EUR/USD Forecast: Ready to Break Lower

The market started in slow motion this week, with a quiet Asian session keeping majors within familiar ranges, although the greenback edged modestly lower against most of its rivals.

The European opening brought the first batch of data coming from the EU, with the preliminary May PMI figures for France, Germany and the EU itself. The numbers showed that Germany keeps growing at a faster pace that the rest of the region, with the Markit Composite PMI resulting at 54.7, the highest in five months. But also that the eurozone is struggling with growth, as the flash composite PMI fell o its lowest in 16 months, printing 52.9 in May.

During the upcoming US session, the local Manufacturing PMI alongside with a couple of FED speakers will gather all of the attention, and the dollar can benefit from more hawkish jawboning towards a rate hike in June.

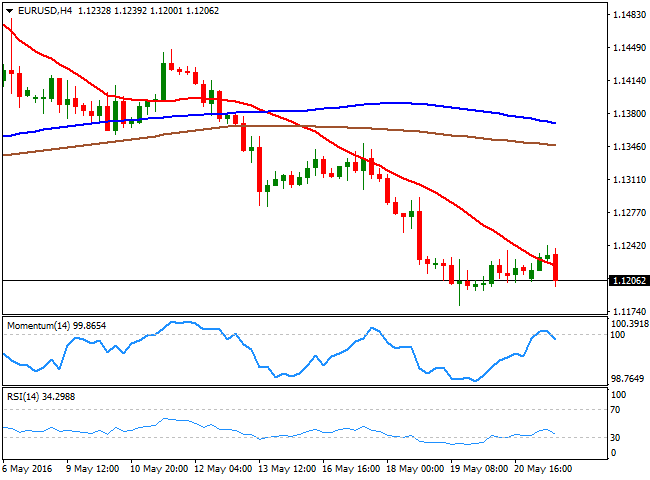

The EUR/USD pair in the meantime, retreated from a daily high of 1.1242, maintaining a heavy tone in the 4 hours chart, as the price has moved quickly back below a bearish 20 SMA, whilst the Momentum indicator turned south around its mid-line, and the RSI indicator resumed its decline near oversold readings after a limited upward corrective move.

A downward acceleration through 1.1190 should lead to a quick test of the 1.1150 region, en route to 1.1120 a major static support level. The upside will remain capped by 1.1280 with approaches to the level most likely attracting selling interest.