1. Introduction:

Financial markets today move within fast-changing cycles of liquidity, volatility, macroeconomic pressure, and trader sentiment. In this environment, most retail traders do not fail because they lack skill, but because they operate without a structured decision-making framework. Without a clear process, trading becomes reactive, emotionally driven, and almost impossible to refine or improve.

The Professional Smart Trading System (PSTS) is a level-based methodology designed to bring structure, clarity, and progression to the trading workflow. Instead of relying on one indicator or strategy, PSTS organizes the trading process into a series of logical layers—each with its own purpose, complexity, and learning objective. This layered structure allows traders to move step by step from simple execution to deeper market interpretation, and ultimately toward systematic, rule-based trading.

The aim of this article is to present PSTS as a neutral educational framework, not tied to any specific tool or commercial product. Each level is explained in terms of its role, its logic, and how it integrates with the others. Understanding this progression helps traders interpret market conditions more clearly, filter irrelevant information, and select strategies appropriate to their skill level and goals.

PSTS functions as a complete roadmap:

-

Level 1 — simplified execution through structured, signal-based trading

-

Level 2 — multi-indicator trend analysis and market structure understanding

-

Level 3 — market-wide context, trend scanning, and instrument selection

-

Level 4 — rule-based automation for consistent execution

-

Level X — advanced institutional concepts and price-action logic

Each level builds on the last, creating a controlled, step-by-step development path. The following sections break down each component and show how PSTS becomes a practical, scalable foundation for modern trading.

![]()

Click below to download this book & Take the Online Course 100% FREE:

Online Course: https://www.mql5.com/en/blogs/post/766525

Join MQL5 Channel: https://www.mql5.com/en/channels/issam_kassas

2: the Need for Structured Trading

Across all markets—forex, indices, commodities, and crypto—retail traders face remarkably similar challenges. These problems rarely stem from a lack of intelligence or effort. Instead, they arise because traders operate without a structured framework to guide their decisions. Before discussing the individual levels of the Professional Smart Trading System (PSTS), it is essential to understand why structure is the foundation of consistent trading.

2.1: The Fragmentation Problem:

Most traders gather information from many unrelated sources: individual indicators, random strategies, YouTube tutorials, books, Telegram channels, and social media posts. While each piece may offer value on its own, they are almost never designed to work together. This creates a fragmented workflow that leads to contradicting signals, hesitation, over-analysis, and inconsistent execution. Because the trader changes methods frequently, improvement becomes nearly impossible.

PSTS resolves this by offering a unified, progressive structure. Every level has a defined role, and every concept fits into a larger logical system. Instead of random tools, traders follow an organized methodology.

2.2: The Absence of Defined Entry & Exit Logic:

Many traders assume they have a “strategy,” when what they actually have is a collection of ideas with no operational rules. Without clear definitions for:

-

when to enter,

-

when to exit,

-

when to avoid trading entirely,

-

how to size positions, and

-

how to evaluate risk,

consistent execution becomes impossible. Decisions become subjective, timing becomes emotional, and results fluctuate wildly.

PSTS solves this by giving each level a specific function and decision framework. The trader moves from idea-based trading toward rule-based execution, which removes randomness from the process.

2.3: The Emotional Pressure of Trading Without Structure:

Uncertainty is the strongest psychological stressor in trading. When a trader does not know why they are entering a position, even normal market fluctuations create anxiety. This often leads to:

-

closing trades prematurely,

-

moving stop-losses,

-

chasing entries,

-

over-trading,

-

ignoring risk management rules.

A structured methodology reduces emotional pressure because the trader no longer needs to guess. Each level of PSTS defines exactly what to observe, how to interpret it, and what action to take, allowing emotions to play a smaller role.

2.4: Why a Level-Based Approach Works:

The PSTS framework is intentionally designed as a progressive learning path. Each level builds on skills developed in the previous one:

-

Level 1 → Simple, rule-based execution with no complex analysis

-

Level 2 → Structured technical reading of trend, structure, and behavior

-

Level 3 → Market-wide context and directional confirmation

-

Level 4 → Turning rules into consistent, automated execution

-

Level X → Advanced institutional and liquidity concepts

This progression mirrors how professional traders develop: start simple, build clarity, expand into structure, automate rules, and finally study advanced price-action logic.

Structured trading is not a bonus—it is essential. Most trading problems come from a lack of order: inconsistent execution, conflicting information, emotional reactions, and fragmented workflows. PSTS organizes the entire process into a clear set of levels, making decisions more objective, more repeatable, and easier to refine with experience.

By following this roadmap, traders move from confusion toward clarity, from randomness toward discipline, and from emotional decisions toward structured performance.

![]()

3. Level 1 — Foundation: Atomic Analyst Logic and Structured Trade Execution

The first component of the Professional Smart Trading System (PSTS) is Level 1, the foundation of the entire framework. Its purpose is simple: before a trader interprets trend structure or advanced market behavior, they must learn to execute clean, rule-based trades with consistency.

Level 1 provides that foundation by combining directional bias, predefined entry/exit rules, and a strict risk-management model. Together, these elements remove the uncertainty and decision overload that affect most beginners. Once these habits become natural, the trader is ready to expand into Level 2’s structural interpretation.

3.1: Purpose of Level 1 in the PSTS Framework:

Early-stage traders often lose not because they choose “bad strategies,” but because they try to interpret too many variables at once—trend direction, structure, volatility, patterns, timing—without a stable execution model.

Level 1 resolves this by reducing trading to a structured, repeatable process. It provides:

-

Clear signals including entry, stop-loss, and targets

-

Directional alignment through trend filtering

-

Performance guidance, such as win-ratio and multi-timeframe confirmation

-

A universal money-management model, based on the 1% rule

With Level 1, the trader learns discipline and consistency before engaging with the more complex decision layers introduced in Level 2.

