Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.24 13:51

Forex Weekly Outlook January 26-30 (based on forexcrunch article)

Greek Parliamentary Election; German Ifo Business Climate; UK GDP

data; US Durable Goods Orders; US CB Consumer Confidence; US housing

data; Rate decision in the US and in New Zealand; US Unemployment

Claims; GDP data in Canada and the US. These are the most important

economic releases for this week. Follow along as we explore these Forex

market movers.

Last week’s central event was Draghi’s announcement of an extensive

bond-buying program which will insert hundreds of billions in new money

into the sluggish euro zone economy. The European Central Bank said it

would buy sovereign debt from March till September 2016. Germany opposed

this move, saying it will aid countries in debt to loosen economic

reforms. The ECB plans to add more than 1 trillion euros by September

2016, to boost the Euro-area economy and fight deflation. However, since

only 20% of purchases would be the responsibility of the ECB, critics

warn that in case a euro zone government defaults, it would fall on

national central banks, getting weak countries deeper in debt. Draghi

said the QE could create the basis for growth, but the main

responsibility lays on governments to implement structural reforms to

sustain growth. Will this move help revive the Eurozone economy?

- Eurozone Greek Parliamentary Election: Sunday. The national elections this week will determine whether Prime Minister Antonis Samaras will maintain his position or be defeated by Alexis Tsipras from Syriza party. Samaras said he can reach an agreement with Greece’s creditors by the end of February, while Tsipras said he can get an agreement by this summer keeping Greece within the euro area. Greece will not receive the next bailout money of 7.2 billion euros unless a review of the country’s progress in meeting the terms of its bailout is completed by Feb. 28.

- Eurozone German Ifo Business Climate: Monday, 9:00. German business confidence increased 0.8 points in December, reaching 105.5, broadly within market expectations. Falling oil prices and the weaker euro boosted German economy. Economic data showed improvements in the manufacturing and wholesaling sectors despite downturn trend in sales to Russia and sluggish reforms in France and Italy. Business sentiment is expected to reach 106.7 this time.

- UK GDP data: Tuesday, 9:30. U.K. economic growth weakened in the third quarter, amid sluggish economic activity in the euro-area. Gross domestic product increased 0.7% in the three months through September, following 0.9% rise in the second quarter. The reading was in line with market forecast. On an annualized basis, the U.K. economy expanded 2.8% in the third quarter. Worrying signs of renewed stagnation in the euro zone may have a negative effect on UK’s. UK growth is predicted to be 0.6% in the fourth quarter of 2014.

- US Durable Goods Orders: Tuesday, 13:30. Durables orders plunged 0.7% in November after gaining 0.3% in October, while analysts expected a 3.0% jump. Likewise, core orders dropped 0.4% in November after contracting 1.0% in the prior month. Analysts predicted a 1.2% rise. Transportation declined 1.2% a 3.3% jump in October. The rise in autos and nondefense aircraft was overshadowed by a sharp drop in defense aircraft orders. Both Durable orders and Core orders are expected to gain 0.6%.

- US CB Consumer Confidence: Tuesday, 15:00. American consumers were more positive in December amid strong economic data releases. Consumer sentiment climbed to 92.6 in December from a revised 91 in the previous month. 17.1% of responders noted a rise in job availability from 16.2% in November. 19.6% claimed business conditions were worse compared to 21.8 in November. The rise in confidence goes hand in hand with GDP growth and the constant improvement in the job market. A further increase to 95.7 is expected now.

- US New Home Sales: Tuesday, 15:00. Sales of new U.S. homes contracted 1.6% in November to a seasonally adjusted annual rate of 438,000 units, indicating the housing sector still hasn’t benefited from the recent improvements in the job market. The reading was worse than the 461,000 rate forecasted by analysts and lower than October’s downwardly revised rate of 445,000. New-home sales remain far below the annual rate of 700,000 seen during the 1990s, as many Americans lack solid credit records to enable obtaining mortgages. Sales of new U.S. homes is expected to reach 452,000 in December.

