Video Lesson - Price Action: Introduction To Price Action Trading (what is price action, basic set-ups and stop placement, and more)

- What is price action trading?

- The basics of reading charts

- Support and resistance

- Basic set-ups and stop placement

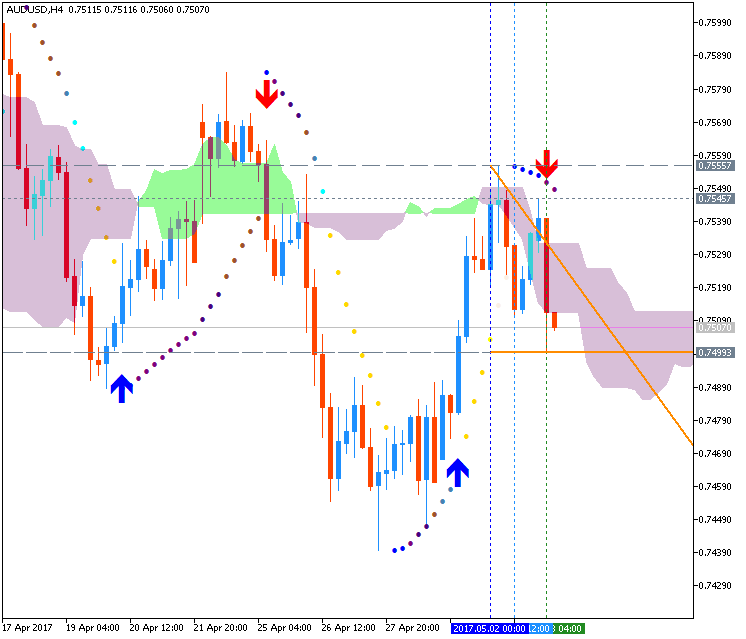

- Two examples of trades from the forex market

What is Price Action?

Price action is a particular methodology employed by traders, based on the observation and interpretation of price action, usually through the use of candlestick or bar charts. The price action style of trading is usually characterized by clean charts, without indicators, with the explanation that indicators are themselves interpretations of the historical movements of price, which don't contain any information or predictive power that isn't available from the charts themselves. Nonetheless, some traders include basic indicators, such as exponential moving averages or average true range to augment their charts or to provide confluence. The attitude of the price action trader is that the interpretation of price movements can provide an edge, a possibility of being more right than wrong in their predictions about the future behavior of price.

The basics of reading candles and charts

Since candlestick and bar charts are the fundamental interface of the price action trader, the most basic unit is the candle or bar itself. Candles sum up the price action over a set period of time: on a 5 minute chart, each candle represents 5 minutes of price behavior, whereas on a daily chart, only one candle is produced per day. The body of the candle constitutes the range between the open price and close price, whereas the wicks or shadows of the candle indicate the high and low over that period of trading. Various color schemes are used to determine whether the price movement represented by the candle is bullish (increasing in price) or bearish (decreasing in price); bullish candles are usually white, blue, or green, whereas bearish candles are usually black or red.

- Longer candle bodies demonstrate strong momentum and decisive market behavior in the movement from open to close; longer shadows, however, demonstrate increased volatility, since some prices were reached during the time period but ultimately excluded from the range between open and close.

- Smaller candles can indicate the market's indecision, disinterest, or a balance between bullish and bearish forces.

Support and resistance lines are typically horizontal, but when they are diagonal along a trend they are known as trend lines. The basic idea behind using support and resistance effectively in a trading range is to buy at the support level and sell at resistance in an uptrend, or to sell at resistance and buy at support in a downtrend; so, we're not necessarily hoping for a break-out through the established levels, because a break-out means that the market isn't behaving predictably enough to allow for safe bets on its future performance. Instead, the most conservative or reliable trades are those that occur as the market fluctuates between identifiable support and resistance levels, allowing you, in an uptrend, to buy when a retracement of bearish leg has brought prices down to a support level, and then sell when price returns to the resistance level, or, in a downtrend, to sell when price is maxed out at a reliable resistance level. The reason we are looking to buy in an uptrend and sell in a downtrend is that price action trading is all about playing the odds, so trading with the trend rather than against it is usually a better idea since a trend is statistically more likely to continue than to reverse.