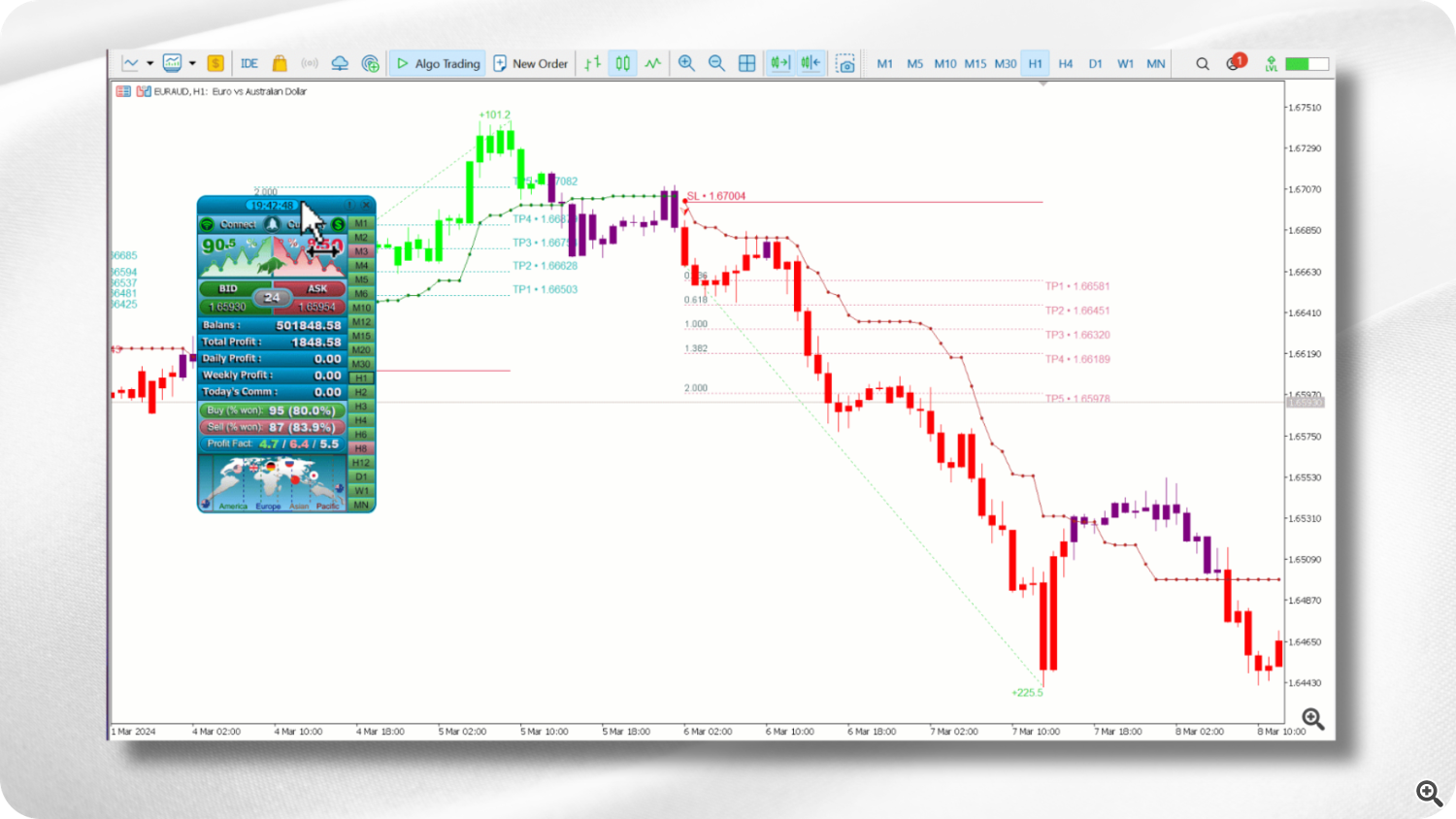

3.2: How Level 1 Works:

Level 1 can be applied in two operational modes, depending on how actively the trader participates:

-

Active Mode — for traders who monitor the charts

-

Passive Mode — for traders who rely on alerts and VPS execution

Both modes use the same underlying logic; the difference lies in how much additional confirmation the trader uses.

3.3: Active Trading Mode — Structured Decision-Making:

In Active Mode, the trader uses Level 1’s panel to reinforce each signal with contextual checks.

When a signal appears, the trader immediately checks the win ratio of signals in the same direction. A ratio above 70% indicates that the system performs well under current conditions, increasing confidence in the entry.

Multi-Timeframe Trend ScannerThe scanner displays trend alignment across several timeframes. If most timeframes are bullish during a buy signal, or bearish during a sell signal, the directional conviction increases.

Combined Confirmation ExampleA high-probability trade typically follows this structure:

-

Signal appears

-

Win ratio > 70%

-

Multi-timeframe alignment confirms direction

This workflow reduces randomness, enforces discipline, and helps the trader act decisively instead of reacting emotionally.

3.4: Stop-Loss and Target Placement in Level 1:

Level 1 provides a complete exit structure, allowing traders to follow professional risk management without interpretation.

Stop-Loss (SL)-

Always place SL exactly at the system-generated level.

-

These levels are optimized through extensive scenario testing.

-

Losses are normal; altering SL invalidates the strategy.

Level 1 supports two management approaches:

(1) Single TP (TP5)

-

Target ≈ 1:2 RRR

-

Simple and effective for beginners

(2) Split TP (TP3 + TP5)

-

TP3 ≈ 1:1 → close half, move SL to BE

-

TP5 ≈ 1:2 → close remainder

-

Reduces drawdown and smooths equity curve

Level 1 enforces the 1% risk rule, ensuring sustainability.

Even a strategy with a 99% win rate becomes destructive if the trader risks too much on a single trade. Level 1 teaches the discipline required for long-term stability.

3.5: Passive Trading Mode — VPS-Based Signal Execution:

Passive Mode is designed for traders who prefer automated notifications rather than screen time.

Workflow:

-

Install Level 1 on a VPS

-

Remove the panel to reduce CPU load

-

Receive alerts containing:

-

Entry price

-

Stop-loss

-

TP1 (~1:1)

-

TP2 (~1:2)

-

Execution becomes straightforward:

-

Risk 1%

-

Set SL exactly at the provided level

-

Choose between full TP2 exit or partial TP1 exit with BE adjustment

Even in passive mode, the rules remain systematic and consistent.

Market Selection RecommendationsLevel 1 performs best on trending instruments and the H1 timeframe.

Recommended markets:

-

EURUSD

-

AUDUSD

-

XAUUSD

Other markets can be used, but traders should consider:

-

Win-ratio behavior

-

Whether the asset trends or ranges

-

Volatility characteristics

This ensures Level 1 is applied where its statistical strengths are highest.

3.6: Why Level 1 Prepares Traders for Level 2:

Level 1 prepares traders by developing four essential skills:

-

Following predefined rules without modification

-

Understanding directional bias through trend filtering

-

Executing trades within a fixed risk framework

-

Building confidence through structured, repeatable behavior

Level 2 introduces multi-indicator logic, trend structure analysis, pullback identification, breakout behavior, and discretionary interpretation.

