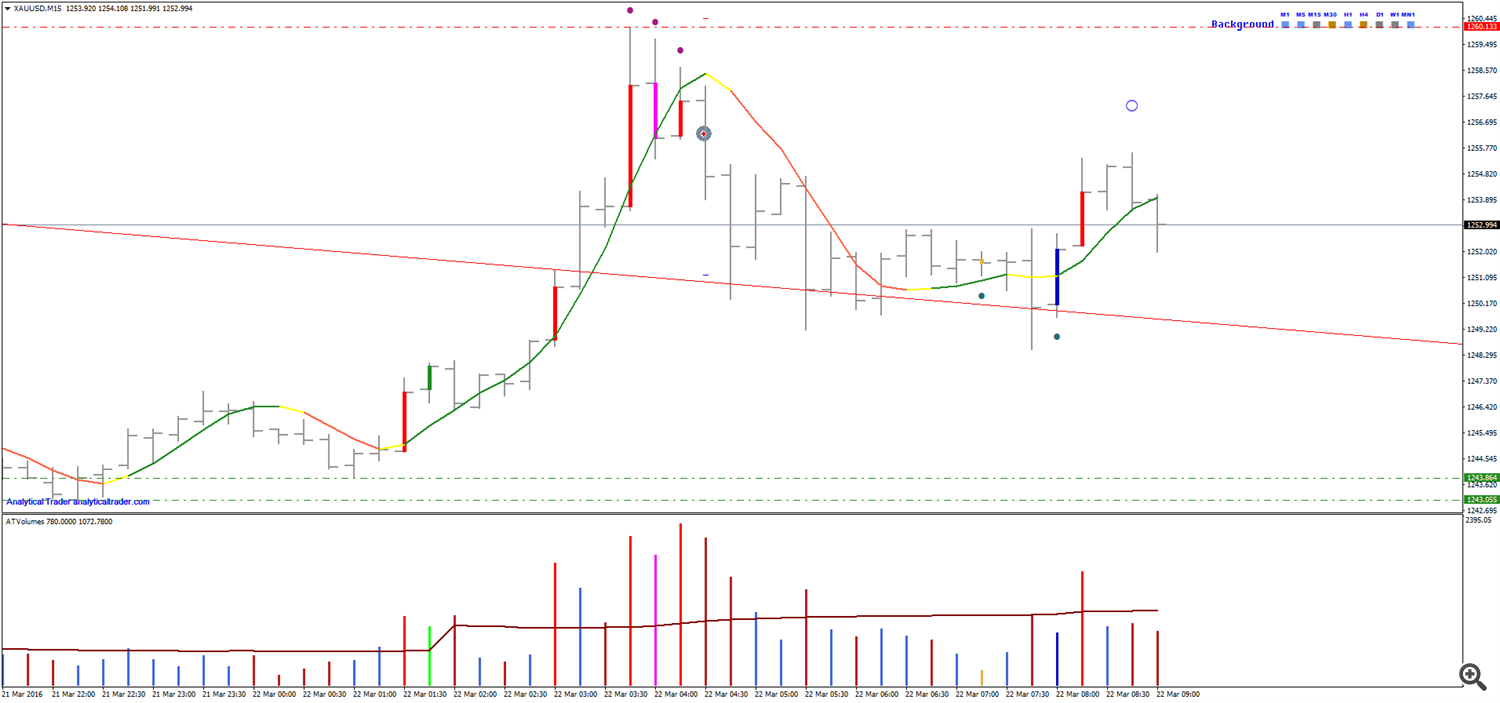

In the first hours of today’s London session, activity and volumes spiked up in gold. This activity, VSA showed, was major supply hitting the market, just below a high formed days before, on heavy supply, at $1258. In the last post we noted that below $1270, the “control point” of selling of the last weeks, we should be looking for shorts in lower timeframes, and this was the ‘golden’ opportunity.

In M15 there were multiple supply signals, and the background turned from strong to neutral.

In M5 the dynamic trend turned red shortly after, when the short was taken, with SL above the previous high and TP a bit above the down trendline, where buying is to be expected. Prices went down on wide range and reached the target, with the rally afterwards showing low volume. When prices attempted to break the trendline, VSA showed Minor Demand, and the price then went up on high volume. The no-demand test shown in M5 (pink bar) succeeded, as there was supply afterwards and its low was broken, which is a temporary stop of the uptrend. The background is strong in M5, and more demand, or a bullish test, just above the broken down trendline, would be a long.