Market Condition Evaluation based on standard indicators in Metatrader 5 - page 95

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Next setup.

For M1 and M5 timeframe.

I call it PriceChannel ColorPar Ichi

AUDUSD:

GBPUSD:

USDJPY:

I just started this thread as a continuation of the talking made on this topic (we can read it).

Or ...to make it shorter: it was some discussion about forecasting/predicting of the next candle or direction of the movement or market condition evaluation.

And it was around standard indiocators in Metatrader 5 for example.

As a results - some good setups were made which are related to this story and I decided to open separated thread about this kind of technical analysis and evaluation.

It may be interesting for the people who are using lower timeframes (M1 to H1) to trade and, I hope - this thread will help them to predict/forecast some market condition and to catch |big movement" for example.

Sorry for complicated explanation. :)

Anyway - Happy New Year!

Sangat membantu

Hi

To NEW digital

I am using MT4 can u make thi indicator work for mt4.

thanks

Maksigen indicator for MT4 is on this post attached.

Ichimoku is standard indicator in MT4.

Other 2 indicators are related to Igorad (I did not find it inside MT4 CodeBase sorry).

Anyway - this is the forum for MT5 :)

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.10.03 10:41

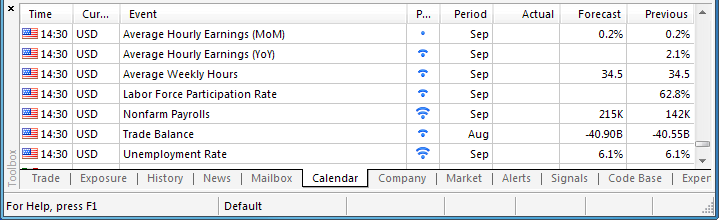

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

A pickup in U.S. Non-Farm Payrolls (NFP) may spur a further decline in the EUR/USD as the Federal Reserve is widely expected to halt its quantitative easing (QE) program at the October 29 policy meeting.

What’s Expected:

Why Is This Event Important:

The deviation in the policy outlook certainly casts a long-term bearish outlook for the EUR/USD, but a further slowdown in job growth may generate a larger pullback in the dollar as it would allow the Federal Open Market Committee (FOMC) to further delay the normalization cycle.

The ongoing decline in planned job-cuts along with the pickup in private sector activity may spur a meaningful uptick in job growth, and a positive print may spur another round of dollar strength as it boosts interest rate expectations.

However, the slowdown in building activity paired with the persistent weakness in the housing market may drag on hiring, and another disappointing employment report may trigger a near-term decline in the greenback as it dampens bets of seeing the Fed normalize policy sooner rather than later.

How To Trade This Event Risk

Bullish USD Trade: Job & Wage Growth Picks Up

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar position, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: NFPs Disappoint for Third Consecutive Month- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- As Relative Strength Index (RSI) comes off of oversold territory, break of near-term bearish momentum should highlight a larger topside correction.

- Interim Resistance: 1.3010 (50.0% retracement) to 1.3020 (23.6% expansion)

- Interim Support: 1.2450 (78.6% retracement) to 1.2500 pivot

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.10.03

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 54 pips price movement by USD - Non-Farm Employment Change news event

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2014.10.03

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 50 pips price movement by USD - Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video October 2014

newdigital, 2014.10.07 16:33

Trading Video: Dollar and S&P 500 Post-NFP Rallies Tripped Up

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.10.10 10:21

Trading the News: Canada Net Change in Employment (based on dailyfx article)

The USD/CAD may face a larger pullback going into the end of the week should Canada’s Employment report show a meaningful rebound in job growth and fuel interest rate expectations.

What’s Expected:

Why Is This Event Important:

An upbeat employment print may put increased pressure on the Bank of Canada (BoC) to further normalize monetary policy, but we would need to see a material shift in the forward-guidance to adopt a bullish outlook for the Canadian dollar as Governor Stephen Poloz continues to endorse a period of interest rate stability.

Easing input costs along with the pickup in private sector activity may generate a strong pickup in job growth, and a positive print may threaten the opening monthly range in the USD/CAD as it boosts interest rate expectations.

However, weakening demand at home and abroad may drag on employment, and a dismal development may heighten the bullish sentiment surrounding the USD/CAD as it gives the BoC greater scope to retain its current policy for an extended period of time.

How To Trade This Event Risk

Bullish CAD Trade: Canada Adds 20.0K or More Jobs

- Need red, five-minute candle following the report for a potential short USD/CAD trade

- If market reaction favors a long loonie trade, sell USD/CAD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit

Bearish CAD Trade: Employment Report Disappoints- Will favor topside targets as inverse head-and-shoulders remains in play & RSI retains bullish momentum

- Interim Resistance: 1.1300 pivot to 1.1320 (61.8% expansion)

- Interim Support: 1.1050 (61.8% expansion) to 1.1065 (23.6% expansion)

Impact that Canada Employment Change has had on CAD during the last release(1 Hour post event )

(End of Day post event)

The Canada employment report disappointed, with the region shedding 11.0K jobs in August after adding 41.7K the month prior. Despite a downtick in the participation rate to 66.0% from 66.1%, the unemployment rate held steady at an annualized 7.0% for the second consecutive month. As a result, it seems as though the Bank of Canada will retain its neutral tone for monetary policy and keep the benchmark interest rate at 1.00% throughout the remainder of the year in an effort to encourage a more robust recovery. The reaction to the dismal reading was short-lived as the USD/CAD chopped around the 1.0880 level during the North America trade, with the pair closing at 1.0879.