Basic Set-ups and Stop Placement

Most price action traders place buy or sell stop orders with a pre-determined stop loss level, and a take profit or target level. The buy or sell stop sets the level that price much reach for the order to be filled; the stop loss level sets the margin of loss that a trader will accept before closing the position; the take profit level sets the level at which to automatically close a successful position. The buy or sell stop, or entry level, is typically set at a significant support or resistance level so that it will only be filled when price has broken definitively in the desired direction; by setting strategic entry levels in their orders, traders can ensure that they enter trades with the momentum of the market.

How to Draw Pitchforks (Median Lines)

Форум по трейдингу, автоматическим торговым системам и тестированию торговых стратегий

Вот что можно сделать с OpenCL прямо в терминале MetaTrader 5 без всяких DLL

Renat Fatkhullin, 2016.12.10 01:10

It demonstrates not only the calculations on the GPU in MQL5 code, but also the graphics capabilities of the terminal:

Full source code in the form of a script is attached. The bug on OpenCL 1.2 was fixed.

This video was created by MetaQuotes. The script is attached to the original post here.

The articles:

- OPENCL: THE BRIDGE TO PARALLEL WORLDS

- OPENCL: FROM NAIVE TOWARDS MORE INSIGHTFUL PROGRAMMING

- HOW TO INSTALL AND USE OPENCL FOR CALCULATIONS

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.12 08:12

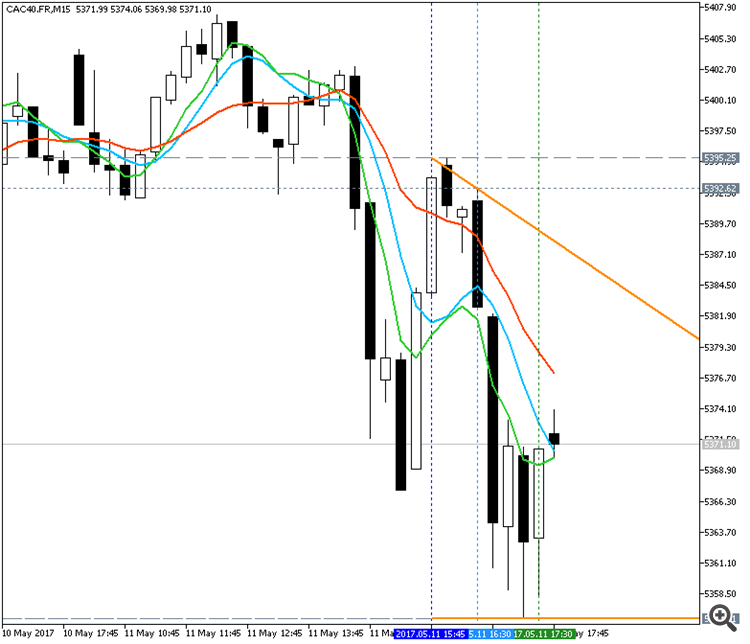

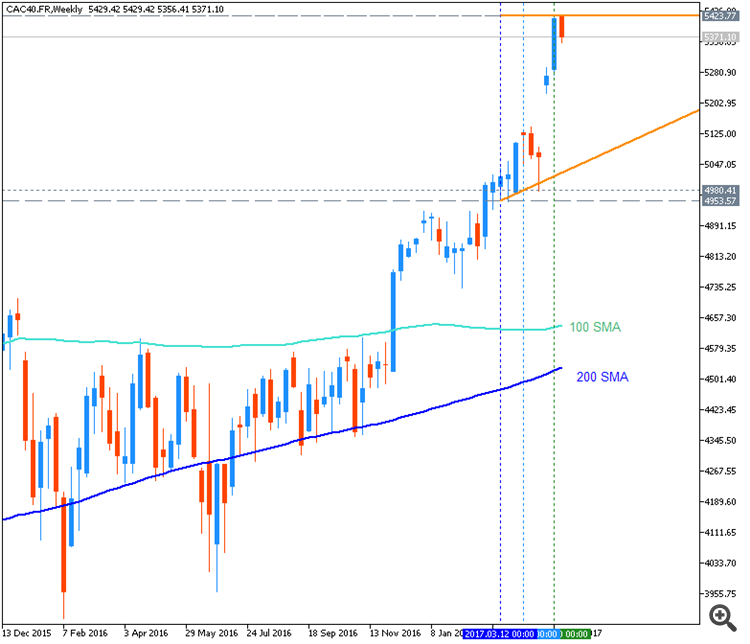

Trading Lesson: Moving Averages and the direction of the trend (based on the article)

"Finding the direction of current market momentum is an important step for trend traders. Moving averages are a unique tool that help traders to just that on a variety of charts and time frames. A 200 period MVA (simple moving average) is often employed for this task, with traders looking to see if prices are currently above or below the average. If prices are trading above the 200 period MVA, the trend and market momentum may be interpreted as rising. As well if prices are below the average, this may be interpreted as a declining market."

"Often times, one line of reference may not be beneficial to a trader. To get a more complete look at momentum, traders may employ a series of MVA’s. Typical averages include the 20,50, and 200 period MVA’s. While the settings of the averages can be changed, traders should consider having a short, mid, and long term MVA for reference. In an uptrend, the shortest moving average should reside above the mid and long term lines. Alternatively in a downtrend, the short term average should be below both the mid and long term lines."

"Lastly, once traders are familiar with traditional averages, traders may expand their knowledge base to include other interpretations of moving averages. EMA’s (Exponential moving average) are similar to traditional MVA’s, however these lines are weighted. This means EMA’s are more sensitive to change in present market price than traditional MVA’s. Their sensitivity makes them a great tool for finding short term shifts in momentum on longer term charts."

