You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

The dollar fell against the other major currencies on Friday after the latest U.S. nonfarm payrolls fell short of economists’ expectations but still showed solid jobs growth, prompting investors to book profits on the greenback.

The Labor Department reported that the U.S. economy added 214,000 jobs in October, missing expectations for jobs growth of 231,000.

September’s figure was revised up to 256,000 from a previously reported 248,000 and August’s figure was also revised up to 203,000 from 180,000 pointing to underlying strength in the labor market.

The U.S. unemployment rate ticked down to a fresh six-year low of 5.8% from 5.9% in September.

The data prompted investors to sell the dollar to lock in gains following its recent rally, but the data did little to alter expectations that the Federal Reserve will raise interest rates ahead of its other major peers.

EUR/USD initially touched a fresh 26-month low of 1.2358 following the release of the data, before rising 0.67% to 1.2454 in late trade. For the week, the pair was still down 0.38%.

The single currency remained under pressure after the European Central Bank reiterated its pledge on Thursday to implement further stimulus measures if needed to combat persistently low levels of inflation in the euro area.

USD/JPY was down 0.56% to 114.58 in late trade on Friday, pulling back from the seven year highs of 115.58 struck earlier in the session. The pair still ended the week with gains of 1.56% as the Bank of Japan’s surprise stimulus move on October 31 continued to weigh on the yen.

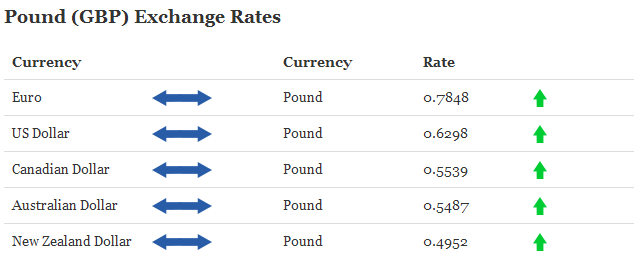

The pound also pushed higher against the dollar on Friday, with GBP/USD rising 0.26% to 1.5872, after falling to 14-month lows of 1.5791 earlier in the session.

The Canadian dollar was also higher after data on Friday showed that the country’s economy added 43,100 jobs last month, compared to expectations for a decline of 5,000. The Canadian unemployment rate unexpectedly fell to a six year low of 6.5% from 6.8%.

USD/CAD was down 0.84% to 1.1327 late Friday, paring the week’s gains to 0.35%.

The Canadian dollar fell to more than five year lows against the greenback earlier in the week as steep falls in oil prices pressured the commodity exposed currency lower.

In the week ahead, investors will be looking ahead to Friday’s report on third quarter growth from the euro zone, as well as the latest retail sales figures from the U.S. Thursday’s inflation report from the Bank of England will also be in focus.

Monday, November 10

- China is to release data on producer and consumer price inflation.

- Australia is to publish a report on home loans.

- Later in the day, Canada is to publish data on housing starts.

Tuesday, November 11- Japan is to publish data on the current account.

- Australia is to release private sector data on business confidence, as well as official data on house price inflation.

- Later

Tuesday, the Reserve Bank of New Zealand is to publish its financial

stability report, and Governor Graeme Wheeler is to hold a press

conference to discuss the report.

Wednesday, November 12- Australia is to release a private sector report on consumer sentiment, as well as official data on the wage price index.

- Japan is to publish data on tertiary industry activity.

- The U.K. is to release data on the change in the number of people employed, the unemployment rate and average earnings.

- Meanwhile,

the Bank of England is to publish its quarterly inflation report and

Governor Mark Carney is to hold a press conference to discuss the

report.

- The euro zone is to produce data on industrial production.

Thursday, November 13- Japan is to release data on core machinery orders.

- Australia is to publish private sector data on inflation expectations.

- China is to produce data on industrial production and fixed asset investment.

- Switzerland is to report on producer price inflation.

- Canada is to publish data on new house price inflation.

- The U.S. is to publish the weekly report on initial jobless claims.

Friday, November 14The U.S. dollar fell against the Canadian dollar on Friday after stronger than expected Canadian employment data, while a softer than expected U.S. jobs report prompted profit taking in the greenback.

USDCAD was down 0.84% to 1.1327 late Friday, paring the week’s gains to 0.35%.

The Labor Department reported that the U.S. economy added 214,000 jobs in October, missing expectations for jobs growth of 231,000.

September’s figure was revised up to 256,000 from a previously reported 248,000 and August’s figure was also revised up to 203,000 from 180,000 pointing to underlying strength in the labor market.

The U.S. unemployment rate ticked down to a fresh six-year low of 5.8% from 5.9% in September.

The data prompted investors to sell the dollar to lock in gains following its recent rally but the data did little to alter expectations that the Federal Reserve will raise interest rates ahead of its other major peers.

The Canadian dollar received an additional boost after official data showed that the country’s economy added 43,100 jobs last month, compared to expectations for a decline of 5,000.

The Canadian unemployment rate unexpectedly fell to a six year low of 6.5% from 6.8%.

