint- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEURUSD Daily

- Will continue to look for string of lower-highs as descending triangle takes shape.

- Interim Resistance: 1.3650 (78.6% expansion) to 1.3670 (61.8% retracement)

- Interim Support: 1.3490 (50.0% retracement to 1.3500 Pivot

Impact that the U. of Michigan Confidence has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

The U. of Michigan Confidence survey unexpectedly weakened in July, with the index slipping to 81.3 from 82.5 the month prior, while 12-month inflation expectations climbed to an annualized 3.3% from 3.1% in June. Nevertheless, the greenback struggled to hold its ground following the dismal confidence report, with the EURUSD trading back above the 1.3500 handle, and the reserve currency continued to trade heavy throughout the North American trade as the pair ended the day at 1.3521.

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2014.08.15

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 6 pips price movement by USD - UoM Consumer Sentiments news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.08.19 06:53

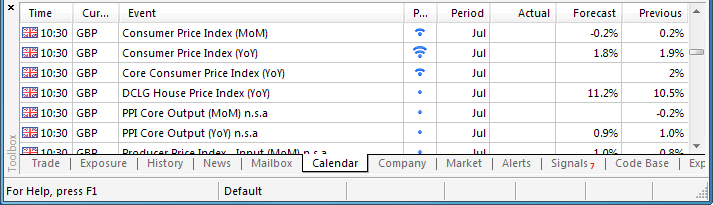

Trading the News: U.K. Consumer Price Index (based on dailyfx article)

A slowdown in the U.K.’s Consumer Price Index (CPI) may help to close the weekly opening gap in the GBP/USD should the inflation report drag on interest rate expectations.

What’s Expected:

Why Is This Event Important:

The Bank of England (BoE) may continue to soften its hawkish tone for monetary policy as the central bank cuts its outlook for U.K. wage growth, and a weaker-than-expected CPI print is likely to trigger a bearish reaction in the GBP/USD as market participants scale back bets of seeing a rate hike in 2014.

U.K. firms may conduct heavy discounting amid weak wage growth paired with the slowdown in private sector consumption, and a dismal CPI reading may instill a more bearish outlook for the GBP/USD as it reduces the BoE’s scope to normalize monetary policy sooner rather than later.

The pickup in private sector lending along with expectations for a faster recovery may generate another stronger-than-expected inflation print, and the pound-dollar may continue to push off of the 200-Day SMA (1.6662) should the data print boost rate expectations.

How To Trade This Event Risk

Bearish GBP Trade: U.K. CPI Slips to 1.8% or Lower

- Need red, five-minute candle following the release to consider a short British Pound trade

- If market reaction favors selling sterling, short GBP/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: Headline Reading for Inflation Tops Market Expectations- Need green, five-minute candle to favor a long GBP/USD trade

- Implement same setup as the bearish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBP/USD Daily

- Break of Bearish RSI Momentum Raises Risk for Bottoming Process

- Interim Resistance: 1.6960 (50.0% retracement) to 1.6970 (23.6% retracement)

- Interim Support: 1.6630 (50.0% expansion) to 1.6660 (200-Day SMA)

Impact that the U.K. CPI report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

June 2014 U.K. Consumer Price Index

GBPUSD M5 : 64 pips price movement by GBP - CPI news event

The U.K.’s Consumer Price Index (CPI) expanded sharply at an annualized rate of 1.9% in June, beating the average estimate of 1.6%. The core CPI also exceeded market forecast to reach 2.0% from 1.6% the month prior. The print was mostly pushed up by clothing & footwear and food & beverage. The larger-than-expected figure boosted the pound, with the GBP/USD climbing to a high of 1.7190 during the North American trade. However, the GBP/USD consolidated going the close, with the pair ending the day at 1.7146.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.08.19

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 46 pips price movement by GBP - CPI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.08.20 13:39

2014-08-20 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - Bank of England Minutes][GBP - Bank of England Minutes] = The BOE's MPC meeting minutes contain the interest rate vote for each MPC member during the most recent meeting. The breakdown of votes provides insight into which members are changing their stance on interest rates and how close the committee is to enacting a rate change in the future.

==========

BoE Split On Rates For First Time In More Than 3 Years

Bank of England policymakers split on rate decision this month, for the first time in more than three years as two members said the current economic situation warrant an immediate rate hike from a historic-low.

At the August Monetary Policy Committee meeting, Ian McCafferty and Martin Weale sought a quarter-point hike in the bank rate to 0.75 percent, while all other seven members voted to keep the rate unchanged at 0.50 percent.

Members were unanimous on holding the rate at 0.50 percent since July 2011.

Regarding the stock of purchased assets, the nine-member board unanimously voted to leave the the programme unchanged at GBP 375 billion.

