Crypto Investor EA MT4 product page: https://www.mql5.com/en/market/product/118963

Crypto Investor EA MT5 product page: https://www.mql5.com/en/market/product/118964

Live Performance /Signal Account/: https://www.mql5.com/en/signals/2310384

Crypto Investor EA

- No more second-guessing.

- No more missed chances.

- No more delays.

Proven Performance, Total Control — The Smarter Way to Trade Bitcoin

What Is Crypto Investor EA?

Standout Features of Crypto Investor EA

- 24/7 Automated Market Monitoring

- Real-Time Trading Opportunities

- Smarter Trade Selection

- Zero Emotional Trading — only logical, data-driven actions

- Adaptive Learning Algorithms

- Minimal Starting Deposit ($500)

- Full Compatibility with MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Dedicated technical Support

- Lightning-Fast Execution

- Precision Trading Decisions – no emotional mistakes

- Market Adaptability – adapts to new data instantly

- Flexible Automation – full-auto or manual control based on your preference

- Drawdown Protection Functions

- Randomization System

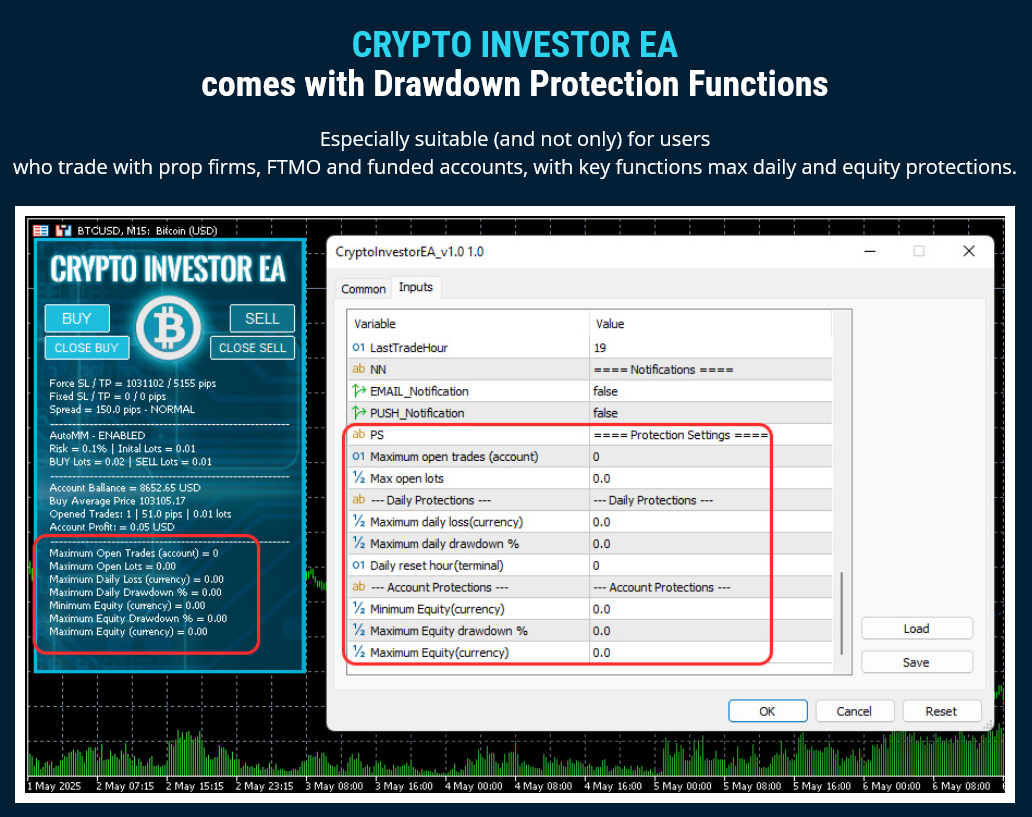

Crypto Investor EA comes with Drawdown Protection Functions

Smarter Risk Management for Confident Bitcoin Trading

Why Crypto Investor EA Stands in a League of Its Own

Non-Stop Opportunities – Active, Dynamic Trading

- No waiting.

