Analytical Review of the Stocks of International Paper Company

Analytical Review of the Stocks of International Paper Company

International Paper Company, #IP [NYSE]

Consumer goods, production of paper & packaging, USA

Financial performance of the company:

Index – S&P 500;

Beta – 1.55;

Capitalization – 16.97 В;

Return on asset – 3.20%;

Income - 938.00 M;

Average volume – 4.69 М;

P/E - 18.51;

ATR – 1.03.

Analytical review:

- In the last month company’s stock have grown by over 23%. It is expected that the rise in quotes will continue.

- The company ranks the first on capitalization in the sector of “production of paper and packaging” among the issuers traded in the American stock market.

- At the beginning of February the company reported for Q4 of the fiscal year 2015. According to the company’s press-release in the reporting period net profit of the company fell by 19.1% (from 220 million USD to 178 million USD). The decline in EPS ((earning per share) was over 17%, from 0.52 USD to 0.43 USD.

- At the press-conference Management of the company said that company’s revenue fell by 5.3% to 22.36 billion USD due to strong USD. It is worth noting that despite pressure from ong USD net profit of the company rose by 698%, from 555 million USD to 938 million USD in the fiscal year.

- Over 85% of company’s shares belong to institutional investors. The most shares belong to State Street Corporation (6.49%) and Vanguard Group (6.24%).

- Presently, the company is expanding its business activity. IP has signed an agreement with Xiamen Bridge Hexing Equity Investment Partnership Enterprise on sale of the assets in China and South-East Asia for the amount of 150 million USD. The deal will include a sale of 18 plants with 3000 employees.

Summary:

- Company’s repost for Q4 of the fiscal year 2015 showed that management of the company is on the right track. Despite strong pressure from the USD the company net profit has grown significantly. Most parts of the company’s shares belong to institutional investors. Successful diversification of the company’s business will help increase market share of the company in the sector of production of paper and packaging.

- It is likely that in the near future company’s quotes will go up.

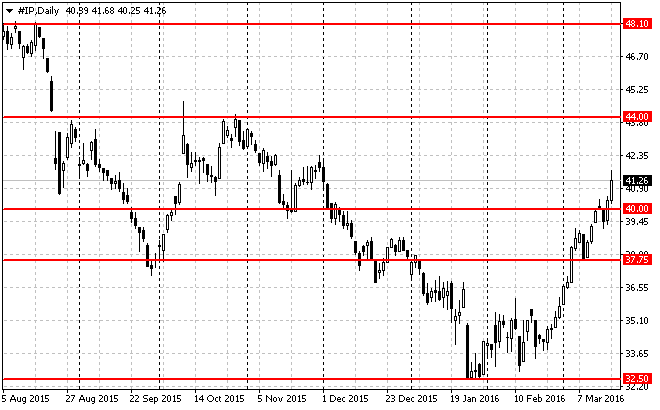

Trading tips for CFD of International Paper Company

Long-term trading: the moment the issuer has broken resistance level of 40.00 USD. If the price maintains at the gap of 37.75-40.00 USD and in case of the respective confirmation (such as pattern Price Action), we recommend to open long positions. Risk per trade is not more than 2% of the capital. Stop order can be placed slightly below the signal line. Take profit can be placed in parts at the levels of 43.50 USD, 46.50 USD and 48.00 USD with the use of trailing stop.

Short-term trading: on the chart with the timeframe 15M the issuer has broken out and consolidated above the local resistance level of 40.40 USD. If the price maintains “mirrored” support level 40.40 USD, it will be advisable to open long positions. Risk per trade is not more than 3% of the capital. Stop order can be placed slightly below the signal line. Take profit can be placed in parts at the levels of : 41.50 USD, 42.50 USD and 44.00 USD with the use of trailing stop.