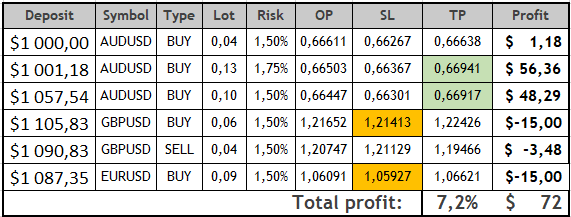

Review of trades of the Owl Smart Levels strategy for the week from March 13 to 17, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from March 13 to 17, 2023.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

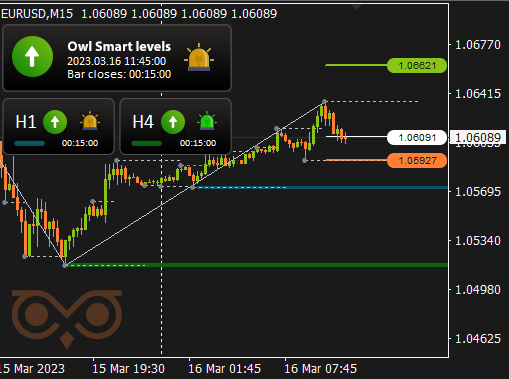

EURUSD review

The first asset we will quickly review is EURUSD. The reviewwill be short because the indicator has shown only one trade on this asset and unfortunately the trade was unprofitable due to the high market volatility in this area.

Fig. 1. EURUSD BUY 0.09, OpenPrice = 1.06091, StopLoss = 1.05927, TakeProfit = 1.06621, Profit = -15$.

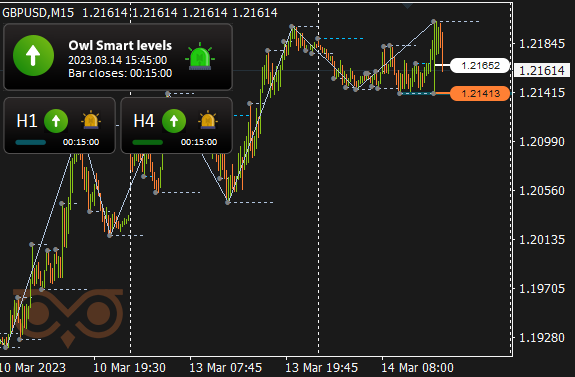

GBPUSD review

The Owl Smart Levels Indicator has not yet been trained to take global news into account but the trader who uses the indicator can do it. It is well-known that during the release of especially significant news the market behavior is difficult to predict: there might be strong volatile fluctuations and gaps. In the morning of March 14 there were released two news which influenced the GBP-pair trading one way or another: 1) The average payroll including bonuses and 2) Change in the number of jobless claims.

The trade was negative on March 14. Coincidence? I don't think so. Although, of course, we are not making a direct correlation here and we are not timing it.

Fig. 2. GBPUSD BUY 0.06, OpenPrice = 1.21652, StopLoss = 1.21413, TakeProfit = 1.22426, Profit = -15$.

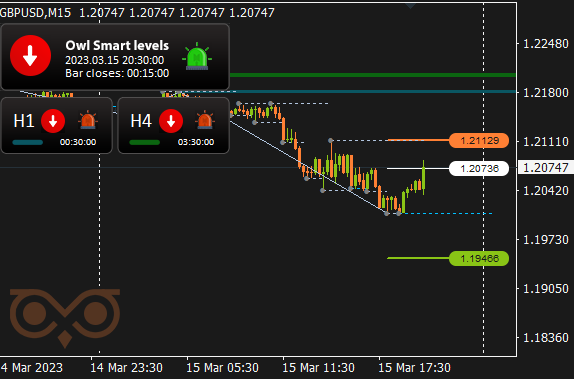

The next losing trade was saved and the loss was minimized reducing it to the value of "arithmetic error". Regular readers know that after opening a trade it is necessary to monitor the indicator, and if it shows the change of the big arrow direction, the trade should be closed in the "manual mode" without waiting until the StopLoss order does it.

Fig. 3. GBPUSD SELL 0.04, OpenPrice = 1.20747, StopLoss = 1.21129, TakeProfit = 1.19466, Profit = -3.48$.

Further, on March 16 and 17 the market for the most part was in the dead zone where the indicator does not recommend to open trades.

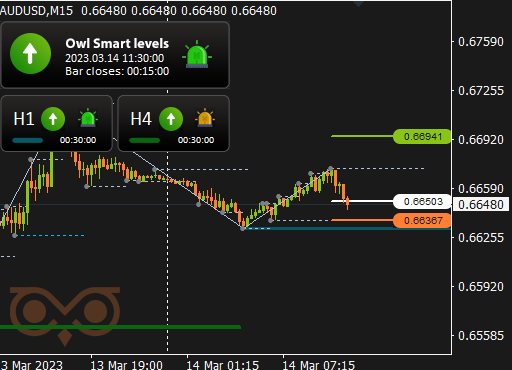

AUDUSD review

On March 13 and 14 there were two serious news for USD, and on the 16th there was news for both USD and AUD. Owl Smart Levels handled these trading days very well suggesting trades in the asset, although one of them still had to be "saved".

Fig. 4. AUDUSD BUY 0.04, OpenPrice = 0.66611, StopLoss = 0.66267, TakeProfit = 0.66638, Profit = +1.18$.

Of course, this was a trade with three "666" in the value of the OpenPrice number. The market changed direction and the trade had to be closed at 0.66638 instead of the much expected 0.67723. The big arrow on the Owl Smart Levels changed direction and color from green to red signaling this sudden change in direction. The trade has brought in a whole dollar but it has remained in the plus, which, in fact, corresponds to our task - to remain profitable under any circumstances.

Fig.5. AUDUSD BUY 0.13, OpenPrice = 0.66503, StopLoss = 0.66367, TakeProfit = 0.66941, Profit = +56.36$.

The next trade (Fig. 5) has "classically" closed at TakeProfit and has brought a good profit.

Then, on March 15, the market was in the dead zone almost a day. It seemed that the week could be closed this way on the currency pair but the next day the indicator found one more profitable trade, which put the week in its final place.

Fig.6. AUDUSD BUY 0,13, OpenPrice = 0,66447, StopLoss = 0,66301, TakeProfit = 0,66917, Profit = +48.29$.

The last trade of the week also was closed with TakeProfit. Just as the previous one, it brought quite a good profit making quite a decent profit for a small deposit.

Results:

In this review I tried to remind you that while planning a trading strategy, it is useful to consider the major global news that can significantly affect the market volatility. And, although the trading strategy using the Owl Smart Levels Indicator is based only on the technical analysis, the fundamental analysis, in fact, should not be forgotten and it can be very useful to take its main factors into consideration by using the indicator.

Let's see what the next week brings and how the Owl Smart Levels performs.

See other reviews of the Owl Smart Levels strategy:

- From March 6 to 10, 2023, Total: +3.6%

- From February 27 to March 3, 2023, Total: +7.3%

- From February 20 to 24, 2023, Total: +28.4%

- Archive of reviews >>

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.