What is ICT Series about?

Well ICT series is focused on using all the different tools that ICT have taught, simplified for the use of everyone. This way we can see the market from a different view and ease our decision taking process. Of course, there is too many concepts to use, so we will start with the most popular ones like the power of 3 , liquidity, Trading Sessions as well kill zones.

However, I want to cover all the possible concepts of ICT, and I would like you to help me doing it. If you have a concept that you believe has great potential or any trading related question, idea, suggestion, please leave it in the comments. I would be happy to program it and make and article about it displaying the results.

I am passionate about trading, probably you are as well, and I want this series to focus on how we can all profit from the different trading concepts out there and if they’re reliable or not.

Why do I make the ICT Series?

Well, I am myself a manual trader, and after so many years of learning, different courses and my own research I have come to the conclusion that there is just too much information.

So, I have decided to create different indicators, tools and EA’s which will help you to apply the ICT concepts without doubt and fear. This is a framework for you the reader to simplify your trading and start the road to profitability.

Why ICT?

Well, from all the concepts that are out there, ICT seems to me the most logical and well thought approach, is one of the only approaches which thinks about the different dynamics of the market, where are the buyers? What are they doing? Are they stronger than the sellers? Where do they want to go?

These questions are things that most of the other trading strategies don’t ask and for me that’s what makes ICT stand out. It feels like a way to understand market behaviors, and is not only applicable to trading, but as well to crypto investments and overall life decisions, because as in trading there is always a seller for every buyer.