- US rate decision: Wednesday, 19:00. The Federal Reserve policy makers have repeatedly announced their intentions to raise rates. However the sharp plunge in consumer prices during December may detain such a move. Federal Reserve chair Janet Yellen, claimed that the sharp drop in oil prices was positive for the US economy boosting household spending, but other Fed policy makers prefer to see stronger inflation before voting to raise rates. The Fed’s focus is on core inflation to help assess underlying price pressures in the economy. Fed official said recently that mid-year would be an appropriate time to consider a rate rise. No change in rates is expected.

- NZ rate decision: Wednesday, 20:00. The Reserve Bank of New Zealand has maintained its Official Cash Rate at 3.5% in December in line with market forecast. The central bank estimates output will grow above capacity and inflation will reach the 2% target by the end of the forecast period, which will advance a 40 basis points rate hike by early 2017. Reserve Bank of New Zealand Governor Graeme Wheeler repeated his warnings about the overrated New Zealand dollar but noted that global financial market volatility had taken some pressure off the currency.

- US Unemployment Claims: Thursday, 13:30. The number of Americans filing initial claims for unemployment benefits was higher than expected last week, indicating the holiday volatility sill continues. Jobless claims declined by 10,000 to 307,000, while expected to reach 301,000. Layoffs of holiday staffing make it difficult to assess the true state of the weekly jobs data. However, except for these temporary layoffs the US job market remains resilient at the beginning of 2015. The number of jobless claims is expected to reach 301,000 this week.

- Canadian GDP: Friday, 13:30. Canada’s economy expanded more than expected in October rising 0.3% following a 0.4% gain in the previous month. Analysts expected a small increase of 0.1%. However weak oil prices are forecasted to weaken growth in 2015 by contracting exports and investment. The BOC projects a yearly growth of 2.2% in 2015 from 2.5% growth in 2014. However exports to the US are expected to increase as the US economy strengthens. Canadian growth is expected to contract 0.1%.

- US GDP data: Friday, 13:30. The U.S. economy expanded 3.5% in the third quarter, indicating the US economy continues to improve and has no need for further QE. The GDP release was stronger than the 3.1% growth rate expected by analysts. Business investment and consumer spending dropped slightly from the second quarter, however, trade deficit contracted. Growth in four of the past five quarters reached 3.5% or above suggesting self- sustaining growth. Us economic growth in the fourth quarter is expected to be 3.1%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.26 13:43

The greenback found good support at 115.85 and has rebounded, retaining

our view that further consolidation within 115.57-121.85 range would be

seen with initial mild upside bias for another bounce to 119.00 and

possibly towards 119.96-00. Having said that, a break of resistance at

120.83 is needed to signal correction from 121.85 has ended bring retest

of this level, above there would signal medium term upmove has resumed

for gain to 122.50-60, however, loss of near term upward momentum should

prevent sharp move beyond 123.20-25 (2 times extension of 101.07-110.09

measuring from 105.20) and reckon 124.10-15 (50% projection of

105.20-118.98 measuring from 117.24) would hold, price should falter

well below psychological resistance at 125.00.

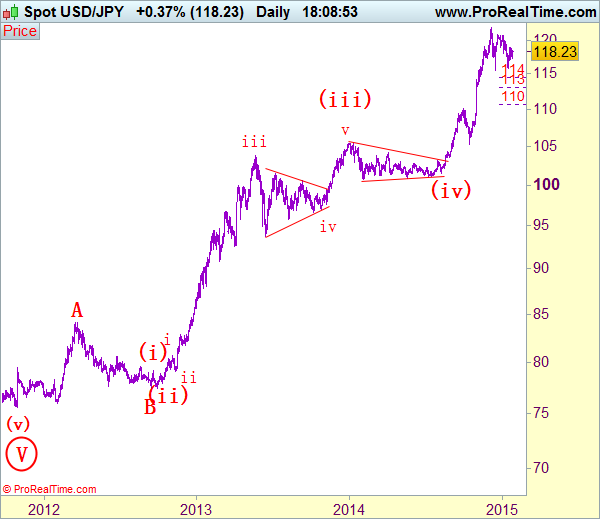

Our preferred

count is that, triangle wave IV (with circle) ended at 101.45 and the

circle wave V brought dollar down to the record low of 75.31 in 2011 and

the subsequent rebound signal major correction has commenced with A leg

ended at 84.19, followed by wave B at 77.14 and impulsive wave C is now

unfolding for gain towards 125.00 level.

