The "Good Time" trading system. Part 1: Why it will work or the fundamental rationale behind the logic of the market.

Stable profits in financial markets are formed from advantages. One of these advantages may be choosing the best time to trade. Markets are constantly changing, but there is a process that remains unchanged from the very beginning of stock trading: small ranges are followed by large ranges, large ranges are followed by small ranges. This obvious cycle is very important to us! That's because speculators need price changes to make money. The greater the changes, the greater the potential for profit. If there is no price change or it is small, the speculator gets stuck in place. The chance of triggering a stop increases, but there is no profit potential. Attempts to trade on flat days have ruined a huge number of traders. At the same time, patterns that take into account only volatility without direction work wonders.

Look at the daily chart of gold. The "ATR 1" indicator has been added to the chart. We use a simple volatility pattern: "ATR 1" drops for 2 days or more, and then growth begins. The next day is likely to have a good potential for a strong move. We have tested this - this pattern alone already allows us to consistently make a profit. Otherwise, it can be seriously improved. Let's try to take only those days that were not shock days (closing above the maximum or below the minimum). They are marked on the chart with a gold star.

Everything is great. But for the convenience of trading and variability, we would like to have a flexible, customizable one (maybe the cycles are better visible on lower timeframes?) the tool. And fortunately, MetaTrader 5 has a great option in its arsenal. Just take the "ATR 30" and build a moving average SMA 75 based on its data.

The resulting instrument signals a potential spike in volatility by crossing its average from bottom to top. We would also like the blue line to stay below the yellow line for a while. This way we can filter out low-quality transactions.

The final element will be a flexible trend indicator. You can use moving averages or all sorts of different stochastics with a long period. There are many variations. We will use a multifunctional trend indicator with four-level smoothing "FourAverage". As with systems of this kind, the flexibility of configuration allows for better results. And as you know, profits are never superfluous.

The combined use of our volatility indicator and trend indicator will allow us to determine the entry into the market. We will enter a trade in the direction of the trend indicator at the moment of a surge in volatility (the blue one crosses the yellow one from the bottom up or when the yellow line turns up). If the symbol we are trading on has a historical orientation, then we trade only in its direction.

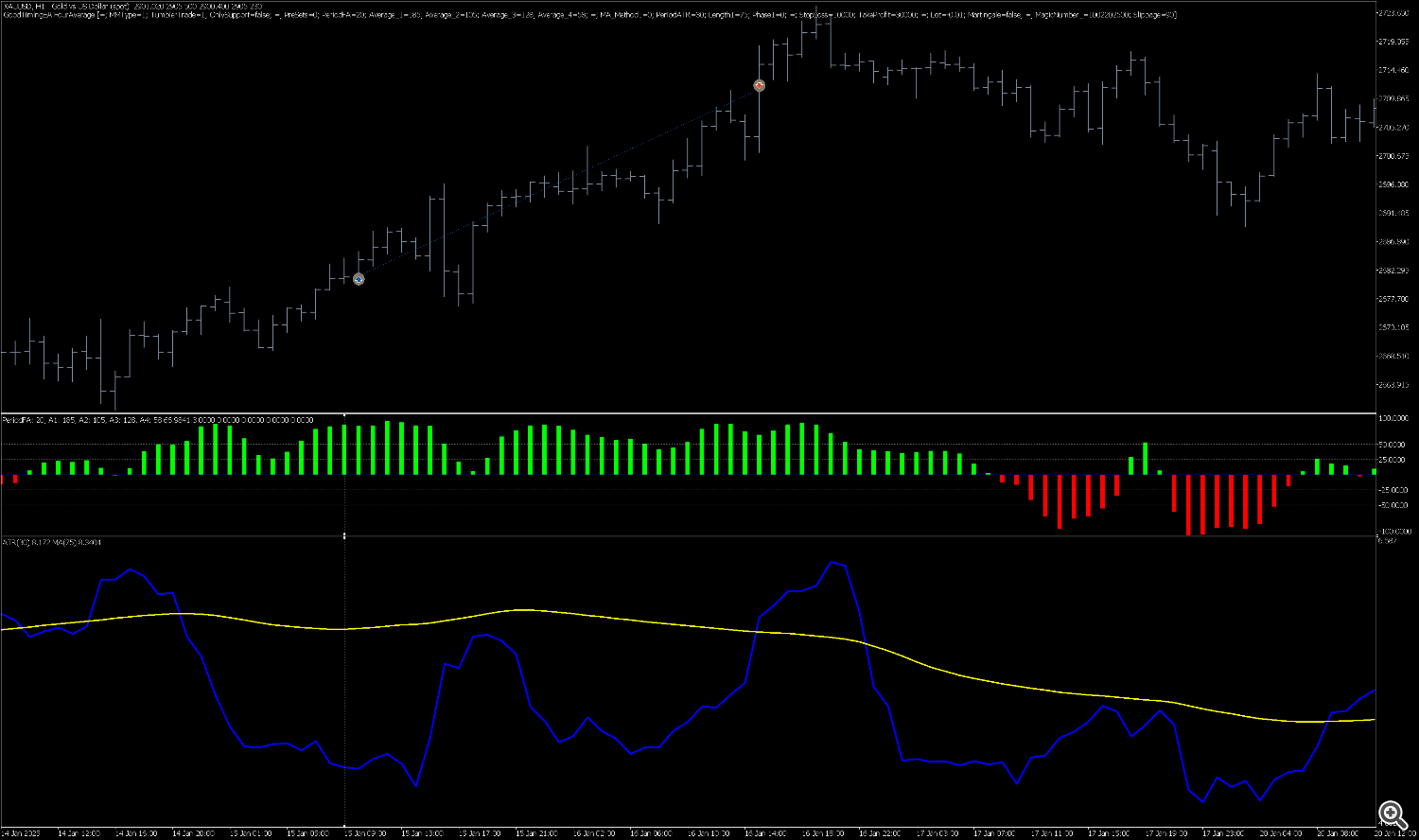

The figures below show a gold chart with the "FourAverage" indicator with buy-only settings. Gold is an asset that has a historical upward trend (at least at the level of inflation). Based on these two reasons, it is logical to accept buy signals only.