A trader who has not mastered Level 1 will struggle with the complexity of Level 2.

Level 1 is not optional—it is the foundation that makes higher-level trading possible.

![]()

4. Level 2 — Smart Trend Trading System (STTS)

Developing Structured Technical Mastery After Level 1

Level 1 teaches traders how to execute: follow a signal, respect stops, manage risk, and remain disciplined.

Level 2—the Smart Trend Trading System (STTS)—expands this foundation by teaching traders how the market actually behaves. It introduces the structural elements that drive price movement: trend formation, pullbacks, breakouts, reversals, volatility shifts, and multi-timeframe interaction. These concepts cannot be absorbed meaningfully without the discipline and repetition developed in Level 1. For this reason, Level 2 is not an alternative path—it is the continuation of the learning curve.

4.1. Why Level 1 Must Come Before Level 2

The logic inside STTS becomes intuitive only when the trader is already comfortable with structured execution.

Level 1 builds essential habits: following signals without hesitation, placing stop-losses correctly, managing consistent 1% risk, and becoming familiar with trend and range behavior. Once a trader has executed dozens of trades with this foundation—entries, exits, TPs, SLs—Level 2 becomes the natural next step.

Without Level 1, traders entering Level 2 feel overwhelmed.

With Level 1, Level 2 feels like “unlocking the rest of the map.”

4.2. Architecture of the Smart Trend Trading System

STTS is not a single indicator—it is a coordinated ecosystem of analytical components.

Each component answers a question that Level 1 cannot address:

-

Trend Breakout Catcher highlights impulses and breakout conditions.

-

Smart Cloud shows trend direction, momentum strength, and potential range boundaries.

-

Smart Trailing Stop adjusts dynamically to volatility and trend continuation.

-

Smart Reversal Zones detect exhaustion and potential turning points.

-

MTF Trend Finder aligns entries with higher-timeframe structure.

-

Support & Resistance Mapping identifies key reaction zones.

-

Candle Color Coding visualizes momentum, pressure, and trend continuation probability.

Together, these modules transform isolated signals into a coherent structural picture.

Level 1 tells you what signal to take.

Level 2 explains why the signal exists.

4.3. STTS Core Strategies

STTS contains multiple strategies, each designed around real market behavior. These strategies only work properly when the trader already understands stop placement, risk control, and basic trend behavior from Level 1.

A. Trend-Following Strategy

This strategy teaches traders to identify a trend early, wait for a structured pullback, and join the continuation leg.

The cloud defines direction, breakout signals reveal trend strength, candle pressure provides confirmation, and multi-timeframe alignment ensures the trend is supported on higher charts. The Smart Trailing Stop manages the trade dynamically as momentum evolves.

This creates a clear visual roadmap: trend direction, pullback zones, breakout areas, and dynamic exits.

Instead of guessing, traders follow a structured interpretation of trend mechanics.

B. Reversal Strategy

Reversals are difficult for beginners because they often rely on intuition or emotion.

STTS removes the guesswork by defining exhaustion zones, candle pressure shifts, and structural breaks that reveal when a trend may be losing strength.

When price enters a reversal zone, candle colors shift, and a structural arrow appears, traders receive a rule-based indication that a reversal is forming.

This converts what is normally an emotional decision into a structured process.

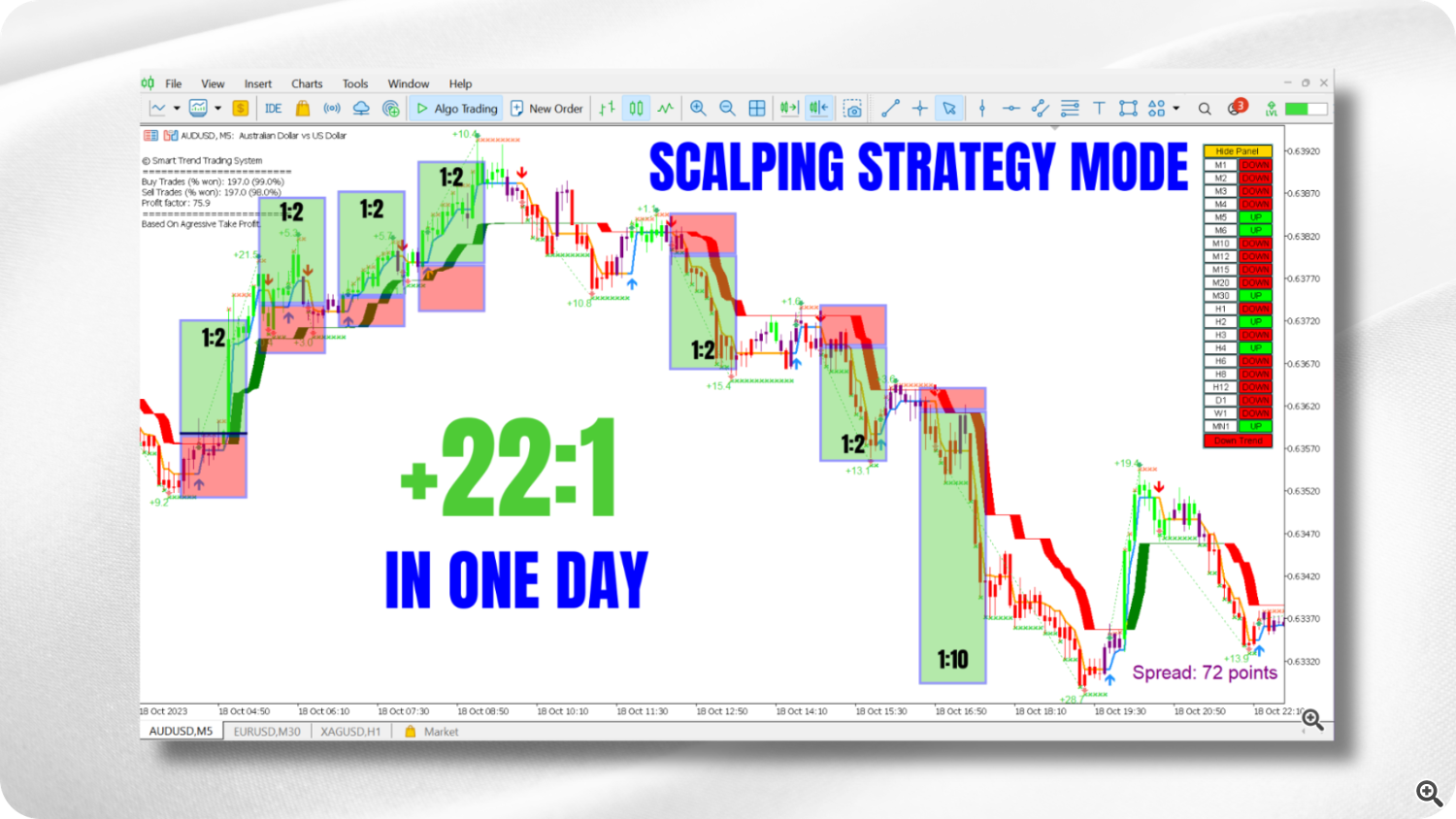

C. Scalping Strategy

The scalping strategy focuses on short-term volatility bursts, using micro-cloud behavior, candle-pressure cues, and minor reversal zones to time precise intraday entries.

