You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

[EUR - ECB Press Conference] = The press conference is about an hour long and has 2 parts - first a prepared statement is read, then the conference is open to press questions. The questions often lead to unscripted answers that create heavy market volatility. The press conference is webcasted on the ECB website with a slight delay from real-time. It's the primary method the ECB uses to communicate with investors regarding monetary policy. It covers in detail the factors that affected the most recent interest rate and other policy decisions, such as the overall economic outlook and inflation. Most importantly, it provides clues regarding future monetary policy

==========

"We will also soon start to purchase asset-backed securities. The programmes will last for at least two years. Together with the series of targeted longer-term refinancing operations to be conducted until June 2016, these asset purchases will have a sizeable impact on our balance sheet, which is expected to move towards the dimensions it had at the beginning of 2012.Our measures will enhance the functioning of the monetary policy transmission mechanism, support financing conditions in the euro area, facilitate credit provision to the real economy and generate positive spillovers to other markets. They will thereby further ease the monetary policy stance more broadly, support our forward guidance on the key ECB interest rates and reinforce the fact that there are significant and increasing differences in the monetary policy cycle between major advanced economies.

With the measures that have been put in place, monetary policy has responded to the outlook for low inflation, a weakening growth momentum and continued subdued monetary and credit dynamics. Our accommodative monetary policy stance will underpin the firm anchoring of medium to long-term inflation expectations, in line with our aim of achieving inflation rates below, but close to, 2%. As they work their way through to the economy, our monetary policy measures will together contribute to a return of inflation rates to levels closer to our aim.

However, looking ahead, and taking into account new information and analysis, the Governing Council will closely monitor and continuously assess the appropriateness of its monetary policy stance. Should it become necessary to further address risks of too prolonged a period of low inflation, the Governing Council is unanimous in its commitment to using additional unconventional instruments within its mandate. The Governing Council has tasked ECB staff and the relevant Eurosystem committees with ensuring the timely preparation of further measures to be implemented, if needed."

==========

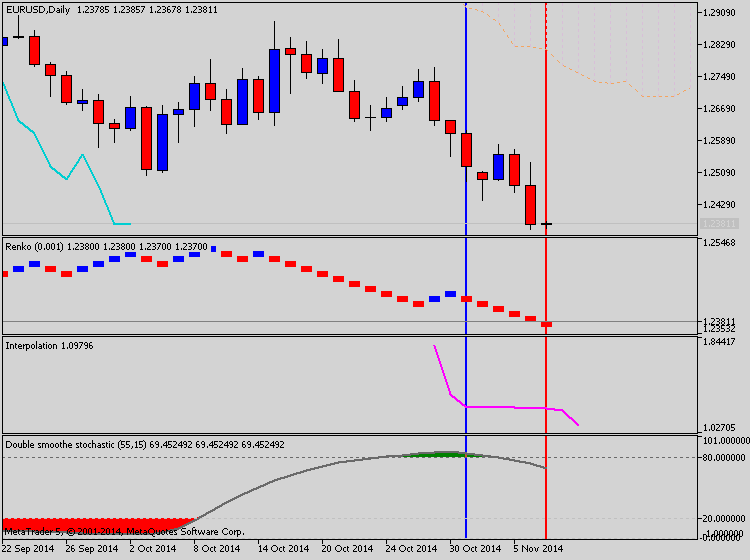

EURUSD M5: 126 pips price movement by EUR - ECB Press Conference news eventEUR/USD Drops to 1.2380 on Draghi’s Stimulus Pledge (based on marketpulse article)

The euro fell to a more than two-year low as European Central Bank President Mario Draghi deepened his commitment to stimulus and signaled policy makers are ready to implement additional measures if needed.

Europe’s shared currency dropped for the first time in six days versus the yen as Draghi told reporters in Frankfurt that the central bank’s bond-buying program will last at least two years and, together with targeted loans, move its balance sheet toward early-2012 levels. The pound weakened to a 14-month low as the Bank of England left interest rates unchanged. The dollar rose to its highest since April 2009 before jobs data tomorrow. Russia’s ruble slid.

“Draghi’s trying to prepare the market for what he sees as a very likely expanded program of quantitative easing, maybe not in size but in terms of the assets purchased,” said Collin Crownover, the head of currency management at State Street Global Advisors Inc. “The fall in the euro, while not massive in historical terms, has been pretty significant. I think we drift a little bit lower but I think we’ll struggle to touch $1.20 this year.”