In the next article, we will test our entry method using the simplest ways to exit a position. In the meantime, we have selected the parameters to get a ready-made system and make sure that we are on the right track and our concept is profitable.

The rules of the trading system "Good time"

Symbol: Gold (XAUUSD)

Direction: BUY

Timeframe: H1

FourAverage parameters: PeriodFA = 20, Average_1 = 185 , Average_2 = 105 , Average_3 = 128 , Average_4 = 58

ATR Parameters: ATR 30 MA 75

Entry Rules: The yellow line turns up. FourAverage > 0

Exit Rules: Stop Loss 10,000 points, Take Profit 30,000 points

As a result, we have a clear entry on the surge in volatility and in the direction of the prevailing trend. This is how the deals look on the chart.

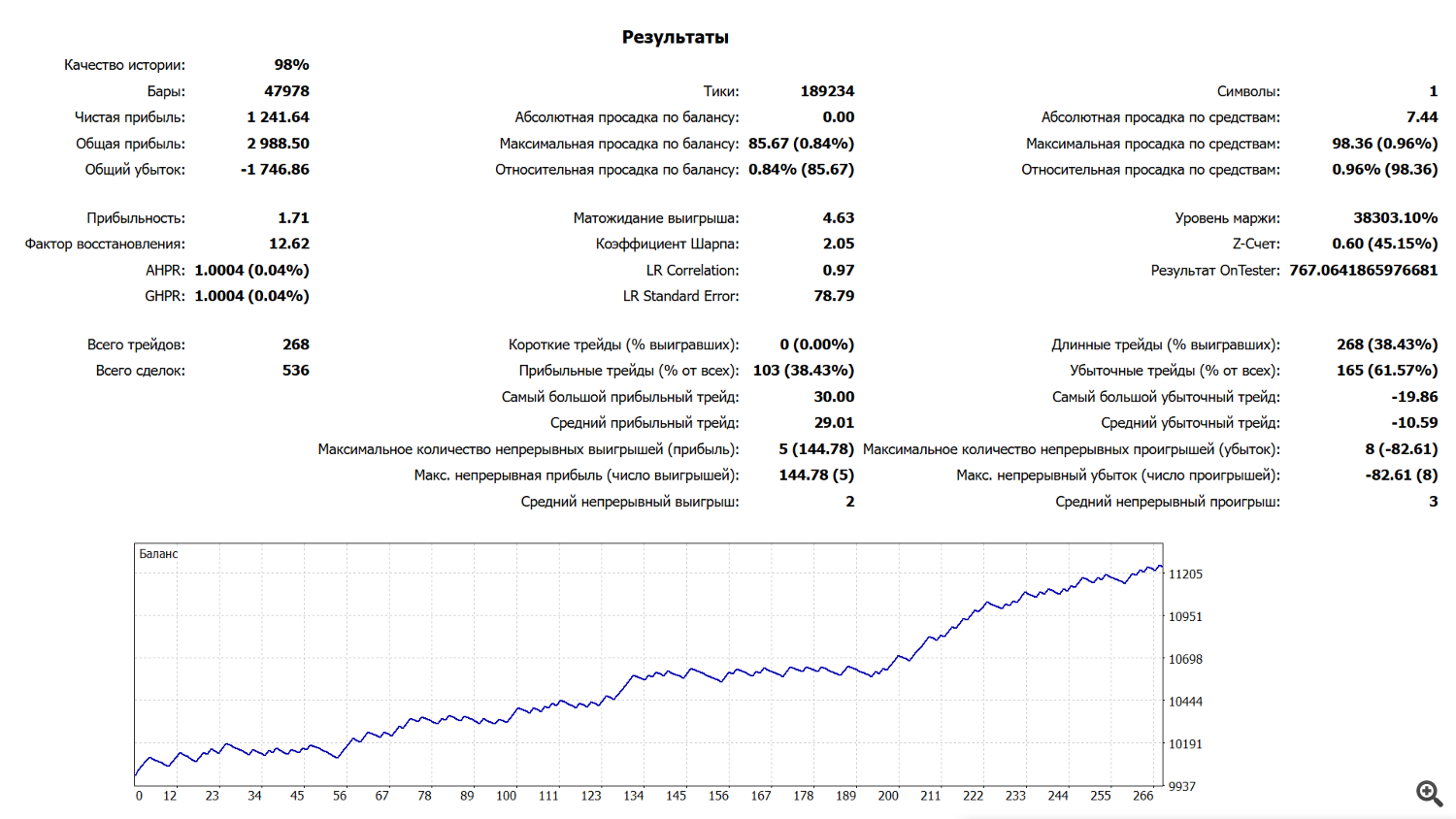

We tested this set in the strategy tester and got an impressive result. The result is good both in terms of profit and recovery factor. Two simple but logical rules shift the odds to our side.

You can use the system as it is or add your own filters or rules. In the following articles, we will try to improve the system and achieve really impressive results.