Under this count, this

wave C is unfolding as impulsive waves with (1) (2), 1 2 ended at 80.67,

79.07, 82.84 and 81.69 respectively, hence the extended wave 3 has

ended at 103.74 and wave 4 correction of recent upmove should bring

weakness to 92.57, then towards 90.88 but psychological support at 90.00

should limit downside and bring another rally later in wave 5,

indicated target at 118.00 had been met and gain to 122.00 cannot be

ruled out but reckon price would falter below 125.00.

On the

downside, expect pullback to be limited to 116.50 and bring another

rebound later. Only a break of said support at 115.57 would dampen our

bullishness and risk retracement of recent upmove to 113.50-55 (50%

Fibonacci retracement of 105.20-121.85), however, downside should be

limited to 112.90-00 and reckon 111.50-60 (61.8% Fibonacci retracement)

would contain weakness and price should stay well above previous

resistance at 110.09, bring another rally later.

Recommendation: Hold long entered at 116.50 for 119.50 with stop below 115.50.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.24 14:08

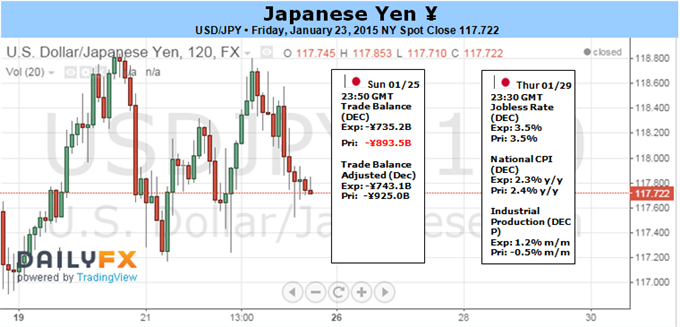

USDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Japanese Yen: Neutral

- ECB Move Drives EURUSD to 11-Year Low, EURJPY On the Edge

- USD/JPY 1 Month into Consolidation; Could be a Triangle

The fundamental developments due out next week may undermine the bullish forecasts surrounding USD/JPY should the Federal Open Market Committee (FOMC) scale back its hawkish tone for monetary policy.

Despite growing expectations for a Fed rate hike in mid-2015, the rotation within the voting committee may spur a material shift in the forward-guidance for monetary policy, and the central bank may sound increasingly cautious this time around amid the fresh batch of monetary support from the Swiss National Bank, European Central Bank and Bank of Canada. Indeed, the Fed may not way to get too far ahead of its major counterparts as it struggles to achieve the 2% target for inflation, and Chair Janet Yellen may show a greater willingness to further delay the normalization cycle especially as the advance 4Q Gross Domestic Product (GDP) report is expected to show the economy growing an annualized 3.2% versus the 5.0% expansion during the three-months through September.

At the same time, Japan’s Consumer Price Index (CPI) may also fail to encourage a bullish outlook for USD/JPY as the Bank of Japan (BoJ) continues to endorse a wait-and-see approach for monetary policy, and the pair remains at risk for a larger correction over the near-term as Governor Haruhiko Kuroda remains confident in achieve the 2% inflation target over the policy horizon. In turn, USD/JPY may continue to carve a sting of lower-highs going into February should the data prints drag on Fed interest rate expectations.

With USD/JPY struggling to push back above the 119.00 handle, the pair faces a risk for move back towards near-term support around the 117.00 handle, and the dollar-yen may make a more meaningful run at the January low (115.84) should the bullish sentiment surrounding the greenback fizzle.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.27 05:58

USD/JPY Technical Analysis: Quiet Consolidation Continues (based on dailyfx article)

| Resistance | Support |

|---|---|

| 119.48 | 117.64 |

| 120.82 | 115.48 |

| 121.91 | 113.51 |

The US Dollar is consolidating gains against the Japanese Yen having advanced as expected after forming a Bullish Engulfing candlestick pattern. Near-term resistance is at 119.48, the 23.6%Fibonacci

expansion, with a break above that on a daily closing basis exposing

the December 23 high at 120.82. Alternatively, a reversal below the 117.64-91 area marked by a horizontal pivot and the 23.6% Fib retracement opens the door for a test of the 38.2% threshold at 115.48.

