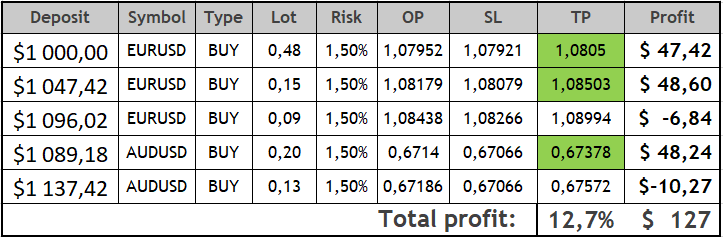

Review of trades of the Owl Smart Levels strategy for the week from March 27 to 31, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from March 27 to 31, 2023.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

EURUSD review

The first trade offered by the indicator on Monday evening gave a good start of the trading week and closed at TakeProfit bringing a very good result for a deposit of $1000 and the first trading day.

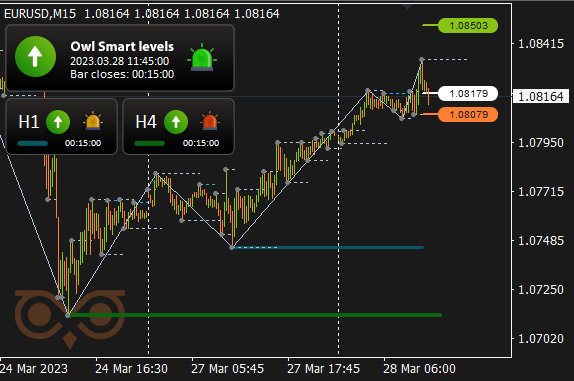

Fig.1. EURUSD BUY 0.48, OpenPrice = 1.07952, StopLoss = 1.07921, TakeProfit = 1.08050, Profit = 47.42$

The growth of the Euro against the dollar during the week was quite stable, and, getting ahead, I say that the indicator suggested opening all trades to buy. The next day there was opened the second trade on this asset for buying.

Fig. 2. EURUSD BUY 0.15, OpenPrice = 1.08179, StopLoss = 1.08079, TakeProfit = 1.08503, Profit = 56.70$

The trade was also closed at TakeProfit and brought even more profit. Profit is a pleasant thing. But as long as trading is not over, with the appearance of profits the following question gradually begins to emerge: how to save it if the market situation stops being favorable? And this question had to be answered on the third EURUSD trade.

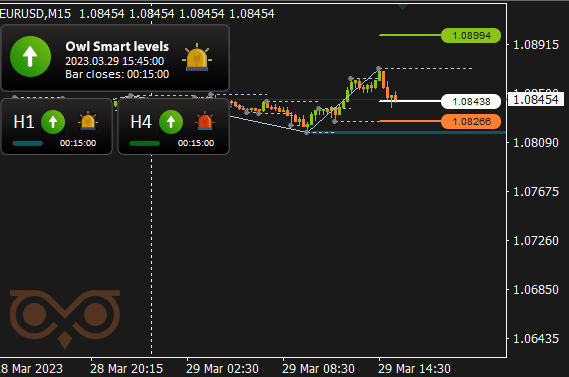

Fig.3. EURUSD BUY 0.09, OpenPrice = 1.08438, StopLoss = 1.08266, TakeProfit = 1.08994, Profit = -6.84$

The third trade was also opened for buying but the volatility on the exit from the small flat turned out to be obviously bigger than it would be desirable. The indicator caught this fluctuation of the market and turned the big arrow of its movement direction. This allowed to close the trade "manually" in the middle of the movement to the StopLoss level and minimize the loss.

GBPUSD review

On Monday the market was in the dead zone which was indicated on the chart. However, even further the Owl Smart Levels indicator did not show any clear signal to open a trade until the end of the trading week. I always propose to look positively on the absence of signals to open trades with the indicator: it saves energy and most likely eliminates possible losses.

AUDUSD review

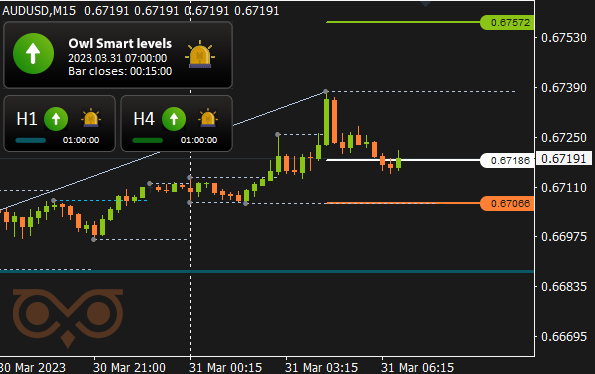

AUDUSD traded in the dead zone all through Monday. On Tuesday there was activity, but there were no signals to open trades, and on Wednesday the price chart gave out a long flat again in the dead zone.

However, the situation was more interesting than on GBPUSD, and on the last day of the trading week the indicator offered to open two more trades.

Fig.4. AUDUSD BUY 0.20, OpenPrice = 0.67140, StopLoss = 0.67066, TakeProfit = 0.67378, Profit = 48.24$

The trade was closed by TakeProfit and it has brought as good profit as the first two trades of the trading period.

Fig.5. AUDUSD BUY 0.13, OpenPrice = 0.67186, StopLoss = 0.67066, TakeProfit = 0.67572, Profit = -10.27$

The last trade was negative, however, it could not significantly affect the overall result of trading.

Results:

It was a profitable week and trading with the Owl Smart Levels Indicator was organized rationally and successfully.

Let's see what the next week brings and how the Owl Smart Levels performs.

See other reviews of the Owl Smart Levels strategy:

- From March 20 to 24, 2023, Total: +1.5%

- From March 13 to 17, 2023, Total: +7.2%

- From March 6 to 10, 2023, Total: +3.6%

- Archive of reviews >>

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.