External members McCafferty and Weale said economic circumstances were sufficient to justify an immediate rise in the Bank Rate. Their arguments sparked market expectations for an action this year itself.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.08.20

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 53 pips price movement by GBP - Bank of England Minutes news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.08.21 10:09

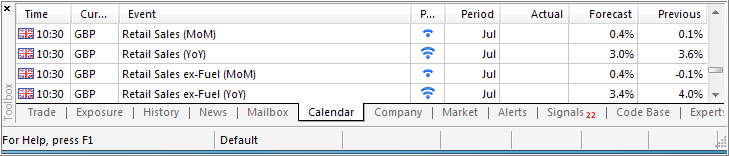

Trading the News: U.K. Retail Sales (based on dailyfx article)

A pickup in U.K. Retail Sales may spur a more meaningful rebound in the GBP/USD as it raises the prospects for a stronger recovery in the second-half of 2014.

What’s Expected:

Why Is This Event Important:

The growing dissent within the Bank of England (BoE) should continue to prop up interest rate expectations as a the central bank sees less spare capacity in the U.K. economy, and we may see a greater rift at the next meeting on September 4 should the fundamental developments coming out of the region raise the outlook for growth and inflation.

Easing price pressures along with the ongoing improvement in the labor market may generate a better-than-expected sales report, and a marked pickup in household spending may spur a meaningful rebound in the GBP/USD as it puts increased pressure on the BoE to normalize monetary policy sooner rather than later.

However, subdued wage growth paired with the ongoing slack in the real economy may drag on private consumption, and a dismal print is likely to spur a further decline in the British Pound as market participants scale back bets for an early rate hike.

How To Trade This Event Risk

Bullish GBP Trade: U.K. Retail Sales Climbs 0.4% or Greater

- Need green, five-minute candle following the release to consider a long British Pound trade

- If market reaction favors long sterling trade, buy GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: Household Spending Disappoints- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in opposite direction

Potential Price Targets For The ReleaseGBP/USD Daily

- Watching RSI as it struggles to hold above 26 along with the April low (1.6549)

- Interim Resistance: 1.6850-60 (78.6% expansion)

- Interim Support: 1.6560 (38.2% expansion) to 1.6570 (61.8% expansion)

Impact that the U.K. Retail Sales report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

The U.K retail sales report showed a slight increase of 0.1% after contracting 0.5% in May. An decline in demand for textile, clothing and footwear contributed to the weaker-than-expected data. The lackluster print dragged on the pound, with GBP/USD sliding below the 1.7000 handle. The bearish reaction continued throughout the North American trade, with the pair ending the day at 1.6988.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.08.21

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 23 pips price movement by GBP - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.08.22 11:40

Trading the News: Canada Consumer Price Index (based on dailyfx article)

Despite expectations for a downtick in Canada’s Consumer Price Index (CPI), the stickiness in core inflation may spur a larger decline in the USD/CAD as it puts increased pressure on the Bank of Canada (BoC) to move away from its neutral policy stance.

What’s Expected:

Why Is This Event Important:

Even though BoC Governor Stephen Poloz talked down the risk for higher interest rates, the growing risk for a prolonged period of above-target inflation may push the central bank to adopt a more hawkish tone for monetary policy in an effort to promote price stability.

The pickup in private sector consumption may heighten price pressures in Canada, and a strong inflation print may spur a more meaningful correction in the USD/CAD as it boosts interest rate expectations.

Nevertheless, slowing wage growth paired with the ongoing weakness in private lending may spur a softer-than-expected CPI print, and a marked slowdown in price growth may trigger a more meaningful run at the 1.1100 handle as it dampens bets for higher interest rates.

How To Trade This Event Risk

Bullish CAD Trade: Core Inflation Expands 1.9% or Higher

- Need red, five-minute candle following the CPI report to consider short USD/CAD entry

- If the market reaction favors a bullish Canadian dollar trade, establish short with two position

- Set stop at the near-by swing high/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish CAD Trade: CPI Report Falls Short of Market Forecast- Need green, five-minute candle following the release to look at a long USD/CAD trade

- Carry out the same setup as the bullish loonie trade, just in the opposite direction

Potential Price Targets For The ReleaseUSD/CAD Daily

- Despite bullish break in RSI, downside remains favored given series of lower highs & lows.

- Interim Resistance: 1.1000 (38.2% retracement) to 1.1020 (23.6% retracement)

- Interim Support: 1.0820 (61.8% retracement) to 1.0830 (61.8% retracement)

Impact that the Canada CPI report has had on CAD during the last month(1 Hour post event )

(End of Day post event)

2014

June 2014 Canada Consumer Price Index (CPI)

USDCAD M5 : 46 pips price movement by CAD - CPI news event :

The annualized inflation rate hit a two-year high of 2.4%, beating an average estimate of 2.3%. The core Consumer Price Index (CPI) reading also exceeded market forecast and climbed 1.8% after expanding 1.7% in May. Bank of Canada Governor Stephen Poloz stressed that the faster rate of price growth was mainly due to transitory factors, including energy and import costs, and expects inflation to slow over the next two years as the central bank retains a “neutral” view for monetary policy. The Canadian dollar jumped following the better-than-expected print, with USD/CAD dipping below the 1.0710 handle. After a quick comeback, the pair moved sideways during the rest of the North American trade and closed at 1.0727.