According to the National Bureau of Statistics (ONS) on Wednesday, consumer prices in the UK in April rose by 2.4% (in annual terms) after growing 2.5% in March. The forecast assumed an increase of + 2.5%. The rate of price growth in April was the weakest since March 2017. On the one hand, this is good for British consumers; on the other hand, a weakening of inflationary pressures postpones a probable increase in the interest rate in the UK to a later date.

At its previous meeting, the bank's management left rates at the same level, as official statistics pointed to the weakness of economic growth in the first quarter of 2018. The Bank of England also lowered its forecast for GDP for 2018 from 1.75% to 1.40%. At the same time, the deficit of the UK trade balance exceeds 3 billion pounds sterling and has a tendency to increase.

As the head of the Bank of England, Mark Carney, said on Tuesday, we should wait "restoring of momentum before raising the stakes".

Political events are also putting pressure on the pound. Conservative politician Jacob

Rice-Mogg, who actively supported Brexit, accused the British government of weakness. Statements by a government spokesman suggest a renewed risk of a change in the composition of the country's leadership. The pound is unlikely to grow until this uncertainty is resolved with Brexit and the composition of the UK government.

At the same time, the Fed leaders continue to give signals for the continuation of the Fed's policy, aimed at further tightening of monetary policy.

According to FOMC member Loretta Mester, "it is advisable to continue to tighten monetary and credit policies to avoid increasing risks for macroeconomic stability".

Today, the focus of traders' attention will be the publication (at 18:00 GMT) of the protocol from the May meeting of the Fed. If it turns out that the Fed assesses the economy less optimistically than the market expects, then it can deploy the dollar, or at least suspend its strengthening.

At the December meeting, the leaders of the Federal Reserve planned 3 rate increases in 2018. However, investors expect that on the background of positive macro statistics and a strong labor market in the US, the Fed can make 4 rate increases this year.

This will significantly increase the investment attractiveness of the dollar among investors looking for a stable profit.

If the Fed's protocols contain signals about the possibility of 4 rate increases this year, then the strengthening of the dollar will continue.

The different focus of the monetary policy of the central banks of the United Kingdom and the United States will further reduce the GBP / USD.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

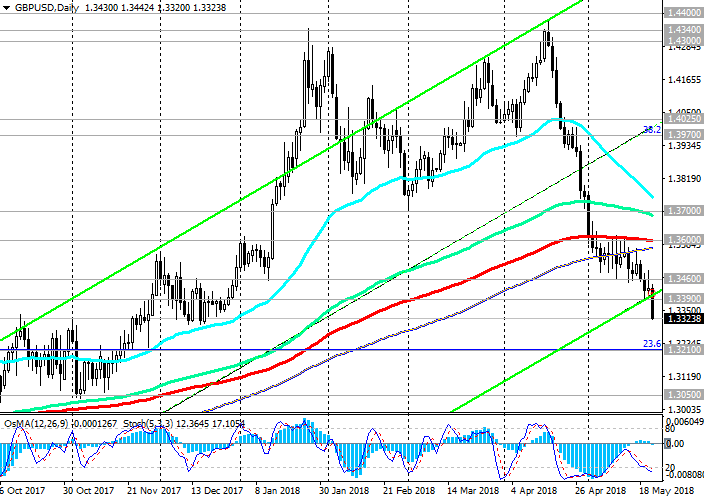

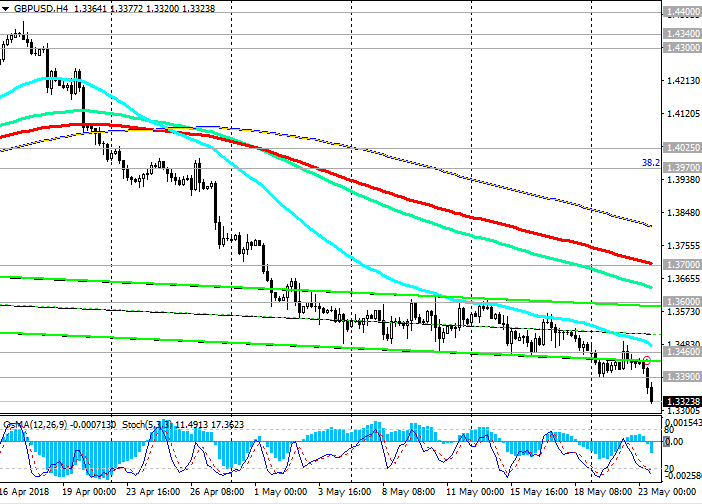

Support levels: 1.3300, 1.3210, 1.3050

Resistance levels: 1.3390, 1.3460, 1.3505, 1.3600, 1.3700, 1.3800, 1.3970, 1.4025

Trading Scenarios

Sell in the market. Stop-Loss 1.3450. Take-Profit 1.3300, 1.3210, 1.3050

Buy Stop 1.3470. Stop-Loss 1.3370. Take-Profit 1.3505, 1.3600

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com