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

The U.S. Non-Farm Payrolls (NFP) report may generate a further decline in the EUR/USD as market participants anticipate a pickup in job growth.

What’s Expected:

Why Is This Event Important:

At the same time, Average Hourly Earnings are also expected to uptick to an annualized 2.1% from 2.0% in September, and stronger employment paired with growing wage pressures should heighten the bullish sentiment surrounding the greenback especially as the Federal Open Market Committee (FOMC) moves away from its easing cycle.

How To Trade This Event Risk

Bullish USD Trade: NFPs Exceed Market Expectations

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar position, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Job/Wage Growth Disappoints- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

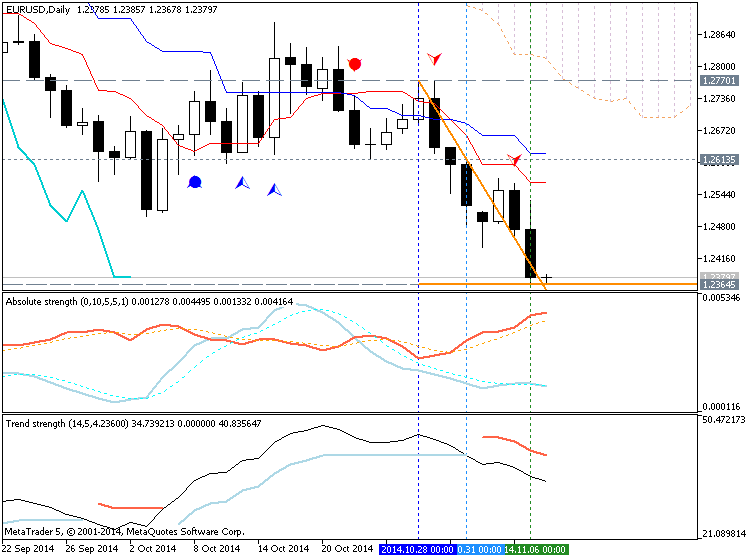

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Will continue to look for lower highs/lows as the RSI retains the bearish momentum carried over from the end of 2013.

- Interim Resistance: 1.2580 (78.6% retracement) to 1.2625 (61.8% expansion)

- Interim Support: 1.2290 (100% expansion) to 1.2320 (38.2% expansion)

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

September 2014 U.S. Non-Farm Payrolls

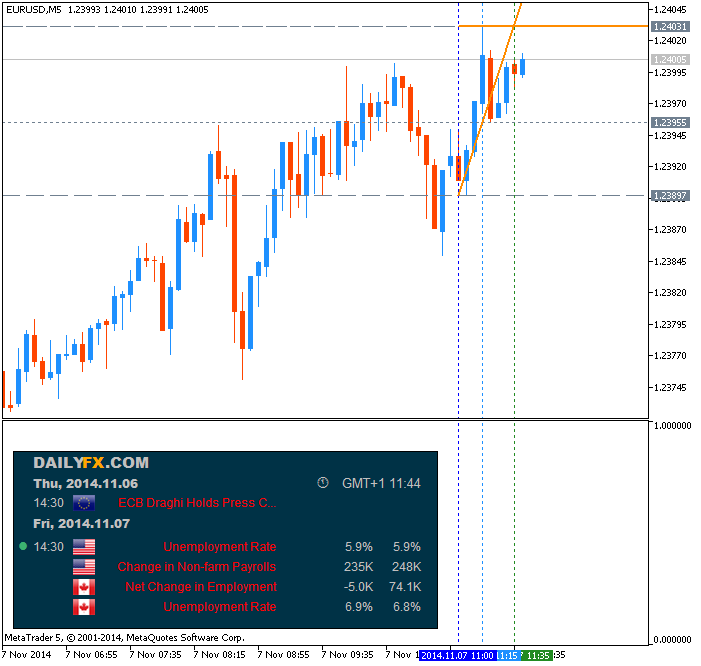

EURUSD M5 : 68 pips price movement by USD - Non-Farm Employment Change news event :

GBPUSD M5 : 54 pips price movement by USD - Non-Farm Employment Change news event :

USDCAD M5 : 50 pips price movement by USD - Non-Farm Employment Change news event :

U.S. Non-Farm Payrolls (NFPs) increased 248K in September after expanding a revised 142K the month prior, while the jobless rate unexpectedly slipped to a six-year low of 5.9% from 6.1% in August. The uptick in hiring certainly highlights an improved outlook for the world’s largest economy, and the bullish sentiment surrounding the U.S. dollar may gather pace over the remainder of the year as the Fed is widely expected to halt its asset-purchase program at the October 29 meeting. Indeed, the better-than-expected prints spurred a bullish dollar reaction, with the EUR/USD slipping below the 1.2550 handle to hit a fresh yearly low of 1.2501.

