Market Condition Evaluation based on standard indicators in Metatrader 5 - page 96

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.10.24 06:30

Trading the News: U.K. Gross Domestic Product (based on dailyfx article)

Trading the News: U.K. Gross Domestic Product (GDP)

The U.K.’s 3Q Gross Domestic Product (GDP) report may spur a lower-low in GBP/USD should the advance reading drag on interest rate expectations.

What’s Expected:

Why Is This Event Important:

A marked slowdown in the U.K. economy may continue to spur a 7-2 split within the Monetary Policy Committee (MPC) as Governor Mark Carney remains in no rush to normalize monetary policy, and the GBP/USD may face a further decline over the remainder of the year as the Fed prepares to exit it easing cycle.

Lower business outputs paired with the slowdown in private-sector consumption may dampen bets of seeing a stronger recovery in the U.K., and a dismal 3Q GDP print may trigger fresh monthly lows in the GBP/USD especially as the BoE retains a rather neutral tone for monetary policy.

Nevertheless, the expansion in building activity along with the ongoing improvement in the labor market may pave the way for a better-than-expected growth report, and a positive development may spur a larger dissent within the BoE as the fundamental outlook for the U.K. improves.

How To Trade This Event Risk

Bearish GBP Trade: U.K. GDP Slows to 0.7% or Lower

- Need red, five-minute candle following the GDP print to consider a short British Pound trade

- If market reaction favors bearish sterling trade, short GBP/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: 3Q Growth Rate Exceeds Market Forecast- Need green, five-minute candle to favor a long GBP/USD trade

- Implement same setup as the bearish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBP/USD Daily Chart

- Despite the string of lower-highs, need a break of the bullish RSI momentum to favor fresh lows.

- Interim Resistance: 1.6280 (38.2% retracement) to 1.6300 (50.0% retracement)

- Interim Support: 1.5890 (61.8% retracement) to 1.5900 (50.0% expansion)

Impact that the U.K. GDP report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

As expected, the U.K. economy expanded another 0.8% in the second quarter of 2014 following the 0.8% rate of growth in the first three months of the year. The lackluster recovery in the U.K. may continue to drag on interest rate expectations as the Bank of England (BoE) remains in no rush to normalize monetary policy, and the British Pound may face additional headwinds over the rest of the year should the central bank scale back its willingness to raise the benchmark interest rate off of the record-low. The initial reaction was largely mixed as the GBP/USD quickly fell back from the 1.6990 region, and the pair continued to consolidate throughout the North American trade as it ended the day at 1.6974.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.10.24

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5: 45 pips price movement by GBP - GDP news event

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video October 2014

newdigital, 2014.10.25 16:56

Trading Video: EURUSD Traders Buckle Up for FOMC, ECB Stress Tests, Risk Trends

- Next week's economic docket will create an extremely treacherous trading environment

- Top concern is Wednesday's FOMC rate decision which can shift the Dollar and 'risk' outlook

- However, there is plenty more scheduled and a particularly perilous week for the Euro

Was this past week's rise in capital markets and relief from volatility a false dawn? The recovery from a bad stumble through the first half of October drew limited participation and occurred during the lull of a changing landscape. Looking ahead, the bearings for sentiment, activity levels, positioning and established trends will be put to the test. In a docket that is overflowing with high-level releases, the FOMC rate decision will be the focal point. Not only will this tap a heavily disputed policy forecast for the Dollar's sake, but it could also carry the burden of defining the next 'risk' move for the financial system. Other key releases like the RBNZ and BoJ rate decisions should be accounted for, but the currency with the most persistent pressure will be the Euro - from week's beginning to end. We look at the risk and potential of the week ahead in this weekend Trading Video.Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.10.29 19:43

2014-10-29 18:00 GMT (or 19:00 MQ MT5 time) | [USD - Federal Funds Rate]if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

Federal Reserve calls end to QE3 - Full Text of the Fed’s Statement

The US Federal Reserve has announced the formal conclusion of its latest bond-buying program, commonly referred to as QE3, while reaffirming plans to hold interest rates at current levels for a "considerable time".

