You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

NZD/USD - bearish ranging; 0.6820 level is the key (based on the article)

Daily price is on ranging below Ichimoku cloud in the ebarish area of the chart: the price is testing 0.6820 support level to below for the bearish trend to be resumed.

Trading Lesson: Moving Averages and the direction of the trend (based on the article)

"Finding the direction of current market momentum is an important step for trend traders. Moving averages are a unique tool that help traders to just that on a variety of charts and time frames. A 200 period MVA (simple moving average) is often employed for this task, with traders looking to see if prices are currently above or below the average. If prices are trading above the 200 period MVA, the trend and market momentum may be interpreted as rising. As well if prices are below the average, this may be interpreted as a declining market."

"Often times, one line of reference may not be beneficial to a trader. To get a more complete look at momentum, traders may employ a series of MVA’s. Typical averages include the 20,50, and 200 period MVA’s. While the settings of the averages can be changed, traders should consider having a short, mid, and long term MVA for reference. In an uptrend, the shortest moving average should reside above the mid and long term lines. Alternatively in a downtrend, the short term average should be below both the mid and long term lines."

"Lastly, once traders are familiar with traditional averages, traders may expand their knowledge base to include other interpretations of moving averages. EMA’s (Exponential moving average) are similar to traditional MVA’s, however these lines are weighted. This means EMA’s are more sensitive to change in present market price than traditional MVA’s. Their sensitivity makes them a great tool for finding short term shifts in momentum on longer term charts."

USD/CAD and Brent Crude Oil - USD/CAD for the bullish continuation with Brent Crude Oil for the bearish reversal (based on the article)

Daily price is above Ichimoku cloud for the bullish market condition with the ranging within the narrow support/resistance levels:

There is good correlation with Brent Crude Oil chart so if USD/CAD is continuing with the bullish trend so we may see Brent Oil daily price to be reversed to the primary bearish condition.

============

This technical analysis was provided with the following indicators from CodeBase:

Intra-Day Fundamentals - EUR/USD, AUD/USD and Bitcoin (BTC/USD): U.S. Retail Sales and Consumer Price Index (CPI)

2017-05-12 13:30 GMT | [USD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

2017-05-12 13:30 GMT | [USD - CPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From marketwatch article:

==========

EUR/USD M5: range price movement by Retail Sales and CPI news events

==========

AUD/USD M5: range price movement by Retail Sales and CPI news events

==========

BTC/USD M5: range price movement by Retail Sales and CPI news events

What is the difference between CNY and CNH currencies? (based on the article)

"Prior to the establishment of the yuan offshore market, China's capital control rules did not allow renminbi (denoted CNY) to be traded outside of China. In-fact, it was a proposal by the Hong Kong Monetary Authority to allow renminbi trading in Hong Kong that opened the dialog of an offshore renminbi market."

"On July 19th, 2010, the People's Bank of China (PBOC) and the HKMA jointly announced that the renminbi would be deliverable in Hong Kong, thus creating the offshore renminbi (CNH) market where foreign individuals and corporations are allowed to buy, hold or sell CNH. These investors are restricted from participating in the onshore CNY market (aside from Qualified Foreign Institutional Investors)."

"These developments were part of China's path toward internationalization of the renminbi, and to make it an international trade currency of choice (latest achievement being renminbi's inclusion into the IMF's SDR)."

Weekly Outlook: 2017, May 14 - May 21 (based on the article)

The second week of May saw the dollar gaining ground against many currencies despite a political controversy. A mix of events awaits us now: GDP from Japan, jobs from Australia, and housing data from the US.

Weekly EUR/USD Outlook: 2017, May 14 - May 21 (based on the article)

EUR/USD took Macron’s victory with a stride, having priced in the election from the outset. GDP and inflation data stand out in the third week of May.

USD/CNH Intra-Day Fundamentals: China Industrial Production and range price movement

2017-05-15 03:00 GMT | [CNY - Industrial Production]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Industrial Production] = Change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

==========

From official report:

==========

USD/CNH M5: range price movement by China Industrial Production news event

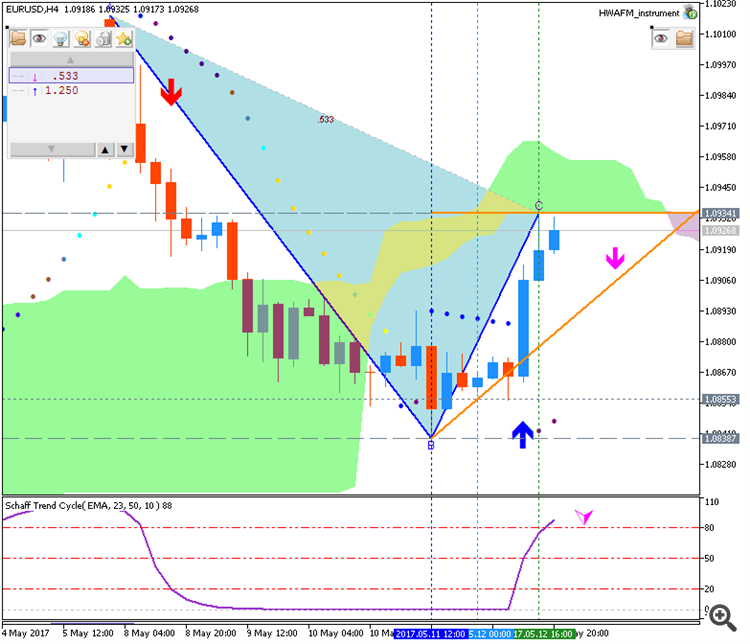

EUR/USD - Bullish ranging within narrow s/r channel (based on the article)

Daily price is above Ichimoku cloud for the bullish market condition with the ranging within 1.1017 resistance level and 1.0838 support level.

If the price breaks 1.1017 resistance on close daily bar so the bullish trend will be resumed.

If the daily price breaks 1.0838 support on close bar so the secondary correction will be started.

If not so the price will be on bullish ranging within the levels.

AUD/USD Intra-Day Fundamentals: RBA Meeting Minutes and range price movement

2017-05-16 02:30 GMT | [AUD - Monetary Policy Meeting Minutes]

[AUD - Monetary Policy Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

From seekingalpha article:

==========

AUD/USD M5: range price movement by RBA Meeting Minutes news event