According to the US Department of Commerce, the gross domestic product, the broadest indicator of the production of goods and services in the economy, increased by 3.3% per annum in the third quarter (the forecast was + 3.0% and + 3.1% quarter).

This growth was the strongest in three years.

Federal Reserve manager Jerome Powell, who was nominated by US President Donald Trump as chairman to replace Janet Yellen, said on Tuesday at a Senate hearing that he expects GDP growth in 2017 to be 2.5%.

The yield of 10-year US government bonds, according to Tradeweb, after the release of data on US GDP on Wednesday rose to 2.385% from the level of 2.338% recorded on Tuesday.

"I believe that there are conditions for raising interest rates at the next meeting", Powell told lawmakers. The next meeting of the Fed is scheduled for December 12-13. Almost with 100% certainty, investors expect an increase in the key rate in December by 0.25%, which is currently in the range of 1% -1.25%.

President of the Federal Reserve Bank of San Francisco, FOMC member John Williams on Wednesday also called for higher rates.

"As long as the data continues to indicate stable growth, and we see such an increase in inflation as we expect, we, in my personal view, should continue to slowly increase interest rates next year. If we do not return interest rates to more normal levels, we risk undermining steady growth and create conditions that could lead to a recession in the future", he said.

In a report published on Wednesday by the Federal Reserve System, known as the "Beige Book", it is said that economic activity in the country has increased "from modest to moderate" in recent weeks amid signs of rising prices and the continued strengthening of the labor market.

And yet, the dollar's growth on Wednesday turned out to be restrained, and on Thursday the dollar traded in different directions from the opening of the trading day and during the Asian session, declining against the euro and the pound. Apparently, several important factors do not allow the dollar to move into a more aggressive offensive.

Earlier in the week, the Budget Committee of the US Senate approved the republican bill of tax reform. On Thursday, a vote on this bill in the Senate should take place. Republican leaders are confident that they will be able to get 50 votes needed to approve the bill. And yet, there is a certain share of the risk for investors who are betting on the further growth of the dollar, if the bill is not adopted today in the Senate.

Disagreements among the leaders of the Fed on the pace and need to raise rates in 2018, which became clear from the previously published protocols from the November meeting of the Fed, also impose a negative imprint on the dynamics of the dollar.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

At the beginning of the European session EUR / USD resumed its decline. This was facilitated by statistical data, published at 10:00 (GMT) and indicated that the rate of inflation in the Eurozone in November remained low.

The annual preliminary consumer price index (CPI) of the Eurozone in November is + 1.5% (against + 1.4% in October and + 1.6% according to the forecast). The unemployment data in the Eurozone, which declined to 8.8% in November (against 8.9% in the forecast and last month), slightly brighten the negative picture.

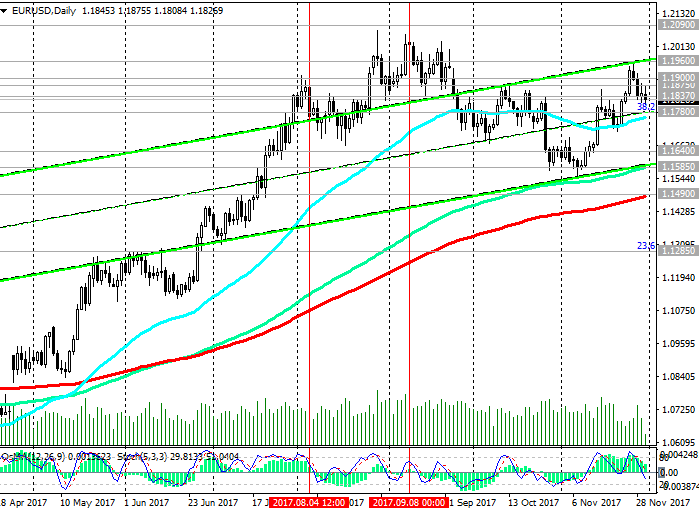

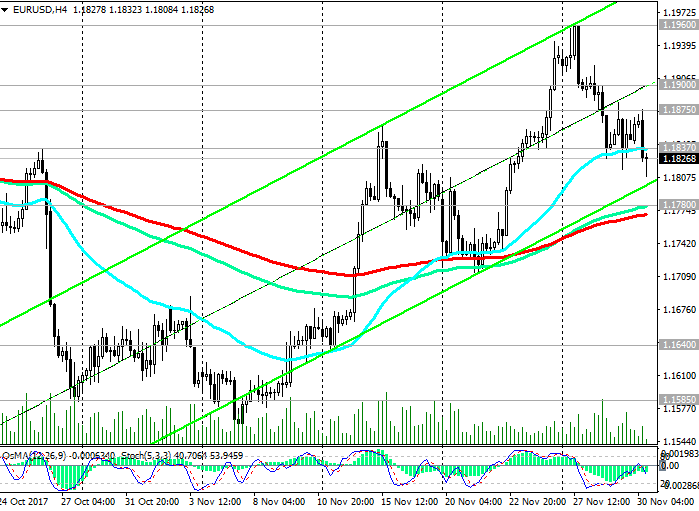

The EUR / USD could not develop the upward momentum and gain a foothold above the resistance level at 1.1875 (last month's highs). Breakdown of resistance level 1.1900 would determine its further growth.

EUR / USD broke the short-term support level 1.1837 (EMA200 on the 1-hour chart, EMA50 and the bottom line of the upward channel on the 4-hour chart) and is down to support level 1.1780 (Fibonacci level 38.2% corrective growth from the lows reached in March 2015 year in the last wave of global decline of the pair from the level of 1.3900, as well as EMA144, EMA200 on the 4-hour chart).

The break of this level will call into question the further growth of EUR / USD, and the medium-term reduction targets will be the support levels 1.1640 (EMA200 and the bottom line of the upward channel on the weekly chart), 1.1585 (EMA144), 1.1490 (EMA200 on the daily chart).

Support levels: 1.1800, 1.1780, 1.1765, 1.1640, 1.1600, 1.1585, 1.1490, 1.1285

Resistance levels: 1.1837, 1.1875, 1.1900, 1.1930, 1.1960, 1.2000, 1.2050, 1.2090, 1.2100, 1.2180, 1.2320, 1.2430

Trading Scenarios

Sell Stop 1.1810. Stop-Loss 1.1880. Take-Profit 1.1780, 1.1765, 1.1640, 1.1600, 1.1585, 1.1490

Buy Stop 1.1880. Stop-Loss 1.1810. Take-Profit 1.1900, 1.1960, 1.2000, 1.2050, 1.2090, 1.2100, 1.2180, 1.2320, 1.2430

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com