The US central bank said it would make a final $US15 billion taper to its quantitative easing program from next month, concluding a 10-month process that has seen it gradually reduce its bond buying from $US85 billion.

The widely expected move came at the end of a two-day meeting of the Fed’s policy-setting Federal Open Market Committee (FOMC), with market eyes now shifting to the central bank’s view on the US economy and outlook for rate hikes.

“The committee judges that there has been a substantial improvement in the outlook for the labour market since the inception of its current asset purchase program,” the Fed’s statement read.

“Moreover, the committee continues to see sufficient underlying strength in the broader economy to support ongoing progress toward maximum employment in a context of price stability.

“Accordingly, the committee decided to conclude its asset purchase program this month.”

“The committee anticipates, based on its current assessment, that it likely will be appropriate to maintain the 0 to 0.25 per cent target range for the federal funds rate for a considerable time following the end of its asset purchase program this month,” the Fed advised.

“However, if incoming information indicates faster progress toward the committee's employment and inflation objectives than the committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated.

“Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.”

The Janet Yellen-led central bank noted that the US economy had expanded at a "moderate" pace since its last meeting in mid-September, while the underutilisation of labour resources was "gradually diminsihing" and long-term inflation expectations remained "stable".

==========

Here is the full text of the Federal Reserve’s policy statement.

MetaTrader Trading Platform Screenshots

USDJPY, M5, 2014.10.29

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5: 85 pips price movement by USD - Federal Funds Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

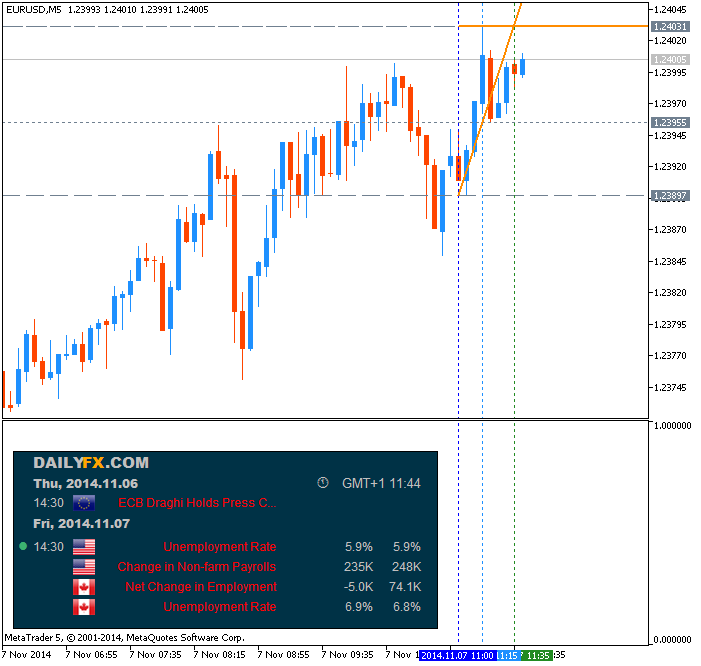

newdigital, 2014.11.07 12:21

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

The U.S. Non-Farm Payrolls (NFP) report may generate a further decline in the EUR/USD as market participants anticipate a pickup in job growth.

What’s Expected:

Why Is This Event Important:

At the same time, Average Hourly Earnings are also expected to uptick to an annualized 2.1% from 2.0% in September, and stronger employment paired with growing wage pressures should heighten the bullish sentiment surrounding the greenback especially as the Federal Open Market Committee (FOMC) moves away from its easing cycle.

How To Trade This Event Risk

Bullish USD Trade: NFPs Exceed Market Expectations

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar position, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Job/Wage Growth Disappoints- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Will continue to look for lower highs/lows as the RSI retains the bearish momentum carried over from the end of 2013.

