The large-scale weakening of the dollar is reflected not only in the financial markets, but also in the commodity market, including the oil market.

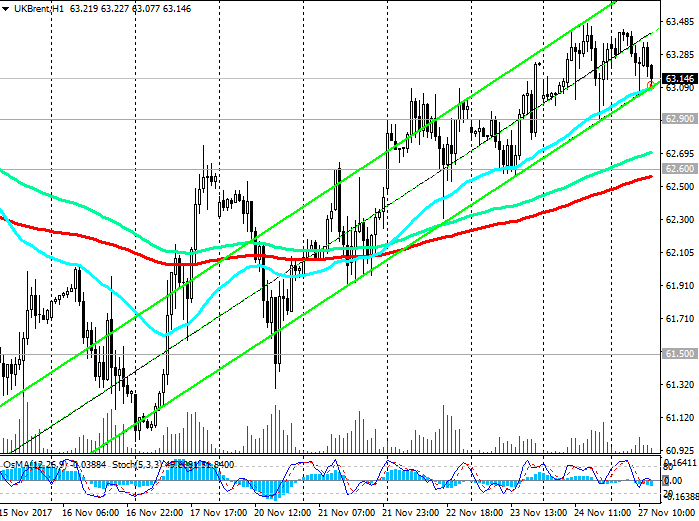

Oil prices have been rising for the fifth consecutive month. During today's Asian session, the price of Brent crude slightly decreased. Futures for Brent crude fell down in price by 0.02%, to 63.85 dollars per barrel. The spot price for Brent crude at the beginning of the European session is close to $ 63.20 per barrel, which is about 0.14 dollars lower than the opening price of today's trading day.

Nevertheless, the positive dynamics persists. This week the market will wait for the decision of the Organization of Petroleum Exporting Countries (OPEC) on the further fate of the production reduction deal.

The meeting of OPEC and a number of countries outside the cartel, including Russia, will be held on Thursday in Vienna. Participants will hope for an extension of the agreements to reduce oil production to the end of 2018.

If there is no extension of the deal, then this can alert investors, and the prices in this case may drop sharply.

In the event of a positive outcome of the meeting and the extension of the deal, prices may soon overcome the $ 65.00 mark and go up to the area of $ 70.

As the oil minister of the UAE said earlier this month, "there is the potential for extending the deal to cut production in order to reduce the excess in the market." "We are not satisfied that the price of oil for the year increased from 40 to 64 dollars per barrel, and we will discuss the terms of the extension of the agreement", the minister added.

Saudi Arabia is extremely interested in higher world oil prices for a more profitable IPO of state-owned company Saudi Aramco, which is the largest oil company in the world.

An upward trend in oil prices may also be linked to the risks of a possible production disruption in Iran, Iraq and Saudi Arabia.

Nevertheless, the negative impact on prices will be provided by the growing production of shale oil in the US, which will create a new inflow of oil to the market.

After a decline in recent months due to hurricanes over the US, the number of oil rigs in the US increased by nine units last week to 747 units, according to Baker Hughes. The maximum number of active drilling in this year was recorded in August (768 units). So, American oil companies still have a significant prospect for growth and increase in production. This will become one of the main negative factors. However, further price increases, perhaps, can not be avoided if the agreement to reduce production on Thursday will be extended.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

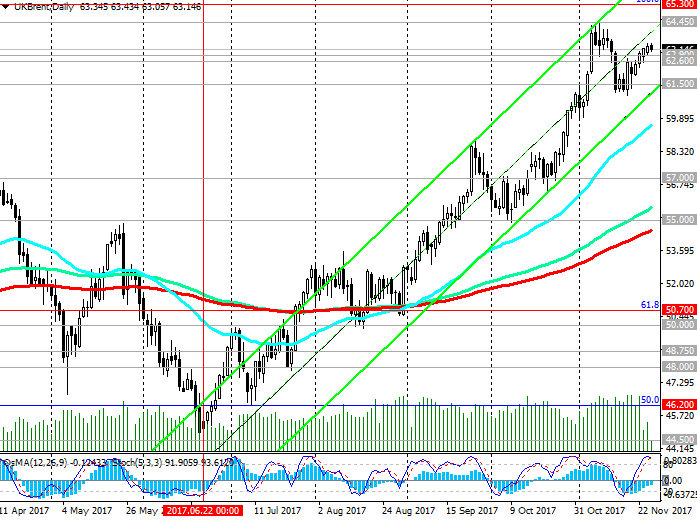

So far, a strong positive impulse of a fundamental nature remains in force, and long positions are preferred.

Support levels: 62.90, 62.60, 61.50, 61.00, 60.00, 59.85, 58.80, 58.00, 57.00, 56.20, 55.55, 55.00, 54.00, 53.50, 52.20, 50.70, 50.00

Resistance levels: 64.00, 64.45, 65.00, 65.30, 66.00, 67.00

Trading scenarios

Sell Stop 62.80. Stop-Loss 63.60. Take-Profit 62.60, 61.50, 61.00, 60.00, 59.85, 58.80, 58.00, 57.00, 56.20, 55.55, 55.00

Buy Stop 63.60. Stop-Loss 62.80. Take-Profit 64.00, 64.45, 65.00, 65.30, 66.00, 67.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com