The Reserve Bank of Australia (RBA) fires the first salvo this month! In case you missed it, we’ve listed down the five things you need to know about the central bank’s monetary policies in July:

1. Interest rates remain at 1.75%

As expected, Glenn Stevens and his gang have kept their interest rates at a record low of 1.75% for the month of July. Remember that the RBA surprisingly cut its rates by 25 basis points back in May following the release of significantly weaker-than-expected inflation reports for Q1 2016. So what’s the RBA looking at this month?

2. The RBA has its eyes on inflation

Yep, you guessed it. It’s still all about inflation, yo! The juiciest bit in the July release is found in the last paragraph where the RBA said that

“Over the period ahead, further information should allow the Board to refine its assessment of the outlook for growth and inflation and to make any adjustment to the stance of policy that may be appropriate.”

The wording is significant because there was no suggestion of a potential “adjustment” in the June statement. While the text doesn’t explicitly state an easing bias, it does warn the market players that the RBA could adjust its policies if further information (a.k.a. Q2 2016 inflation figures out on July 27) that they receive disappoints. Hey, at least we know exactly what to watch out for to predict the RBA’s next moves!

3. Jawboning for the…housing market?

The RBA wasn’t expected to cut its rates but some traders expected a bit of jawboning especially after the recent recoveries in commodity prices. After all, the RBA did warn that an appreciating exchange rate could complicate Australia’s necessary economic adjustments.

Instead, the RBA fired another warning shot at… the housing speculators. For forex newbies out there, you should know that it’s in the RBA’s interests to put a cap on Australia’s housing prices because an overheated housing market would complicate its plans to boost consumer prices by implementing accommodative policies.

The central bank changed its wording from “dwelling prices have begun to rise again recently” to “dwelling prices have risen again in many parts of the country over recent months” and warned that “considerable supply of apartments is scheduled to come on stream over the next couple of years.”

The RBA is certainly no stranger to warning against housing speculation. In its financial stability review in April it warned that “risks appear to have increased” for the developers. Then, two weeks ago RBA Governor Glenn Stevens repeated his advice “not to bet that real estate prices would always keep rising.”

4. The RBA isn’t too worried about Brexit

Another closely-watched point for the RBA is its opinions on the recent political risks, namely last month’s Brexit vote and the more recent Australian federal election. While the RBA remained mum on the election, it did speak up on the Brexit issue.

The central bank noted the increased financial market volatility following the vote, but said that “any effects of the referendum outcome on global economic activity remain to be seen and, outside the effects on the UK economy itself, may be hard to discern.” The sentiment isn’t too surprising since the Australian economy is more dependent on China’s growth than its European counterparts.

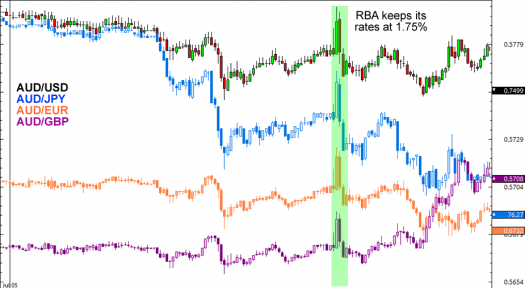

5. The Aussie completely shrugged off the RBA event

As Pip Diddy mentioned in today’s Asian session recap, any optimism over the RBA’s less-dovish-than-expected policy statement collapsed under the weight of Australia’s weak retail sales and trade balance figures as well as the overall risk aversion in the markets.

As of writing most of the Aussie pairs are back to their pre-RBA levels. Does this mean that the Aussie will look to risk sentiment for direction this NFP week?