- No missed opportunities.

- With Crypto Investor EA, your Bitcoin portfolio stays in motion.

- Always hunting.

- Always acting.

- Always growing.

Bitcoin Trading Reinvented: Inspired by the Best Strategies

Crypto Investor EA: For Traders Who Expect More

Manual Trading Made Easy — An Extra Advantage of Crypto Investor EA

Crypto Investor EA Settings

- WinLargeFonts – true/false: use "true" to adjust the robot information box display in case you are using the Windows Large Fonts.

- FixedLots - The extent of the fixed trading volume. If you use AutoMM>0, the value of the FixedLots parameter does not matter.

- AutoMM - When set to a value greater than zero, this enables proportional automatic money management. Calculating risk on cryptocurrencies can be complex, so we’ve simplified the process. For example, with a $1,000 account balance and a 1% risk setting, Crypto Investor EA will open trades with a 0.01 lot size. However, because this EA uses a grid and martingale strategy, we strongly recommend using the default risk setting of 0.1% for more conservative and stable trading.

- K_Mart - lot size multiplier for the first line additional trades.

- Magic - An unique identifier through which Crypto Investor EA recognizes and manages its own positions. If you use other expert advisors on the same account, please ensure that each of them has a distinct unique identifier.

- EA_Comment - You can type a comment here if you wish to mark the Crypto Investor EA trades.

- MaxSpread - Maximum allowed spread.

- OnlyManualTrading – to trade only manually by Crypto Investor EA set this parameter to true. By default, its value is false: this means that the robot can trade automatically and can be used for manual trading.

- M1_Execution - true/false to enable/disable the execution of the trading logic on M1 bar open

- SmartProfit – true/false to enable disable Smart Profit system. By default, SmartProfit is set to true, ensuring trades close at the average price of all open trades. This increases the profitability of the EA. Traders looking to adopt a lower-risk approach, can set SmartProfit to false. When false, the EA will close trades once a total profit (defined by the ForceProfit parameter) is achieved. This is perfect for traders who prefer a more conservative trading strategy.

- ForceProfit – Defines the target average profit as a percentage of the current BTCUSD (Bitcoin) price. Since Bitcoin is highly volatile and has significantly increased in value over the years, using a fixed pip value is no longer practical. Instead, this parameter ties the profit target directly to the live Bitcoin price, ensuring the strategy adapts to market conditions. Based on our extensive testing, this approach delivers consistent and reliable results.

- CloseOnReverse – true/false to activate/deactivate closing the trades on reversal bar.

- CloseReverseBarTF – Time frame for the reversal bar detection system. The default value is 15. Possible values are: 1, 5, 15, 30, 60, 240, 1440, 10080

- ForceLoss - Defines the maximum average loss allowed as a percentage of the current BTCUSD (Bitcoin) price. Due to Bitcoin’s high volatility and significant price growth over the years, using a fixed pip-based stop level is no longer effective. Instead, this parameter dynamically adjusts the loss threshold in relation to the live Bitcoin price, allowing the strategy to remain flexible and relevant in changing market conditions. Our testing confirms that this method provides more consistent and realistic risk control.

- FixedTakeProfit - Fixed take profit in pips.

- FixedStopLoss - Fixed stop loss in pips.

- OscPer - the oscillator period on the M15 timeframe

- OscLev - the entry overbought and oversold level on the M15 timeframe

- OscPerHiTF - the oscillator period on the H1 and H4 timeframes

- OscLevHiTF - the entry overbought and oversold level on the H1 and H4 timeframes

==== Additional Trades Settings ====

- MaxAddTrades - maximum allowed number of the first line additional trades.

- AddOnReverse - activates a mode in which the additional trades are allowed only after a reversal bar is detected

- ReverseBarTF - the timeframe of the reversal bar for the AddOnReverse feature

- AddDistance_Default - the default minimal distance between any of the additional trades and the previews trade as a percentage of the current BTCUSD (Bitcoin) price.