The 3 Step Trading Plan - Webinar (based on the article)

- "Developing a trading plan can be a difficult process for new traders. The good news is that trading the trend can be broken into three manageable steps. In this webinar we cover all three steps so you can begin writing your own unique trading methodology."

- "First, traders will need to find the trend. This step is important because traders should look to buy as prices rise in an uptrend, or sell in a declining downtrend. Typically this can be done using a combination of price action, technical indicators, and sentiment analysis. While there are many options that traders can select from for this process, the good news is once market direction is found traders may immediately move on to the final two steps of their trading plan."

- "Next, traders will need to time their market entries. For this step, traders need to decide if they will be trading breakouts or retracements. A breakout trader will look to buy above values of resistance in an uptrend and sell below support in a downtrend. This differs from retracement traders that will look for pull backs or dips in the trend before entering into the market. It’s important to remember that both breakout and retracement strategies have their Pros and Cons. So take some time here to pick the method that works for you. The key with any strategy is consistency!"

- DailyFX

- www.dailyfx.com

How To Invest in Gold Coins (based on the article)

Investing in gold can be accomplished in 3 popular ways:

- Buy physical gold coins or bullion.

- Buy gold ETFs.

- Buy gold futures.

All 3 methods are great ways to invest in gold, but physical gold in the form of coins or bullion is one of the best and most enjoyable ways to invest in gold for the long term.

One of the biggest benefits of physical gold is that you own the metal and don't need to worry about transaction costs associated with other types of gold investments.

========

Question. What kind of gold should I buy?

Answer. We probably get that question more than any other -- pretty much on a daily basis. The answer, however, is not as straightforward as you might think. What you buy depends upon your goals. We usually answer the "What should I buy?" question with one of our own: "Why are you interested in buying gold?" If your goal is simply to hedge financial uncertainty and/or capitalize on price movement, then contemporary bullion coins will serve your purposes. Those concerned with the possibility of capital controls and a gold seizure, or call-in, often include historic pre-1933 gold coins in their planning. Both the contemporary bullion coins and historic gold coins carry modest premiums over their gold melt value, track the gold price, and enjoy strong liquidity internationally.