Scalping is introduced only after the trader understands trend and reversal logic, protecting beginners from overtrading or entering low-quality setups.

4.4. How STTS Complements and Expands Level 1

Level 1 provides entries, exits, and risk control—but it does not explain trend dynamics.

Level 2 fills that gap by showing:

-

why trends form and how strong they are

-

where pullbacks usually occur

-

how to differentiate ranges from breakouts

-

how to adapt exits to changing momentum

-

how multi-timeframe structure influences probability

Every limitation of Level 1 is addressed by a corresponding component inside STTS.

Level 1 builds discipline; Level 2 builds understanding.

4.5. How to Trade Level 2 (Execution Framework)

STTS can be traded in two practical modes, based on trader preference:

Active Mode

Traders who monitor charts will use the full structural context:

-

Read multi-timeframe trend alignment

-

Confirm cloud direction and strength

-

Identify pullback or reversal zones

-

Wait for candle-pressure confirmation

-

Watch for breakout or reversal arrows

-

Place SL according to system rules

-

Manage trade using the Smart Trailing Stop

This mode teaches traders to read the market like a structured narrative.

Passive Mode

Traders seeking simplicity can follow:

-

Trend-Following preset

-

Alerts with predefined SL/TP

-

Automatic trailing-stop management

This approach is ideal for swing traders or VPS users and offers a more hands-off workflow.

Summary of Level 2

Level 2 elevates traders from “following a signal” to “understanding the market.”

Where Level 1 builds consistency and discipline, Level 2 teaches structure, trend logic, reversal patterns, and dynamic management. Together, they form the technical backbone of the PSTS progression.

![]()

5. Level 3 — The MENA Trend Scanner

Choosing the Right Market Before Choosing the Right Trade

Level 1 teaches traders how to execute trades with discipline.

Level 2 teaches traders how to read technical structure and interpret market behavior.

Level 3 answers a more fundamental question:

“Which markets deserve your attention right now?”

Even the best strategy becomes inconsistent when applied in poor market conditions—weak trends, fragmented momentum, tight ranges, or unstable volatility. Level 3 solves this problem by adding a market-selection layer to the PSTS ecosystem. Instead of opening random charts, traders receive a real-time multidimensional overview of multiple instruments and timeframes, making it clear where the highest-probability environments exist.

5.1. Why Level 3 Is Essential for Level 2 Traders

Level 2 gives traders the tools to identify trends, reversals, and breakout structures. However, even a perfectly executed Level 2 strategy will struggle if applied in low-quality environments.

Ranging markets disrupt trend strategies.

Weak momentum destabilizes reversals.

Low volatility prevents scalping setups from developing.

Level 3 filters all of this before the trader even opens a chart. It becomes the radar system of the PSTS framework:

-

Level 1 = execution discipline

-

Level 2 = structural interpretation

-

Level 3 = directional selection + market filtering

A trader can master Level 2, but without Level 3, they still risk applying strong logic in weak environments. Level 3 ensures that the trader’s technical skills are used only where the market is cooperating.