- Interim Resistance: 1.2580 (78.6% retracement) to 1.2625 (61.8% expansion)

- Interim Support: 1.2290 (100% expansion) to 1.2320 (38.2% expansion)

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

September 2014 U.S. Non-Farm Payrolls

EURUSD M5 : 68 pips price movement by USD - Non-Farm Employment Change news event :

GBPUSD M5 : 54 pips price movement by USD - Non-Farm Employment Change news event :

USDCAD M5 : 50 pips price movement by USD - Non-Farm Employment Change news event :

U.S. Non-Farm Payrolls (NFPs) increased 248K in September after expanding a revised 142K the month prior, while the jobless rate unexpectedly slipped to a six-year low of 5.9% from 6.1% in August. The uptick in hiring certainly highlights an improved outlook for the world’s largest economy, and the bullish sentiment surrounding the U.S. dollar may gather pace over the remainder of the year as the Fed is widely expected to halt its asset-purchase program at the October 29 meeting. Indeed, the better-than-expected prints spurred a bullish dollar reaction, with the EUR/USD slipping below the 1.2550 handle to hit a fresh yearly low of 1.2501.

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2014.11.07

USDCAD M5: 99 pips price range movement by USD - Non-Farm Employment Change news event

MaksiGen indicator for MT4 - see this post.

Just for information

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.11.12 06:44

Trading the News: Bank of England (BoE) Inflation Report (based on dailyfx article)

- Bank of England (BoE) Widely Expected to Reduce Growth, Inflation Forecast.

- Will the BoE Inflation Report Drag on Interest-Rate Expectations?

Trading the Bank of England (BoE) Inflation report may not be clear cut even with expectations for a downward revision in the central bank’s growth/inflation forecast as Governor Mark Carney continues to prepare U.K. households and businesses for higher borrowing-costs.What’s Expected:

Why Is This Event Important:

The fresh batch of central bank rhetoric may continue to drag on interest rate expectations as the majority of the Monetary Policy Committee (MPC) remains in no rush to normalize monetary policy, but the BoE may stick to its current course to raise the benchmark interest rate in 2015 amid the ongoing recovery in the real economy.

However, the BoE may largely retain an upbeat view for the U.K. economy amid the rise in business outputs paired with the ongoing improvement in the labor market, and the British Pound may continue to pare the losses carried over from the previous month should the fresh batch of central bank commentary prop up interest rate expectations.

How To Trade This Event Risk

Bearish GBP Trade: Interest Rate Expectations Falter as BoE Cuts Economic Forecast

- Need red, five-minute candle following the GDP print to consider a short British Pound trade

- If market reaction favors bearish sterling trade, short GBP/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: MPC Stays on Course to Raise Interest Rate in 2015- Need green, five-minute candle to favor a long GBP/USD trade

- Implement same setup as the bearish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBP/USD Daily Chart

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.11.12

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5: 91 pips price movement by GBP - BOE Inflation Report news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.11.14 10:00

Trading the News: Euro-Zone Gross Domestic Product (GDP) (adapted from dailyfx article)

The Euro-Zone’s 3Q Gross Domestic Product (GDP) report may generate a larger correction in EUR/USD as the monetary union is expected to return to growth after stagnating during the three-months through June.

What’s Expected:

Why Is This Event Important:

However, a rebound in the growth rate may do little to heighten the appeal of the single-currency as the European Central Bank (ECB) is widely expected to implement more non-standard measures in December, and the ongoing deviation in the policy outlook continues to foster a bearish outlook for EUR/USD as the Federal Reserve moves away from its easing cycle.

Nevertheless, high unemployment paired with the slowdown in private consumption may continue to drag on economic activity, and a dismal growth print may put increased pressure on the ECB to offer additional monetary support amid the growth threat for deflation.