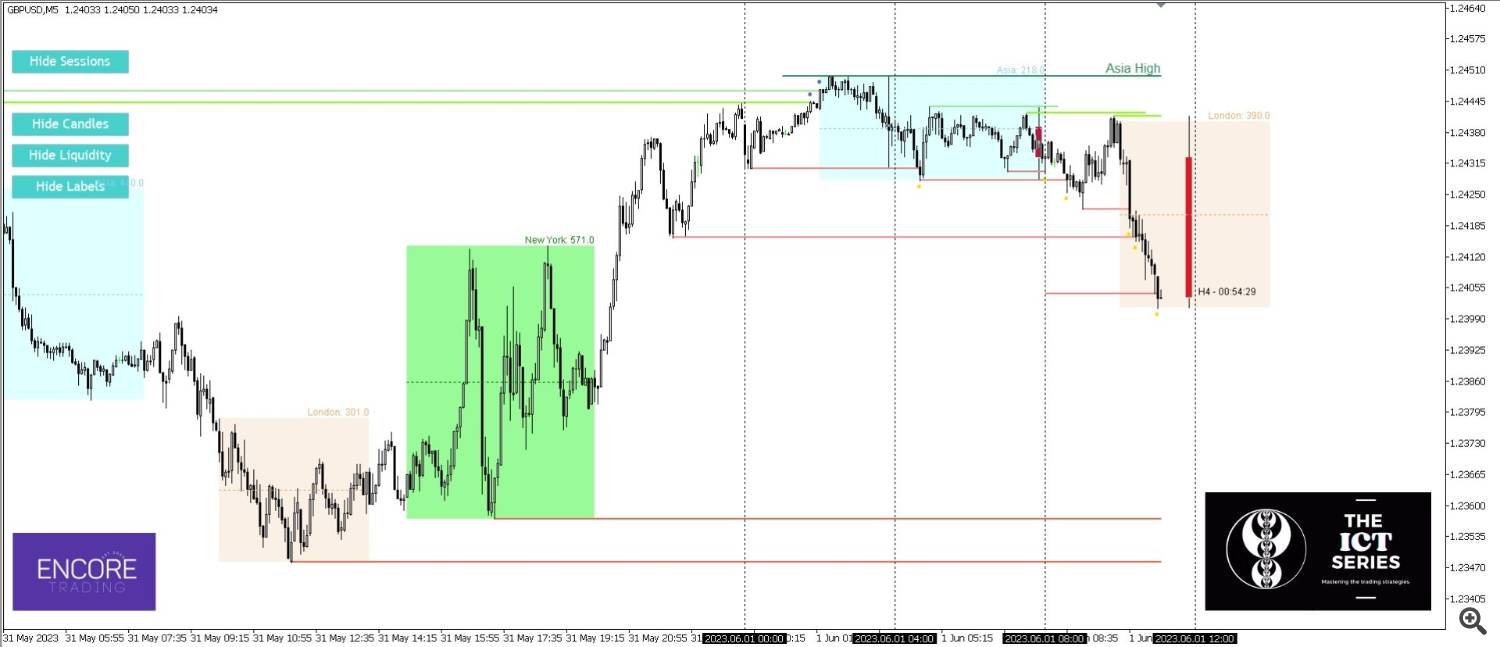

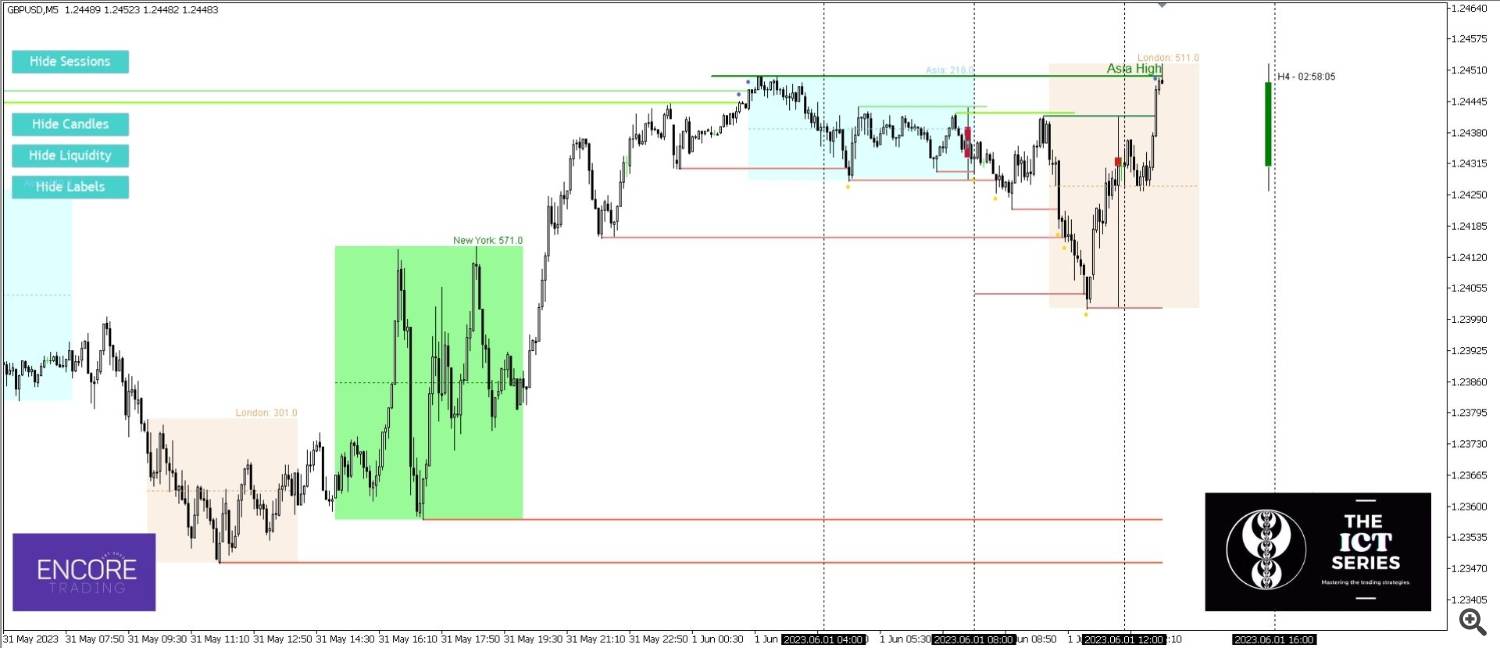

Like the trade above, where we see that we have hunted considerable sell side liquidity which means a good price for buyers to enter, as well we can see that the HTF candle is over-extended and most likely leaving a wick, and additionally we have good liquidity targets on the highs where to set our take profit, and with the right time and entry we have a good trade an strong momentum in our direction as you can see in the after picture below.

What to do?

Firstly, we encourage to stick through all the series, that is what will determine your success, here you can find the first edition. Please read through it carefully, understand every concept and ask any question you have. After that try the strategy and the tools, all of them can be found in the following links as well in my profile, you can test the concepts and get trading the right ICT straight the way.

This is just the start of the series and we have more helps and tools coming to helps us analyze the markets (as well EA’s which do what ICT proposes as the best strategies).

Please, if you like these concepts and have any tool or idea which you would like to see, let us know and we will try to make it a reality and test together the concept. Let’s get better at trading together.

As well any questions, feedbacks or just talk is welcomed. Leave us a message on the comment section and we will get back to you as soon as possible.