Positioning is inconclusive at this point, with prices offering no clear-cut and actionable signal to initiate a long or short trade. We will continue to remain on the sidelines for the time being, waiting for a compelling opportunity to present itself.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.27 10:40

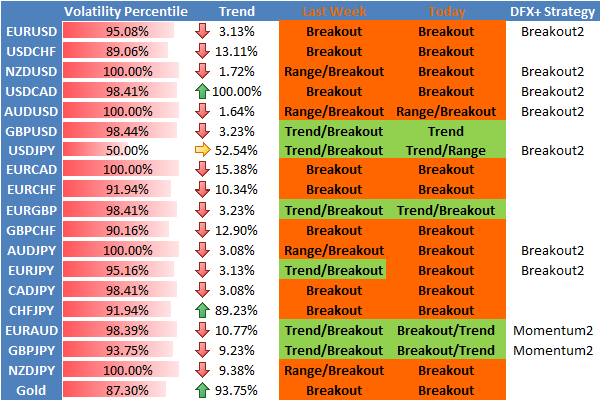

Another Big Week Points to Major Currency Moves - How Might we Trade? (based on dailyfx article)

- US Dollar at elevated risk of volatility ahead of critical US Federal Reserve decision

- Forex volatility prices continue to trade near multi-year highs amid central bank activity

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.27 17:12

Forex technical trading: USDJPY a little more bullish but still within the range parameters (based on forexlive article)

The USDJPY remains stuck in a range – above and below trend line resistance – with the 100 and 200 hour MAs in between (blue and green lines) There have been a couple weak attempts to push outside the boundaries- once on the topside on Friday and today on the downside in the first few hours of trading. Each failed. Currently, the pair has been able to extend above the 100 hour MA which gives it a little more bullish bias (100 hour MA comes in at 118.05 level – blue line). The topside trend line is currently trading at 118.58.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.28 06:09

USDJPY Japan Economy will Collapse (adapted from livetradingnews article)

The shortfall of 12.78tn, Japan’s fourth-consecutive annual deficit, was 11.4% wider than 2013 and was the worst since records began in 1979, according to the finance ministry. Fuel costs have weighed heavily on Japan as the resource-poor country struggles to plug a huge energy gap after the 2011 atomic crisis forced the shutdown of nuclear reactors that once supplied more than a quarter of its power. That problem has been exacerbated by a sharp fall in the yen, which hiked the cost of energy imports purchased in foreign currencies.

In December alone, however, Japan’s trade deficit almost halved over the previous year to 660.7bn, largely thanks to falling oil prices.

The trade balance last month was also helped by a better-than-expected 12.9% jump in exports.

Japan’s trade deficit “is set to narrow further as lower energy prices are still not fully reflected in import costs”, Capital Economics said in note after the figures were published.

“The key development for the trade balance in coming months… remains the plunge in the price of crude oil since last summer. So far, this is only partly reflected in the cost of imported petroleum.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.28 11:38

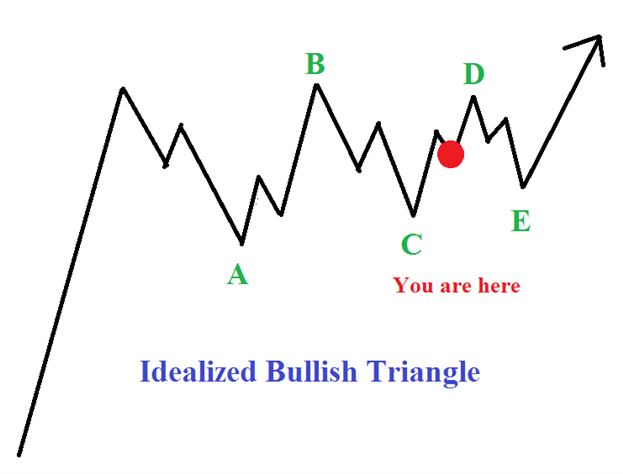

USDJPY Stuck in a Triangle (based on dailyfx article)

- Short term triangle keeps the larger triangle pattern in play

- An immediate move below 117.28 negates the short term triangle

- Look for resistance 119-120 to end wave D of a bullish triangle

The USDJPY has been stuck in a sideways range since December and appears to be carving out a larger degree 4th wave triangle. That means that each of the 5 sub-waves of the triangle should shape up as a zig-zag, triangle, or combination between them.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.28 17:16