How To Trade This Event Risk

Bullish EUR Trade: 3Q GDP Climbs 0.1% or Greater

- Need green, five-minute candle following a positive report to consider a long EUR/USD trade

- If market reaction favors a bullish Euro trade, buy EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bearish EUR Trade: Euro-Zone Fails to Grow & Spurs Bets for More ECB Support- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same strategy as the bullish euro trade, just in reverse

Potential Price Targets For The ReleaseEUR/USD Daily

- Long-term EUR/USD outlook remains bearish as RSI retains downward trend, but will watch former support for new resistance as the exchange rate continues to come off of channel support.

- Interim Resistance: 1.2600 pivot to 1.2620 (61.8% expansion)

- Interim Support: 1.2280 (100% expansion) to 1.2300 pivot

Impact that Euro-Zone GDP has had on EUR/USD during the last quarter(1 Hour post event )

(End of Day post event)

The euro-area economy failed to grow in the second quarter of 2014 following a 0.2% expansion during the first three-months of the year, raising the threat for deflation across the monetary union. The weaker-than-expected growth was mainly attributed to the economic contraction Germany, with Europe’s growth engine slowing for the first time since 1Q 2013. The lackluster recovery is likely to put increased pressure on the European Central Bank (ECB) to boost market liquidity especially as private-sector lending remains subdued. Despite missing market expectations, the EUR/USD climbed above the 1.3400 region during the European trade, but largely struggled to retain the gains as the pair closed at 1.3362.

Trading the News: U.K. Consumer Price Index (based on dailyfx article)

Beyond the headline reading for U.K. inflation, an uptick in the core Consumer Price Index (CPI) may generate a near-term rebound in GBP/USD as the Bank of England (BoE) largely remains on course to normalize monetary policy in 2015.

What’s Expected:

Why Is This Event Important:

Despite the downward revision to the BoE’s growth & inflation forecast, sticky price growth in the U.K. may spur a greater dissent within the Monetary Policy Committee (MPC), and it seems as though Governor Mark Carney will continue to prepare household & businesses for higher borrowing-costs as the economic recovery becomes more broad-based.

How To Trade This Event Risk

Bullish GBP Trade: U.K. Core Inflation Rebounds in October

- Need red, five-minute candle following the release to consider a short British Pound trade

- If market reaction favors selling sterling, short GBP/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: CPI Report Falls Short of Market Forecast- Need green, five-minute candle to favor a long GBP/USD trade

- Implement same setup as the bearish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBP/USD Daily

- GBP/USD remains vulnerable to further losses as the RSI appears to be sliding back into oversold territory.

- Interim Resistance: 1.6000 (50.0% retracement) to 1.6020 pivot

- Interim Support: 1.5540 (61.8% expansion) to 1.5550 (78.6% retracement)

Impact that the U.K. CPI report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

September 2014 U.K. Consumer Price Index

GBPUSD: 108 pips price movement by GBP - PPI news event

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.11.18

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5: 23 pips price movement by GBP - CPI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.11.20 08:58

2014-11-20 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - German PPI]if actual > forecast (or actual data) = good for currency (for EUR in our case)

[EUR - German PPI] = Change in the price of goods sold by manufacturers. It's a leading indicator of consumer inflation - when manufacturers charge more for goods the higher costs are usually passed on to the consumer.

==========

Producer prices in October 2014: –1.0% on October 2013

In October 2014 the index of producer prices for industrial products fell by 1.0% compared with the corresponding month of the preceding year. In September 2014 the annual rate of change all over had been –1.0%, too.

In October 2014 energy prices decreased by 3.6%, prices of consumer non-durable goods by 0.6% and prices of intermediate goods by 0.3%. In contrast prices of capital goods rose by 0.6% and prices of durable consumer goods by 1.2%.

The overall index disregarding energy decreased by 0.1% compared with October 2013.

Compared with the preceding month the overall index decreased by 0.2% in October 2014 (–0.1% in August 2014, unchanged in September 2014).

EURUSD M5: 18 pips price movement by EUR - German PPI news event :