An increase in volatility can cause price to breakout

Camarilla Pivots can be designated for planning order entries

Traders can use 1x extension of the trading range for profit targets

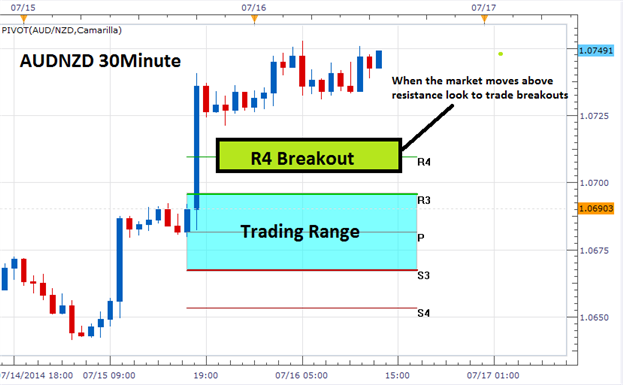

While price may spend the majority of its time reversing between lines of support and resistance, there will also be periods of volatility when price breaks out. A price breakout simply refers to the price of a traded asset moving through a pre-designated area of either support or resistance. Savvy traders can then prepare to look for these opportunities by finding these values on their graph. To help plan for a breakout, we will continue our review of camarilla pivots.

AUDNZD Breakout

Support, Resistance, & Breakouts

We will first need to identify existing points of support and

resistance. When added Camarilla pivot points to the graph, these pivots

will allow traders to spot a breakout using the R4 and S4 lines now

available on their graph. Now traders can consider a series of options

for trading.

The easiest way to trade breakouts is through the use of a series of

order entries. Entry orders set above resistance will be waiting to buy

the market in the event price moves to higher highs.

Conversely, orders to sell below the S4 line of support will be

triggered upon the market moving to lower lows. Traders that would like

more confirmation may also consider waiting for a candle close, then

triggering a market order. The key is to get into the market on a new

surge in price, which generally transpires along with an economic

announcement.

AUDNZD Entry and Target

Risk & Profit Targets

As with any trading strategy, traders should spend as much time planning

their exits as they do their entry orders. Through the use of Camarilla

Pivots, traders again can develop a very systematic methodology for

exiting the market. Since the market is breaking out, risk can be

managed by placing stop orders inside of the designated trading range.

The rationale behind this is that if market conditions change, traders

should close their positions and look for other opportunities.

Once a stop is found, traders can then set a profit target. Since our

pivot points are calculated using a fraction of the previous day’s

trading range, we can again use the designated values for profit

targets. Traders can look for a minimum of 1 times the denoted range,

which in the example of the AUDNZD above would be 28 pips. This would

equate to a 1:2 risk reward ratio when used with a standardized stop.