- AddDistance_1 - the distance between the initial trade and 1st additional trade as a percentage of the current BTCUSD (Bitcoin) price. If the value is 0 (zero) the value of AddDistance_Default will be used!

- AddDistance_2 - the distance between 1st additional trade and 2nd additional trade as a percentage of the current BTCUSD (Bitcoin) price. If the value is 0 (zero) the value of AddDistance_Default will be used!

- AddDistance_3 - the distance between 2nd additional trade and 3rd additional trade as a percentage of the current BTCUSD (Bitcoin) price. If the value is 0 (zero) the value of AddDistance_Default will be used!

- AddDistance_4 - the distance between 3rd additional trade and 4th additional trade as a percentage of the current BTCUSD (Bitcoin) price. If the value is 0 (zero) the value of AddDistance_Default will be used!

- AddDelay_1 - delay in minutes for opening of 1st additional trade. Value equal to 0 (zero) means that no delay will be used.

- AddDelay_2 - delay in minutes before opening of 2nd additional trade. Value equal to 0 (zero) means that no delay will be used.

- AddDelay_3 - delay in minutes before opening of 3rd additional trade. Value equal to 0 (zero) means that no delay will be used.

- AddDelay_4 - delay in minutes before opening of 4th additional trade. Value equal to 0 (zero) means that no delay will be used.

- RecoveryProfit – Specifies the exit profit target as a percentage of the current BTCUSD (Bitcoin) price when a recovery trade is triggered.

- RecoveryAfter – minimum distance (as a percentage of the current BTCUSD price) between the first recovery trade and the previews additional trade.

- RecoveryTrades – maximum allowed number of recovery trades.

- RecoveryTradesDistance – minimum distance (as a percentage of the current BTCUSD price) between the recovery trades.

- RecoveryRiskMultiplier - lot size multiplier for the recovery trades

- FridayExit - true/false - if you wish to close all trades on Friday, you should use FridayExit=true.

- ExitHourFr - the robot will close all open positions at this hour on Friday.

- LastTradeHour - the robot can trade until the end of this hour on Friday (including this hour).

- EMAIL_Notification - true/false - enable/disable email notifications.

- PUSH_Notification - true/false – enable/disable push notifications to mobile phones

- Maximum open trades (account) – Limits the total number of open trades on the account where Crypto Investor EA is running. When set to a value greater than 0, the EA will monitor all active trades on the account—including those placed by other EAs or manually. If the total number of trades reaches or exceeds the specified limit, Crypto Investor EA will pause opening new positions.

- Max open lots – The total allowed lot size for all open trades.

- Maximum daily loss(currency) - Set a maximum limit on the amount you can lose in a single day to protect your capital.

- Maximum daily drawdown % - Define the maximum percentage of your balance that can be lost in one day.

- Daily reset hour(terminal) – Daily reset hour. This is usually 00:00 but if your broker has different reset hour then you can set any hour. Have in mind that if you change the hour directly on the control panel it will be effective after the new hour is reached!

- Minimum Equity(currency) - Establish a minimum equity level that, when reached, triggers protective measures.

- Maximum Equity drawdown % - Limit the maximum percentage drawdown of your total equity to prevent significant losses.

- Maximum Equity(currency) - Set an upper limit on your equity to help manage gains and protect from volatile shifts.

==== Protection Settings ====

The Randomization System enables variability in the EA’s execution logic by randomly adjusting the price levels and timing of trade entries and exits. This helps your trades appear less uniform and more individualized—even when using similar settings as other traders.

This is especially important for traders working with proprietary firms, where duplicated strategies may lead to disqualification or restrictions.

>>> Exit Randomization Settings

- RandomizeExit (true/false) - Enable or disable exit randomization logic.

- ForceLossRange (Default: 500 points) - Randomly modifies the ForceLoss level within a ±500 point range.

- ForceProfitRange (Default: 500 points) - Randomly modifies the ForceProfit level within a ±500 point range.

- RecoveryProfitRange (Default: 500 points) - Randomly modifies the RecoveryProfit value within a ±500 point range.