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2014.10.10

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 59 pips range price movement by CAD - Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.10.14 13:36

2014-10-14 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - CPI]if actual > forecast (or actual data) = good for currency (for GBP in our case)

[GBP - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========

U.K. Sep Inflation Falls To 5-Year Low

U.K. inflation slowed to a five-year low in September, the Office for National Statistics showed Tuesday.

Consumer price inflation eased more-than-expected to 1.2 percent in September from 1.5 percent in August. Economists had forecast the rate to slow marginally to 1.4 percent.

Month-on-month, consumer prices remained flat in September versus 0.4 percent rise in August. Prices were expected to grow 0.2 percent.

Consumer prices excluding energy, food, alcoholic beverages and tobacco, rose 1.5 percent from last year, slower than the 1.9 percent increase seen in August.

Another report from the ONS showed that output prices declined for the third consecutive month in September. Output prices declined 0.4 percent year-on-year after falling 0.3 percent in August. Economists had forecast a 0.3 percent drop.

On a monthly basis, output prices were down 0.1 percent, the same rate of fall as seen in August.

MetaTrader Trading Platform Screenshots

GBPUSD, H1, 2014.10.14

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5: 108 pips price movement by GBP - PPI news event

Price is moved by itself irrespective off any economic news events :)

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.10.16

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.10.17 09:44

Trading the News: Canada Consumer Price Index (CPI) (based on dailyfx article)

A slowdown in Canada’s Consumer Price Index (CPI) may generate a further advance in USD/CAD as it gives the Bank of Canada (BoC) greater scope to retain its current policy throughout the remainder of 2014.

What’s Expected:

Why Is This Event Important:

However, the stickiness in core inflation may heighten the appeal of the loonie as it puts increased pressure on central bank Governor Stephen Poloz to adopt a more hawkish tone for monetary policy, and the USD/CAD may face a larger pullback ahead of the October 22 policy meeting should the report boost interest rate expectations.

Easing input costs along with the slowdown in private consumption may generate a marked slowdown in price growth, and a dismal CPI print may generate fresh monthly highs in USD/CAD as market participants scale back bets for higher borrowing costs.

However, higher wage growth paired with expectations for a faster recovery may boost price pressures in Canada, and a strong inflation reading should spur a bullish reaction in the Canadian dollar as it raises the BoC’s scope to further normalize monetary policy.

How To Trade This Event Risk

Bearish CAD Trade: Headline & Core Inflation Slows in September

- Need green, five-minute candle following a dismal CPI report to consider long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish CAD Trade: Consumer Price Report Tops Market Expectations- Need red, five-minute candle following the release to look at a short USD/CAD trade

- Carry out the same setup as the bearish loonie trade, just in the opposite direction

Potential Price Targets For The ReleaseUSD/CAD Daily Chart

- Bearish RSI break may undermine inverse head-and-shoulders pattern; will stay constructive as long as USD/CAD holds above the August low (1.0809).

- Interim Resistance: 1.1380 (78.6% expansion) to 1.1400 Pivot

- Interim Support: 1.0830 (61.8% retracement) to 1.0850 (38.2% retracement)

Impact that the Canada CPI report has had on CAD during the last month(1 Hour post event )

(End of Day post event)

2014

Canada’s Consumer Price Index (CPI) held steady at an annualized rate of 2.1% in August, while the core CPI unexpectedly increased to 2.1% from 1.7% in July, marking the highest reading since May 2012. Though the rise in core inflation may put increased pressure on the Bank of Canada (BoC) to raise the benchmark interest rate, it seems as though the central bank will retain its neutral tone for some time as the fundamental outlook remains clouded by the weakness in global growth. The better-than-expected core inflation print propped up the Canadian dollar, with the USD/CAD dipping below 1.0900 following the release, but the loonie struggled to hold the gains during the North America trade as it closed at 1.0957.

USDCAD M5: 40 pips range price movement by CAD - CPI news event:

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.10.24 05:23

Video: Major Event Risk Can Move and Restrain EURUSD, USDJPY, GBPUSD (based on dailyfx article)

Normally, we look at event risk like a Fed rate decision and ECB stress test results as the fuel for trade setups. Yet, the influence of such high level events and data can dampen markets as readily as they motivate them. Looking ahead to next week's docket, there is a range of high profile risk - any one capable of changing the trend on their respective currency and a few even capable of turning the tide on global sentiment. We discuss how headline events can disrupt active and potential trade setups like those seen from S&P 500, EURUSD, USDJPY and others in today's Strategy Video.