UK jobs data, Inflation report followed by Mark Carney’s speech, US Unemployment Claims, Retail sales and consumer confidence are the major market movers for this week. Here is an outlook on the highlight events.

Last week, the October Non-Farm Payrolls release was mixed with a lower than expected jobs gain of 214K compared to 256K in the previous month, while Unemployment reached the lowest level since July 2008 with a 5.8% rate, beating estimates for a 5.9%. Overall the report stayed positive backing the Fed’s decision to end its massive bond-buying program aimed to stimulate the economy. However, the job market participation rate increased mildly to 62.8% from 62.7% in September, remaining at its lowest level in nearly four decades, taking some shine away from the official NFP report.

Trading Video: Next EURUSD, USDJPY and SPX Moves Require Greater Conviction (based on dailyfx article)

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: NeutralGBP/USD may face increased volatility next week as U.K. wage growth is projected to uptick in September, while the Bank of England (BoE) is widely expected to retain a cautious outlook for the region.

Indeed, another 20.0K decline in Jobless Claims paired with a pickup in Average Hourly Earnings is likely to highlight an improved outlook for the U.K. economy, but the data may fail to remove the bearish sentiment surrounding the British Pound as Governor Mark Carney largely continues to implement a wait-and-see approach.

Despite bets for faster wage growth, the updated forecasts along with the fresh batch of central bank rhetoric may further dampen the appeal of the sterling as the committee remains in no rush to normalize monetary policy. The BoE may lower its growth forecast as the Euro-Zone, the U.K.’s largest trading partner, stands at risk of slipping back into recession, and we may see a growing number of central bank officials adopt a more dovish tone for monetary policy as easing energy prices reinforces the argument for weak inflation.

With that said, the BoE Minutes due out on November 19 is likely to show another 7-2 split within the Monetary Policy Committee (MPC), and the British Pound remains at risk of facing a further decline over the remainder of the year should the fundamental developments coming out of the U.K. drag on interest rate expectations.

In turn, a more dovish statement from the BoE may put increased downside pressure on GBP/USD especially as the Relative Strength Index (RSI) fails to preserve the bullish momentum from back in September, with the next key downside objective coming in around 1.5720, the 61.8% Fibonacci retracement from July 2013.

USDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Japanese Yen: NeutralThe Japanese Yen has been distinctly unloved since the Bank of Japan’s surprise expansion of monetary stimulus last week, with the currency sinking to a six-year low against its leading counterparts. The beleaguered unit’s fortunes may reverse in the week ahead however as markets come to terms with the new BOJ status quo and the spotlight shifts back to risk sentiment trends.

The central object of speculation dominating the financial markets’ attention is the degree to which a post-QE3 US recovery is able to countervail weakness in the Eurozone and China. The dominant consensus looks increasingly worrisome, with a survey of economists polled by Bloomberg showing that the baseline 2015 global GDP growth outlook has fallen to a 20-monh low of 2.9 percent.

The deterioration in the growth outlook has played out against a backdrop of ECB and BOJ stimulus expansion, meaning traders do not believe these efforts will meaningfully offset the gradual withdrawal of Fed support. For its part, the US central bank has clearly demonstrated a willingness to look past near-term downswings in the business cycle as it marches toward tightening, meaning its conviction will be easily swayed.

In the week ahead, expected improvements in US Retail Sales figures (+0.2% m/m in October vs. -0.3% in September) as well as the University of Michigan Consumer Confidence gauge (87.5 in November vs. 86.9 in October) stand to reinforce the Fed’s trajectory. Meanwhile, a worrisome news-flow from the Eurozone and China may amplify headwinds facing global growth.

The first estimate of third-quarter Eurozone GDP is due to show that output added 0.1 percent after stalling in the prior period. Separately, October’s Chinese Industrial Production figures are seen registering an 8 percent year-on-year increase, unchanged from the previous month. Economic data outcomes from both the currency bloc and the East Asian giant have broadly disappointed relative to consensus forecasts recently however, opening the door for downside surprises.