>>> Entry Randomization Settings

- RandomizeEntry (true/false) - Enable or disable entry randomization for trade opening time and price.

- OpenTimeMaxDelay (Default: 60 seconds) - Random delay (up to 60 seconds) for executing a trade.

- OpenPriceMinDeviation (Default: 10 points) - Minimum deviation from the original entry price.

- OpenPriceMaxDeviation (Default: 1000 points) - Maximum deviation from the original entry price.

Important Notes About the Randomization Feature

1. Entry Randomization Works Only in Live Trading

Due to platform limitations (MQL4/MQL5), entry randomization does not function in backtesting. However, we’ve rigorously verified its performance in live market conditions.

2. Exit Randomization Can Be Backtested

You can verify its effectiveness by running multiple backtests and observing different outcomes, confirming the randomness in action.

3. Parameter Recommendations

Using smaller deviation ranges (e.g., 10–100 points) may offer higher accuracy, but be aware of potential missed trades.

Larger deviation ranges (e.g., 500–2000 points) offer greater randomness but may lead to less favorable trade execution.

Adjust settings carefully based on your trading strategy and goals.

Tips for Achieving Truly Unique Trading Behavior

To further individualize your trading and avoid detection by prop firm monitoring systems, we recommend:

- Customizing the EA_Comment: Replace the default EA name with a personal tag or custom phrase.

- Using Unique Magic Numbers: Helps differentiate trades from other accounts using the same EA.

- Running a Secondary EA: Introducing another EA on the same account can further diversify your trade footprint.

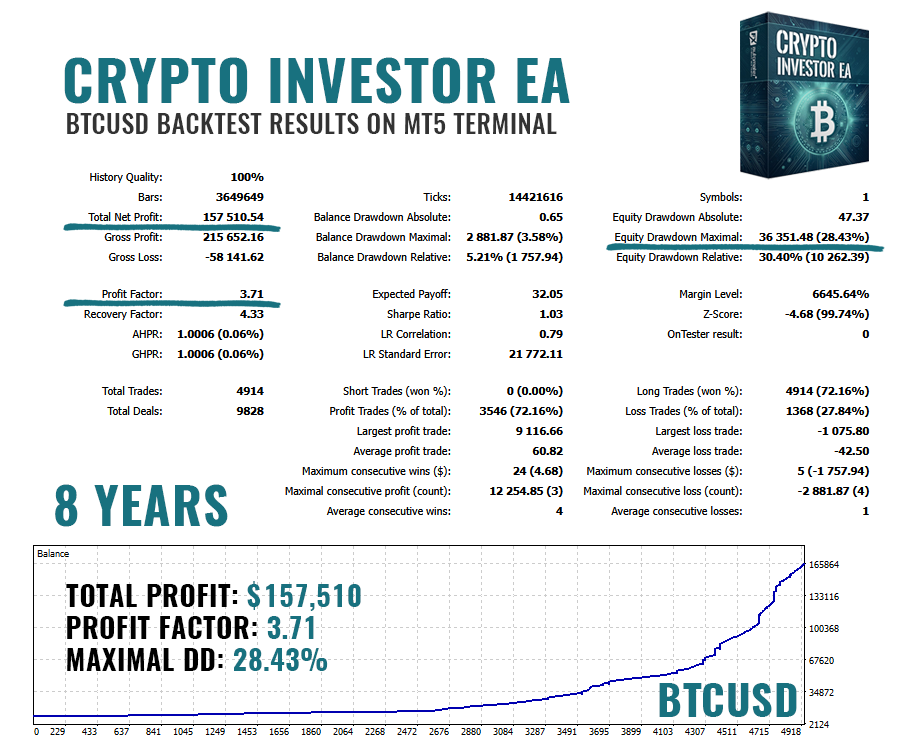

Crypto Investor EA Backtest Results

Crypto Investor EA Additional Settings (.set file)

- ciea-conservative.set: for traders who like to trade with conservative risk settings (medium risk).

- ciea-low-risk.set: for traders who like to trade with low-risk settings.