The U.S. dollar rose to more than five year highs against the loonie earlier in the week as steep falls in oil prices pressured the commodity exposed Canadian dollar lower.

Oil prices have been hit by speculation that rising global supplies will be more than enough to meet slowing demand.

In the week ahead, investors will be looking ahead to Friday’s reports on U.S. retail sales and consumer confidence, while Canada has no major economic releases scheduled.

Monday, November 10

- Canada is to publish data on housing starts.

Thursday, November 13- Canada is to release a report on new house price inflation.

- The U.S. is to publish the weekly report on initial jobless claims.

Friday, November 14Keltner channels lead USDCAD higher (based on tradingfloor article)

Initial demand took USDCAD to the most positive levels traded for five years last week. Although last week ended with some sharp profit taking, a second positive weekly performance in a row, bullish daily and weekly Keltner channels and the support of the 13-day moving average keep the focus on the topside.

Entry: 1.1225/35 area and dip to 1.1267.

Stop: 1.1220 offered.

Target: 1.1400 and 1.1468.

Time horizon: This week.

USD/CAD Sharp Pullback Produces A Bearish Engulfing Formation (based on dailyfx article)

USD/CAD has retreated back below the former 1.1380 peak, leaving behind a Bearish Engulfing formation. Similar pullbacks have proven shallow in the past and the latest dip may prove no different. Buyers may look to step up at former resistance-turned-support at the 1.1285 mark.

AUDIO - Sitting Down with Michael Young

For 38 years Michael Young has been trading a variety of asset classes, and seen many things! He joins Merlin to talk about market pattens and what emphasis he places on thise, as well as what he sees as good trading opportunities going forward. The duo take a look at the dollar, oil, gold, silver and much more! They also talk about an end of year trade plan review which is designed to help traders learn and improve.

USD/CAD Technical Analysis: Digesting Losses Above 1.13 (based on dailyfx article)

The US Dollar is digesting losses above the 1.13 figure against its Canadian namesake having run into resistance below the 1.15 mark. Near-term support is at 1.1311, the 23.6% Fibonacci retracement, with a break below that on a daily closing basis exposing the 1.1215-47 area (38.2% level, rising trend line). Alternatively, a reversal above the 14.6% Fib expansion at 1.1395 clears the way for a test of the 23.6% threshold at 1.1454.

Video: Yen Crosses Surge and GBPUSD Ready for Volatility

Market-wide sentiment swings have settled, but that hasn't curbed FX volatility. In the absence of a unified catalyst, we are finding localized fundamental developments that are generating heavy trading conditions. This past session, the Yen crosses were the most active amongst the majors. A troubled economic outlook and doubt over the effectiveness of stimulus measures has led to speculation/fear that an election could be around the corner and/or a delay in the second sales tax hike. This theme certainly isn't played out. Meanwhile, the most potential-packed liquid currency moving forward is the Pound. A key event release will tap a Sterling nerve with volatility and trend high-probability outcomes. We look at what is driving the FX market in today's Trading Video.

Trading the News: Bank of England (BoE) Inflation Report (based on dailyfx article)

- Bank of England (BoE) Widely Expected to Reduce Growth, Inflation Forecast.

-

Will the BoE Inflation Report Drag on Interest-Rate Expectations?

Trading the Bank of England (BoE) Inflation report may not be clear cut even with expectations for a downward revision in the central bank’s growth/inflation forecast as Governor Mark Carney continues to prepare U.K. households and businesses for higher borrowing-costs.What’s Expected:

Why Is This Event Important:

The fresh batch of central bank rhetoric may continue to drag on interest rate expectations as the majority of the Monetary Policy Committee (MPC) remains in no rush to normalize monetary policy, but the BoE may stick to its current course to raise the benchmark interest rate in 2015 amid the ongoing recovery in the real economy.

However, the BoE may largely retain an upbeat view for the U.K. economy amid the rise in business outputs paired with the ongoing improvement in the labor market, and the British Pound may continue to pare the losses carried over from the previous month should the fresh batch of central bank commentary prop up interest rate expectations.

How To Trade This Event Risk

Bearish GBP Trade: Interest Rate Expectations Falter as BoE Cuts Economic Forecast

- Need red, five-minute candle following the GDP print to consider a short British Pound trade

- If market reaction favors bearish sterling trade, short GBP/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: MPC Stays on Course to Raise Interest Rate in 2015- Need green, five-minute candle to favor a long GBP/USD trade

- Implement same setup as the bearish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBP/USD Daily Chart

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.11.12

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5: 91 pips price movement by GBP - BOE Inflation Report news event

GBP/CAD, USD/CAD Exchange Rates Bearish after BoE Inflation Report (based on futurecurrencyforecast article)

The Pound to Canadian Dollar (GBP/CAD) exchange rate has softened after a mixed day for UK data. In addition, the US Dollar to Canadian Dollar (USD/CAD) currency pair also recorded losses as the ‘Buck’ pauses in its recent rally.