US Dollar May Fall as FOMC Fails to Fuel Interest Rate Hike Bets (based on dailyfx article)

- US Dollar May Fall as Status-Quo FOMC Fails to Fuel Rate Hike Outlook

- Aussie Dollar Gains as CPI Data Undermines RBA Interest Rate Cut Bets

A quiet economic calendar in European trading hours is likely to see traders looking ahead to the US session for direction cues, with the spotlight pointing firmly to the outcome of the FOMC monetary policy meeting. Janet Yellen and company introduced a much-discussed change to the language of the policy statement at December’s sit-down, swapping out a pledge to hold rates low for a “considerable time” after the end of QE3 and replacing it with another promising to be “patient” before tightening. It seems unlikely that the cautiously slow-moving US central bank will opt to tinker with policy again so soon after making an adjustment, meaning today’s announcement will probably stick closely to the status quo.

The substance of the FOMC outcome and its interpretation by the financial markets need not align however. The markets seem primed for a hawkish result, if only because the US Dollar is hovering near six-year highs while speculative net-long positioning in the benchmark unit is at the highest since at least 1993. An outcome that sees the Fed in wait-and-see mode and fails to meaningfully advance the case for tightening may have a hard time sustaining such levels. In fact, it may serve to remind investors that the central bank has signaled no rate hikes will occur through April.Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.28 20:30

2015-01-28 19:00 GMT (or 21:00 MQ MT5 time) | [USD - Federal Funds Rate]- past data is 0.25%

- forecast data is 0.25%

- actual data is 0.25% according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

"To support continued progress toward maximum employment and price

stability, the Committee today reaffirmed its view that a highly

accommodative stance of monetary policy will remain appropriate for a

considerable time after the asset purchase program ends and the economic

recovery strengthens. The Committee also reaffirmed its expectation

that the current exceptionally low target range for the federal funds

rate of 0 to 1/4 percent will be appropriate at least as long as the

unemployment rate remains above 6-1/2 percent, inflation between one and

two years ahead is projected to be no more than a half percentage point

above the Committee's 2 percent longer-run goal, and longer-term

inflation expectations continue to be well anchored. In determining how

long to maintain a highly accommodative stance of monetary policy, the

Committee will also consider other information, including additional

measures of labor market conditions, indicators of inflation pressures

and inflation expectations, and readings on financial developments. The

Committee continues to anticipate, based on its assessment of these

factors, that it likely will be appropriate to maintain the current

target range for the federal funds rate well past the time that the

unemployment rate declines below 6-1/2 percent, especially if projected

inflation continues to run below the Committee's 2 percent longer-run

goal. When the Committee decides to begin to remove policy

accommodation, it will take a balanced approach consistent with its

longer-run goals of maximum employment and inflation of 2 percent."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

USDJPY M5: 42 pips price movement by USD - Federal Funds Rate news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish and secndary ranging ranging market condition:

W1 price is on primary bullish with the secondary correction started in the middle of December last year.

MN price is on bullish trend which was stopped by 121.84 resistance level.

If D1 price will break 115.85 support level so the ranging bearish with possible btreakdown will be continuing

If D1 price will break 118.85 resistance level so we may see the reversal of the price movement from the primary bearish to primary bullish condition

If not so we can see the ranging to be continuing between 115.85 and 118.85 levels

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDJPY price movement for this coming week)

2015-01-25 23:50 GMT (or 01:50 MQ MT5 time) | [JPY - Trade Balance]

2015-01-27 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Durable Goods Orders]

2015-01-27 15:00 GMT (or 17:00 MQ MT5 time) | [USD - New Home Sales]

2015-01-27 15:00 GMT (or 17:00 MQ MT5 time) | [USD - CB Consumer Confidence]

2015-01-28 19:00 GMT (or 21:00 MQ MT5 time) | [USD - Federal Funds Rate]

2015-01-29 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Unemployment Claims]

2015-01-29 23:30 GMT (or 01:30 MQ MT5 time) | [JPY - CPI]

2015-01-30 13:30 GMT (or 15:30 MQ MT5 time) | [USD - GDP]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDJPY price movement

SUMMARY : bearish

TREND : ranging