Disappointing European and Chinese news-flow coupled with another round of evidence supporting the Fed’s steady progression toward interest rate hikes in 2015 will probably make for a toxic mix of sentiment cues. The ensuing bout of risk aversion threatens to trigger liquidation of Yen-funded carry trades, sending the Yen broadly higher against most of its counterparts.

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: BearishAUD/USD finally breached the critical 0.8660 barrier over the past week. Yet it was not the abundance of top-tier domestic economic event risk that catalyzed the ‘breakout’. Indeed, a status-quo RBA decision left steadfast policy bets intact and muted the impact of local data prints. Rather it was broad-based US Dollar gains that finally pushed the pair off the precipice.

Local business and consumer confidence data are on offer next week. Patchy readings from the leading indicators over recent months are not encouraging for broader domestic growth. Yet, we would likely need to see a severe deterioration over future months in order to elicit any response from policy makers. Until then the releases may prove non-events for the AUD, and it may look for guidance from other sources.

Elsewhere in the region; Chinese Retail Sales, Industrial Production, CPI and Aggregate Financing figures are on the docket. Yet the Aussie has witnessed a lackluster response to recent economic releases from the Asian giant. This suggests there is a high threshold for the upcoming China data to impact the commodity currency.

Outside of monetary policy expectations general market conditions remain an important consideration for the AUD. Implied volatility has recently rocketed to its highest level this year, suggesting traders are anticipating large swings amongst the majors in the near-term. Such expectations generally bode ill for the high-yield currencies as they suggest traders will be less tempted into carry trades. This in turn could leave the Aussie vulnerable to further weakness.

Speculative trader positioning in the futures market remains well off the extremes witnessed last year. This indicates there may still be room in the AUD short trade before it becomes ‘overcrowded’.

GOLD Fundamentals (based on dailyfx article)

Fundamental Forecast for Gold: NeutralGold prices were softer this week with the precious metal off by a mere 0.10% to trade at $1171 ahead of the New York close on Friday. Although this marks the third consecutive weekly loss, a substantial rally post NFPs on Friday pared nearly the entire weekly decline which saw gold off by as much as three percent. Although the immediate bias favors the topside targets in the days ahead, the correction is likely to remain capped as USD strength and the broader technical outlook keeps the focus on the short-side of the trade.

The release of the US October Non-Farm Payrolls on Friday was the main event this week with the data showing a gain of 214K jobs as unemployment ticked down to 5.8%. Although the print was slightly softer than the 235K consensus estimates, there was an upward revision of last month’s blowout read from 248K to 256K as the participation rate climbed to 62.8% after rebounding off its lowest levels since the late 1970s.

The release prompted a massive rally in bullion which posted its largest single-day advance since in nearly five months as the USD pulled back from fresh 5-year highs.

Despite the weaker-than-expected employment print, the macroeconomic developments due out next week may continue to heighten the appeal of the greenback amid growing concerns surrounding the global economy. Indeed, China CPI and Euro-Zone 3Q GDP may generate increased demand for the reserve currency as the U.S. growth prospects outpace its major counterparts. Looking ahead to next week investors will also be closely eyeing the US data flow with the Dow Jones FXCM US Dollar Index looking vulnerable near-term after failing to close the week above the 2010 highs.

From a technical standpoint, gold looks poised for further topside in the near-term with Friday’s price action posting a massive outside reversal candle. The snap-back from extremes in the momentum signature suggests this is likely to be a simple bear market rally with topside objectives eyed at $1180, 1192 & 1206/07 (where we would be looking for favorable short entries). Interim support stands at $1150 and is backed by $1125/30. Longer-term support objectives are eyed the 1.618% extension off the 2014 high at $1100. Bottom line: looking higher near-term for favorable short entries with only a breach above $1207 invalidating our broader directional bias.

The USD/CAD pair broke higher during the course of the week, testing the 1.15 level. We failed there and turned back around and form a shooting star, and that of course is a very sign. However, the candle ready for was a hammer at the 1.12 level, so it appears of the market will probably bounce around in this general vicinity. With that being said, the market should eventually go higher, and perhaps go as high as 1.20 the course of the next several months. We are bullish of this market, and have no interest whatsoever in selling.