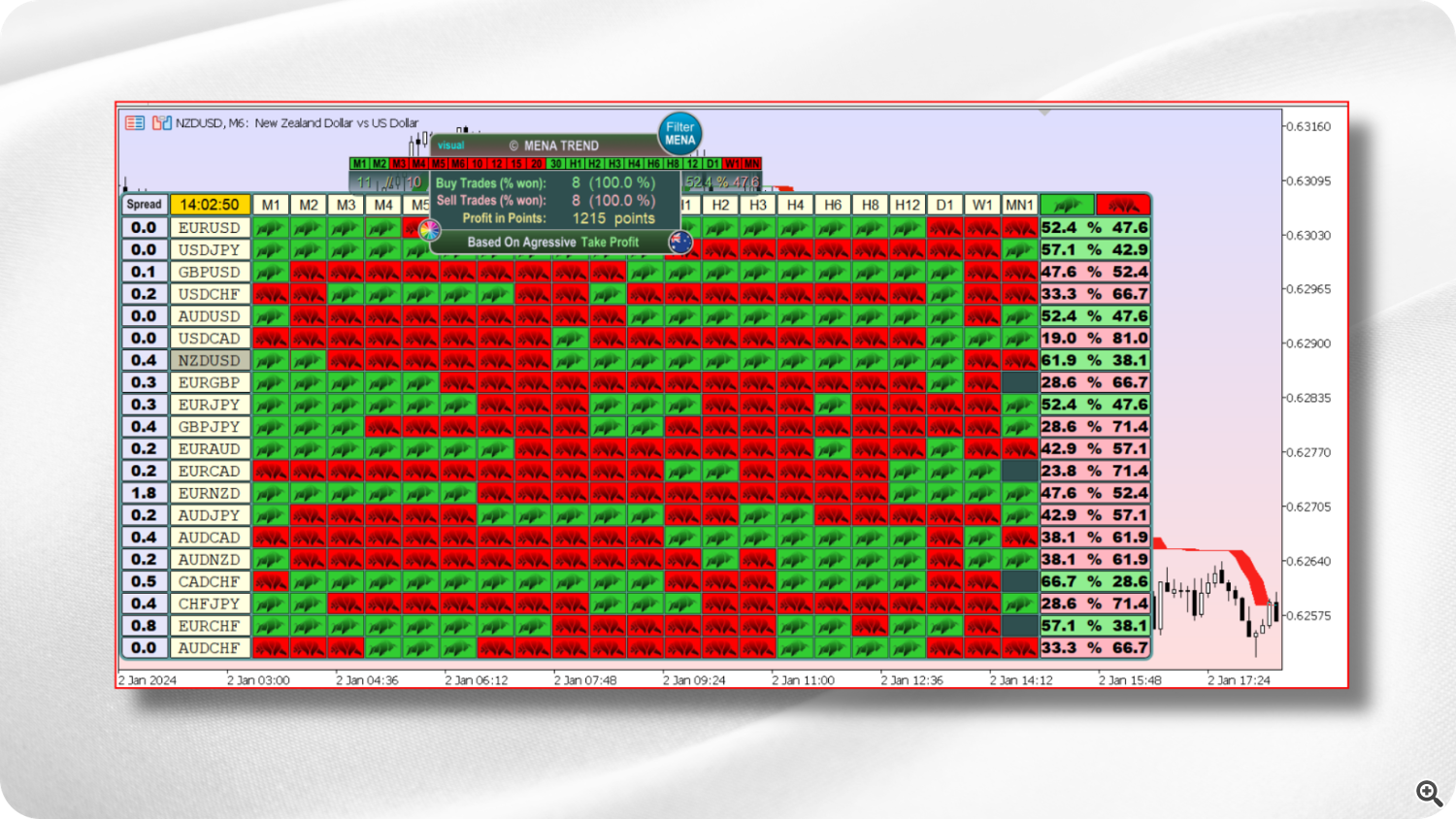

5.2. Purpose of the MENA Trend Scanner

The MENA Scanner provides a complete top-down market view from a single dashboard. It evaluates multiple symbols and multiple timeframes simultaneously, identifying trend bias, strength, structural transitions, and momentum behavior. The scanner eliminates the guesswork of opening charts blindly. Instead of searching for opportunities, the trader scans the entire market in seconds, identifies which pairs are trending, which are ranging, and which are undergoing shifts in structure.

This transforms the workflow from reactive to strategic:

Scan → Select → Apply Level 2 → Execute with Level 1 discipline.

5.3. How the Scanner Works — Technical Breakdown

The scanner operates through four analytical layers, each contributing to the decision-making process.

1. Multi-Pair Trend Grid

Each instrument displays its trend direction across several timeframes. A unified green alignment indicates bullish strength; a unified red alignment signals bearish strength; mixed colors imply indecision or range conditions. This instantly reveals whether a pair is aligned across the market structure or behaving chaotically.

2. Structure-Shift Detection

The scanner identifies changes in directional behavior—transitions from bullish to bearish, trending to ranging, or consolidating to breakout. These shifts are critical because Level 2 strategies adjust based on structure. A trend strategy may be excellent, but not during a structural slowdown. Level 3 warns the trader before they commit.

3. Momentum Alignment

Momentum readings confirm whether a trend has internal strength. A strong trend with conflicting momentum becomes riskier. A unified trend supported by momentum becomes a high-probability environment. This alignment helps traders avoid slow or unstable sessions.

4. Noise Filtering

The scanner applies internal smoothing to reduce false transitions. Like the STTS, the MENA Scanner is built around non-repainting logic, ensuring consistency and stability in its directional readings.

5.4. How Level 3 Integrates With Level 2

Level 3 tells the trader what to trade, when a market is favorable, and when to stay out entirely.

Level 2 tells the trader how to trade once the right chart is selected.

The workflow becomes:

-

Use Level 3 to find strong, aligned instruments.

-

Open the chosen chart and analyze structure through Level 2.

-

Execute with the risk discipline learned in Level 1.

Example Workflow:

Suppose EURUSD shows five bullish timeframes, strong momentum, and stable structure. Level 3 tells the trader this is a high-probability environment. The trader then moves to STTS, reads the cloud, waits for a pullback, confirms trend continuation, and executes with proper stop placement. Level 3 chooses the battlefield; Level 2 guides the plan; Level 1 ensures correct execution.

5.5. Why Level 3 Cannot Replace Level 2

The scanner is not a strategy and is not designed to generate trades.

It provides no chart-level structure, no pullback indication, no candle-pressure signals, and no exit or risk framework. Level 3 is strategic; Level 2 is tactical. The scanner filters the environment; STTS manages the trade. They are complementary—not interchangeable.

5.6. How Level 3 Improves Win Rate

Traders without Level 3 often jump between random pairs, many of which are consolidating or unclear. Even a strong system will appear inconsistent under these conditions.

With Level 3, traders focus only on instruments with aligned trends, clean structure, and supportive momentum. This increases probability, improves trade quality, and reduces emotional fatigue.

5.7. Professional Trading Logic Behind Level 3

Institutional traders follow the same three-step cycle:

Market Scan → Structure Analysis → Execution

The PSTS framework mirrors this methodology:

Level 3 performs the scan, Level 2 provides the structural analysis, and Level 1 ensures disciplined execution.

This alignment with professional workflow is what makes Level 3 indispensable in the PSTS system.

5.8. When Level 3 Becomes Essential

Level 3 becomes crucial for traders who work with multiple instruments, those trying to avoid choppy conditions, traders with limited time, and those seeking higher consistency. Scalpers use it to find strong short-term flows; swing traders use it to find stable higher-timeframe alignments. Beginners use it to avoid dangerous environments altogether.

Regardless of experience, Level 3 removes randomness from the trading process.

5.9. How Level 3 Completes the PSTS Ecosystem

Level 1 asks: Can you follow rules consistently?

Level 2 asks: Do you understand market structure?

Level 3 asks: Are you choosing the right market?

By integrating discipline, structure, and intelligent selection, the PSTS becomes a complete, multi-layer trading framework suitable for all market types and all trader levels. Level 3 elevates the trader from simply reacting to charts to strategically controlling their trading environment.

![]()

6. Level 4 — The Automation Layer (Smart Universal Expert Advisor)

Turning Structure Into Strategy, and Strategy Into Code-Free Automation

Levels 1–3 train the trader to follow rules, understand structure, and choose the right market.

Level 4 answers the final professional question:

“Can I automate everything I have learned — without writing code?”

