You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Hey Sergey, I looked through the links that you sent me and I found every thing except the indicator that I am really interested in. check the arrows that I have cycled with yellow color

Hey Sergey, I looked through the links that you sent me and I found every thing except the indicator that I am really interested in. check the arrows that I have cycled with yellow color

below is the asctrend that I am not really intersted in

AscTrend arrow - check my previous post

In the above image, I have cycled the indicator that I am interested in with yellow color and in the image below is the Asctrend that I am not interested in

It was long year ago sorry ...

I think you can request to the Freelance service: https://www.mql5.com/en/job

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2018.01.14 08:50

Weekly Outlook: 2018, January 14 - January 21 (based on the article)

The dollar suffered across the board in the second week of 2018. Will it remain under pressure? The upcoming week features housing data and consumer confidence from the US, Chinese GDP, and other market-moving events. Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

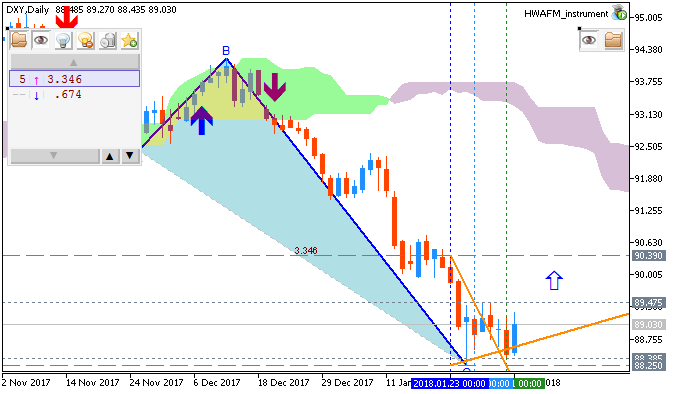

Sergey Golubev, 2018.01.20 09:27

Weekly Outlook: 2018, January 21 - January 28 (based on the article)

The dollar remained on the defensive but it wasn’t one-sided anymore. The greenback fought back. GDP from the US and the UK, rate decisions in Japan and the euro, and many other events await us in a busy week. Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2018.01.23 08:11

IMF revises up world economic growth (based on the article)

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2018.01.28 12:17

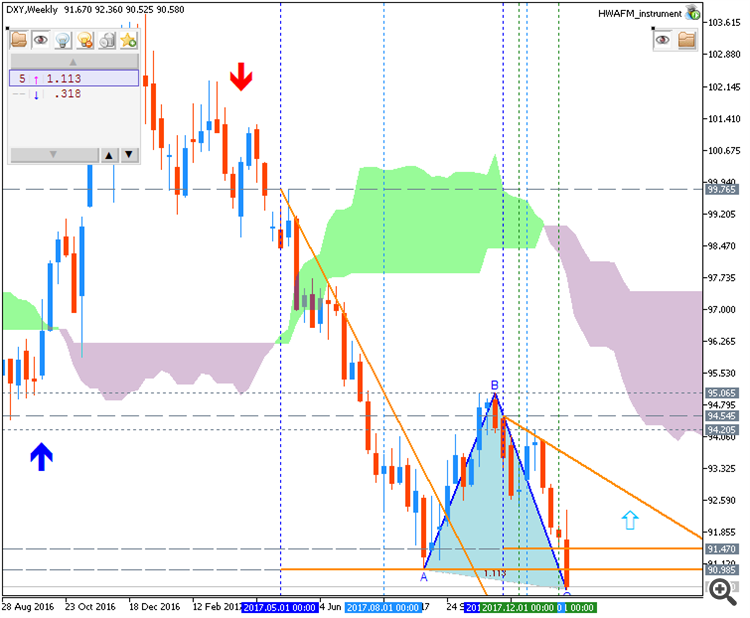

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The US Dollar continues to face heavy selling pressure, falling for a seventh consecutive week against its major counterparts. That is the longest losing streak in over 13 years. The currency seems to have become a victim of its own success: starting in 2014, the greenback enjoyed three years of gains as the Fed tightened policy while its G10 peers lagged behind. Now, a rosy global growth outlook is inspiring catch-up bets."

-----------

Chart was made on MT4 using iFibonacci indicator and MaksiGen_Range_Move indicator from CodeBase (free to download).

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2018.01.30 17:16

Intra-Day Fundamentals - NZD/USD, USD/CNH and Dollar Index: The Conference Board United States Consumer Confidence Index

2018-01-30 15:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

From official report :

==========

NZD/USD M5: range price movement by U.S. CB Consumer Confidence news events

==========

USD/CNH M5: range price movement by U.S. CB Consumer Confidence news events

============

Dollar Index M5: range price movement by U.S. CB Consumer Confidence news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

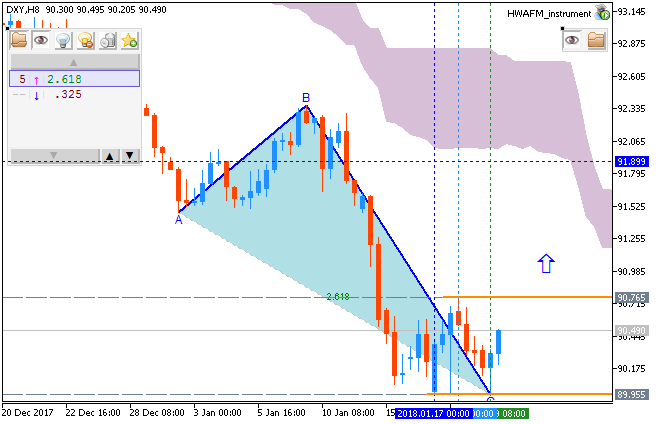

Sergey Golubev, 2018.02.04 04:28

Weekly Outlook: 2018, February 04 - February 11 (based on the article)

The US dollar made an attempt to recover but the results were mixed in a very busy week. What’s next? The focus shifts away from the US as we have three rate decisions and two jobs reports from other places Here are the highlights for the upcoming week.

============

The chart was made on Metatrader 5 using HWAFM tool pattern tool from this post.