Q. When should I buy?

A. The short answer is 'When you need it.' Gold, first and foremost, is wealth insurance. You cannot approach it the way you approach stock or real estate investments. Timing is not the real issue. The first question you need to ask yourself is whether or not you believe you need to own gold. If you answer that question in the affirmative, there is no point in delaying your actual purchase, or waiting for a more favorable price which may or may not appear. Cost averaging can be a good strategy. The real goal is to diversify so that your overall wealth is not compromised by economic dangers and uncertainties like the kind generated by the 2008 financial crisis, or those now unfolding in Europe and Japan.

Q. Why not wait for the necessity to arise, then buy gold?

A. Over the past few years, as concern about a financial and economic breakdown spread, there were periods of gold coin bottlenecks and actual shortages. In 2008-2009 at the height of the financial crisis, demand was so great that the national mints could not keep up with it. The flow of historic gold coins from Europe was also insufficient to meet accelerating demand both there and in the United States. Premiums shot-up on all gold coins and a scramble developed for what was available. There is an old saying that the best time to buy gold is when everything is quiet. I would underline that sentiment.

Q. Can you give us a profile of the typical gold investor?

A. Gold owners are a group of people I have come to know very well in my 40+ years in the business. Contrary to the less than flattering picture sometimes painted by the mainstream press, the people we have helped become gold owners are among those we rely upon most in our daily lives -- our physicians and dentists, nurses and teachers, plumbers, carpenters and building contractors, business owners, attorneys, engineers and university professors (to name a few.) In other words, gold ownership is pretty much a Main Street endeavor. A recent Gallup poll found that 34% of American investors rated gold the best investment "regardless of gender, age, income or party ID. . ." In that survey, gold was rated higher than stocks, bonds, real estate and bank savings.

Q. What about high net worth investors?

A. Traditionally, wealthy, aristocratic European and Asian families have kept a strong percentage of their assets in gold as a protective factor. The long term economic picture for the United States has changed enormously over the past several years. As a result, that same philosophy has taken hold here particularly among those interested in preserving their wealth both for themselves and for their families from one generation to the next. In recent years, we have helped a good many family trusts diversify with gold coins and bullion at the advice of their portfolio managers.

Q. You frequently mention gold as insurance. What do you mean by that?

A. Gold's baseline, essential quality is its role as the only primary asset that is not someone else's liability. That separates gold from the majority of capital assets which in fact do rely on another's ability to pay, like bonds and bank savings, or the performance of the management, or some other delimiting factor, as is the case with stocks. The first chapter of the ABCs of Gold Investing ends with this: "No matter what happens in this country, with the dollar, with the stock and bond markets, the gold owner will find a friend in the yellow metal -- something to rely upon when the chips are down. In gold, investors will find a vehicle to protect their wealth. Gold is bedrock."

Q. What percentage of my assets should I invest in gold?

A. Once again the answer is not cut and dry, but a general rule of thumb is 10% to 30%. How high you go between 10% and 30% depends upon how concerned you are about the current economic, financial and political situation. Recently, CNBC television commentator Jim Cramer strongly advocated a 20% gold diversification.

Q. In your book, you state: "Who you do business with is one of the most important aspects of gold investing." Why is that?

A. A solid, professional gold firm can go a long way in helping the investor shortcut the learning curve. A good gold firm can help you avoid some the problems and pitfalls encountered along the way, and provide some direction. It can help you in the beginning and through the course of your gold ownership both in making additions to your portfolio and liquidations.

========

MetaTrader 5 for Android Smartphones and Tablets

Access to the Forex and Exchange markets, a large set of technical indicators and analytical objects, all types of trading orders and execution modes. Market Watch and Depth of Market, financial news and traders' chat. All these features now fit in your hand and are available anywhere in the world from your favorite smartphone.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.