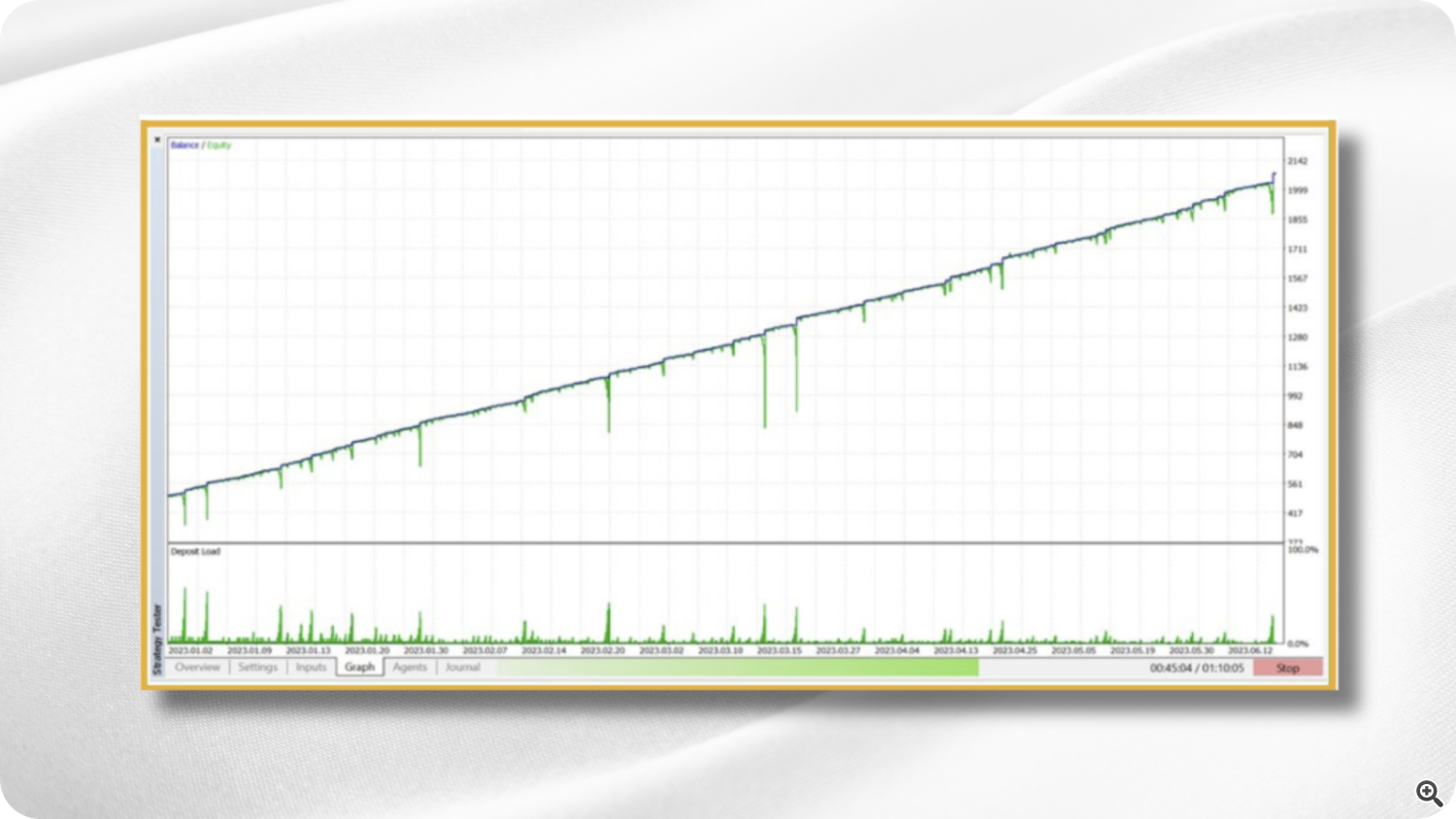

Level 4 is not a strategy, not a signal generator, and not a shortcut.

It is the execution engine that transforms the PSTS framework into a mechanically consistent workflow.

It allows traders to automate their rules, enforce discipline, and execute with precision regardless of emotion, speed, or market volatility.

6.1. Purpose of Level 4 — Why Automation Matters

As traders progress, two realities become obvious.

1. Human discipline is inconsistent.

Even skilled traders fall into emotional traps: late entries, early exits, FOMO trades, over-sizing, hesitation, or breaking rules.

Automation removes these weaknesses by applying rules with perfect consistency.

2. Markets often move faster than humans.

Volatility spikes, news-driven candles, and rapid pullbacks create environments where manual execution becomes inefficient or impossible.

An EA reacts instantly, updates stops mechanically, and manages trades without delay.

Level 4 ensures that trading decisions—once defined—are executed flawlessly every time.

6.2. What the Smart Universal EA Does

The Smart Universal EA (SUEA) is a framework that converts signals and structure into automated behavior.

It does not invent strategies; it automates the trader’s logic.

It can:

-

read indicator buffers from Level 1 (entry/SL/TP logic)

-

read structural logic from Level 2 (trend, breakouts, reversals)

-

filter trades using Level 3 (market direction, volatility, sessions)

-

execute trades automatically

-

position-size based on chosen risk

-

apply break-even and trailing-stop rules

-

filter by spread, time, direction, and volatility

-

avoid news or low-liquidity windows

Rather than imposing its own method, the EA becomes a mechanical extension of the trader's rules.

The trader remains in full control of the logic being automated.

6.3. Why Level 4 Requires Mastery of Levels 1–3

Automation amplifies whatever logic you attach to it.

If the underlying logic is unclear, automation simply accelerates the mistakes.

-

Weak discipline → becomes automated inconsistency

-

Poor structure understanding → becomes automated randomness

-

Bad market selection → becomes faster drawdown

But when the trader has mastered Levels 1–3:

-

Level 1 provides structured entries and risk templates

-

Level 2 provides the technical strategy logic

-

Level 3 provides market selection and direction

Level 4 becomes a force multiplier, not a shortcut.

It scales good logic instead of speeding up incorrect behavior.

This is why PSTS is intentionally progressive: the trader must first understand the rules they are automating.

6.4. How Level 4 Works With the Earlier Levels

Here is a practical example of full PSTS alignment:

Step 1 — Level 3 (Scanner):

EURUSD shows strong bullish alignment across multiple timeframes.

Momentum is stable, structure is clean → the pair is valid for trading.

Step 2 — Level 2 (STTS):

Price is positioned above the cloud, reversal zones are holding, and a pullback is forming.

A breakout continuation is likely.

Step 3 — Level 1 (Atomic Analyst):

A bullish entry signal appears with defined SL and TP levels, providing a structured setup.

Step 4 — Level 4 (SUEA):

The EA executes:

-

opens the position automatically

-

applies correct lot sizing

-

sets hard stop-loss

-

activates break-even rules

-

initiates trailing stop

-

manages trade to completion

Emotion is removed. Speed is maximized. Consistency is guaranteed.

6.5. The EA as an Extension of the Trader’s Personality

Level 4 is built around customization.

Different traders have different risk tolerance, schedules, and management preferences.

Risk-Averse Traders:

Prefer small positions, wider stops, conservative trailing rules, and strict filters.

Aggressive Traders:

Prefer higher risk-reward, faster trailing, more frequent signals, and looser filters.

Time-Limited Traders:

Automate specific sessions only, avoid volatility spikes, and focus on clean directional periods.

Full-Time Traders:

Use semi-automation—manual confirmation for entries, automatic management after execution.

The EA adapts to the trader’s personality, not the other way around.

6.6. What Level 4 Does NOT Do

To stay aligned with the educational tone of PSTS:

-

Level 4 does not generate new strategies

-

Level 4 does not guarantee profit

-

Level 4 does not replace trader knowledge

What it does is simple and powerful:

It listens.

It executes.

It manages.

It protects the account.

It enforces discipline.

Automation is a tool—not a trading edge by itself.

6.7. Why Automation Is the Natural Evolution of a Serious Trader

Once traders understand structure and direction, they inevitably ask:

-

“How do I make my execution more consistent?”

-

“How do I eliminate emotional interference?”

-

“How do I trade multiple pairs efficiently?”

The answer is automation.

Level 4 represents the professional transition from discretionary trading → structured system trading.

It turns workflow into code, and code into consistent behavior.

This is why Level 4 is embedded into the PSTS progression: it is the natural endpoint of a well-designed framework.

6.8. How Level 4 Completes the PSTS Progression

Level 1 — Execution Discipline

You learn to follow structured entries and control risk.

Level 2 — Technical Structure

You learn why trades form and how price behaves.

Level 3 — Market Selection

You choose only high-probability environments.

Level 4 — Automation

You enforce rules with perfect consistency.

Once Level 4 is integrated, the trader operates with:

✓ structure

✓ direction

✓ discipline

✓ automation

This completes the PSTS ecosystem and transitions the trader into a fully system-driven methodology.

![]()

7. Level X — The Smart Money Concepts Layer (Advanced Structural Mastery)

From Systematic Trading → Into Institutional Logic

Levels 1–4 give the trader structure, discipline, direction, and automation.

Level X adds the final layer: institutional price behavior — the logic that sits behind every trend, reversal, breakout, and consolidation.

This level is intentionally placed at the end of the PSTS progression.

Smart Money Concepts (SMC) only becomes meaningful when the trader already understands:

-

how to follow rules (Level 1)

-

how price structure behaves (Level 2)

-

how market conditions shift (Level 3)

-

how automation enforces consistency (Level 4)

Level X turns the PSTS framework from technical trading into analytical trading — a deeper understanding of why the market behaves the way it does.

7.1. Purpose of Level X — Seeing the Market Like Liquidity Providers

While Levels 1–3 focus on entries, structure, trends, and reversals,

Level X asks a deeper question:

“Why does price behave this way?”

Institutions, market makers, and algorithmic liquidity providers operate around a few core principles:

-

they accumulate liquidity before moving price

-

they engineer false breakouts to trap retail traders

-

they sweep equal highs/lows to fill large orders

-

they use displacement and inefficiencies

-

they leave recurring structural footprints

Level X teaches traders to read these footprints early, not to predict the future, but to understand context — which improves timing, confidence, and precision.

7.2. Why Level X Belongs at the Top of the PSTS Structure

SMC is powerful but easy to misuse when learned too early.

Beginners who jump into SMC without structure often fall into:

-

over-analysis

-

misinterpreting liquidity levels

-

emotional confirmation bias

-

random entries

-

chasing every imbalance on the chart

But when Levels 1–4 are mastered:

-

Level 1 → provides disciplined execution

-

Level 2 → explains trend, breakouts, retracements, reversals

-

Level 3 → filters direction and market conditions

-

Level 4 → ensures consistent mechanical execution

…then Level X becomes a precision tool rather than a source of confusion.

SMC gives meaning to the structure the trader already understands.

7.3. Core Components of Level X (Smart Money Concepts)

SMC inside PSTS focuses only on the essential institutional concepts that directly enhance Levels 1–4.

1. Liquidity Pools

Zones where retail traders place stop losses:

-

equal highs

-

equal lows

-

obvious swing points

Institutions target these areas to trigger liquidity before continuing price.

2. Imbalances and Liquidity Voids

Fast price movements create inefficiencies:

-

fair value gaps

-

displacement candles

-

unmitigated imbalances

These zones act like magnets for future retracements, helping traders anticipate pullback behavior.

3. Order Blocks

The institutional footprints before major moves:

-

bullish order block → last down candle before an impulse

-

bearish order block → last up candle before an impulse

These zones provide high-probability entry locations.

4. Break of Structure (BOS) & Change of Character (CHoCH)

The most reliable structural confirmations:

-

BOS → confirms trend continuation

-

CHoCH → signals a possible trend reversal

Both concepts align naturally with the STTS trend/reversal logic.

5. Institutional Swing Points

More reliable pivot levels for SL and TP placement, offering deeper structural accuracy than retail swing highs/lows.

7.4. How Level X Integrates With Levels 1–4

Level 1 → Level X

Atomic Analyst provides precise entries; Level X explains why those entries work.

Example:

-

Atomic gives a buy signal

-

SMC shows a liquidity sweep + bullish order block

→ The trader gains deeper confidence in the setup.

Level 2 → Level X

STTS shows structure; SMC explains what drives that structure.

Example:

-

Cloud shows uptrend

-

SMC reveals an imbalance waiting to be filled

→ The trader anticipates a healthy pullback rather than fearing it.

Level 3 → Level X

Scanner shows direction; SMC helps choose the highest-quality chart.

Example:

-

Scanner shows strong CAD bullishness

-

SMC confirms with BOS + liquidity taken

→ The trader prioritizes CAD pairs confidently.

Level 4 → Level X

Automation executes rules; SMC provides advanced filtering criteria.

Example:

-

Use OB zones to allow/deny EA entries

-

Use BOS/CHoCH signals to activate/deactivate trading logic

SMC becomes a strategic layer that enhances automated decision-making.

7.5. Why Level X Is Optional but Transformational

You can trade profitably with Levels 1–4 alone.

Level X is not mandatory.

But Level X becomes transformational for traders who want to:

-

understand the market at a deeper level

-

time entries with greater precision

-

interpret liquidity behavior

-

anticipate reversals and continuations

-

evolve from mechanical execution to analytical insight

Level X is optional for profitability, but required for mastery.

7.6. When to Transition Into Level X

Level X becomes beneficial when:

-

entries no longer cause hesitation

-

trend structure feels intuitive

-

the scanner is used naturally

-

your trading is stable and disciplined

-

automation is clean and consistent

-

you want more precision, not more signals

If Levels 1–3 still feel confusing, SMC will overwhelm the trader.

If Levels 1–3 feel natural, SMC will elevate their entire decision-making system.

7.7. Example of Level X Inside the PSTS Workflow

A complete PSTS sequence might look like this:

1. Level 3 — Scanner

EURUSD is strongly bullish across multiple timeframes.

2. Level 2 — STTS

Price is above the cloud, pullback forming, reversal zones holding.

3. Level 1 — Atomic Analyst

Buy signal appears with structured SL and TP.

4. Level X — SMC

You identify:

-

liquidity taken below previous low

-

bullish order block mitigated

-

fair value gap resting above price

-

BOS forming

Your confidence now comes from both indicator logic and institutional logic.

5. Level 4 — Automation

The EA executes the trade flawlessly and manages it to completion.

This is the true vision of PSTS:

discipline → structure → direction → automation → institutional logic.

7.8. Final Integration of Level X Within PSTS

Level X does not replace the earlier tools.

Level X completes them.

| Level | Purpose | Progression |

|---|---|---|

| Level 1 | Discipline & consistent entries | Mechanical foundation |

| Level 2 | Structure & multi-strategy logic | Technical development |

| Level 3 | Market-wide direction | Strategic selection |

| Level 4 | Automation & execution | Professional consistency |

| Level X | Institutional logic | Advanced contextual mastery |

9. How Traders Progress Through the PSTS Levels

The Professional Smart Trading System (PSTS) is designed as a progressive learning framework.

Each level represents a natural stage in a trader’s development, giving them the structure and clarity needed to improve without becoming overwhelmed. The journey moves from beginner → intermediate → advanced → automated, reflecting how professional traders build their skillset over time.

9.1. Beginner Stage — Developing Clarity and Consistency

New or inconsistent traders often struggle with the same issues: lack of structure, unclear entries, confusion about market direction, emotional reactions, and an overload of conflicting information.

Level 1 addresses these challenges by presenting a simplified, filtered view of the market. It provides clear directional bias, predefined entry and exit rules, and a consistent risk model. This early stage focuses on clarity rather than complexity, helping traders build confidence through repetition and disciplined execution. The goal is to create stability before introducing deeper analytical concepts.

9.2. Intermediate Stage — Understanding Structure and Market Behavior

Once traders become comfortable with structured execution, they progress into Level 2, where the focus shifts from “taking trades” to understanding how the market moves.

This stage introduces trend identification, pullback behavior, reversal logic, and the differences between trending and ranging conditions. Traders learn to recognize expansions, consolidations, and transition phases. Strategy presets reinforce consistency, helping the trader interpret charts instead of reacting emotionally to them.

The psychological benefit is substantial: structured tools reduce hesitation, and understanding structure reduces impulsive decisions.

9.2. Intermediate Stage — Understanding Structure and Market Behavior

At the advanced level, traders begin integrating multiple layers of confirmation.

They incorporate multi-timeframe alignment, trend strength evaluation, reversal detection, cross-asset context, and institutional concepts such as liquidity, displacement, and inefficiencies.

This is where precision increases. Traders begin to understand why the market behaves a certain way, not just how to respond to it. Decision-making becomes systematic rather than subjective, and confidence grows naturally as the trader’s analysis becomes more structured and context-driven.

9.4. Automated Stage — Turning Rules Into Executable Logic

Once traders fully understand directional filters, structural behavior, and valid versus invalid signals, they move into Level 4: automation.

At this stage, rules are translated into algorithmic logic using consistent risk parameters and predefined trade-management rules. Automation executes trades without emotional interference, ensuring the trader’s discipline remains intact even during fast-moving or stressful market conditions.

Automation is introduced only after structural understanding is solid, ensuring the EA enhances the trader’s logic rather than replacing the need for clarity.

9.5. Psychological Benefits of Structured Progression

A layered development model provides several long-term advantages.

It reduces cognitive load by allowing traders to focus on one skill at a time. It reduces fear and hesitation by replacing uncertainty with clear rules. Structure limits impulsive behavior and creates measurable progress, increasing confidence as traders see objective improvements in their process.

Learning in layers increases retention and replaces the typical cycle of confusion, randomness, and burnout with a clear roadmap for steady growth.

| Level | Best For | Purpose |

|---|---|---|

| Beginner Stage (Level 1) | New or inconsistent traders | Build clarity, structure, and disciplined execution |

| Intermediate Stage (Level 2) | Traders practicing multiple strategies | Understand market structure, phases, trend logic |

| Advanced Stage (Level 3 & X) | Traders integrating deeper logic | Interpret liquidity, manipulation, reversals, and higher-level context |

| Automated Stage (Level 4) | Traders seeking efficiency and consistency | Convert manual systems into stable rule-based logic |

Progress through these stages is flexible. Traders may revisit earlier levels to reinforce key skills or remain longer in a particular stage until consistency is achieved.

![]()

10. Conclusion

The Professional Smart Trading System (PSTS) is not a single indicator or standalone strategy—it is a structured roadmap designed to guide traders through the natural stages of development. Its purpose is to bring clarity, discipline, and progression to a field often dominated by noise, complexity, and emotional decision-making.

By organizing trading into distinct levels, PSTS demonstrates a core principle of effective learning: complexity becomes manageable when introduced gradually and with purpose. Each level builds upon the previous one—first mastering execution, then structure, then broader market context, followed by automation, and finally advanced institutional logic.

Modern markets demand this kind of structure. Volatility, rapid price changes, and the overwhelming amount of available information make trading difficult without a clear framework. PSTS helps filter that complexity by teaching traders how to identify essential signals, interpret structure confidently, reduce emotional interference, and maintain consistent behavior across diverse conditions.

Whether traders follow PSTS or a different methodology, the underlying message remains the same:

clarity comes from systems, not from spontaneous decisions.

Long-term improvement requires disciplined execution, defined rules, and a repeatable decision-making process.

A well-designed roadmap gives traders stability. It replaces randomness with intention, removes guesswork, and brings objectivity to the trading environment. In this way, PSTS serves as an example of how a layered and progressive framework can strengthen decision-making, elevate skill development, and support consistent performance in the markets.