Deutsche Bank explained 3 fundamental reasons for short GBP/USD: short-end rates of UK vs. US rate hikes, absent rate support and UK’s current account deficit since 2011. It is stated that "this mechanically implies the cross below 1.50."

But there are 4 technical reasons to sell GBP/USD:

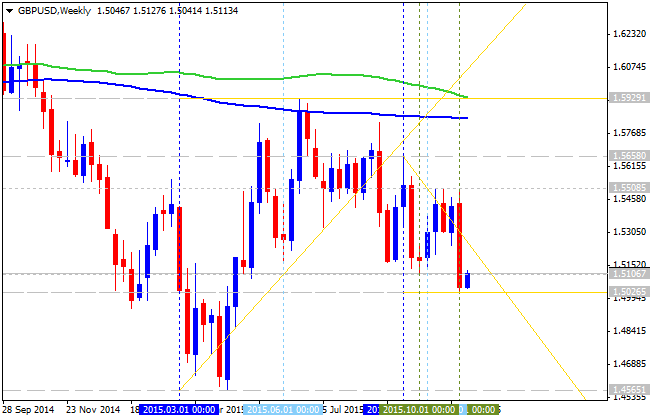

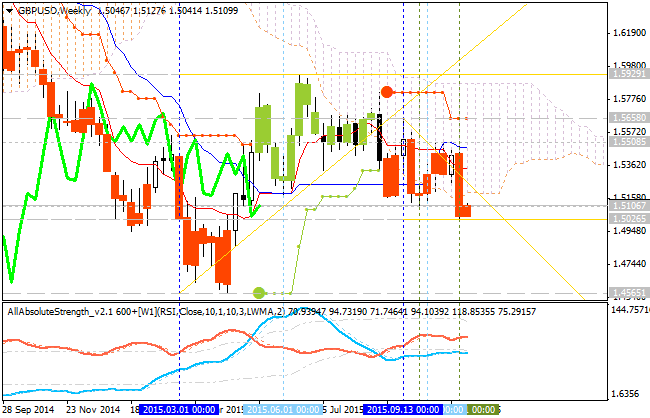

#1. The price is below 100 period SMA (100 SMA) and 200 period SMA (200 SMA) for all the timeframes started with H1 for example. Price is located in the bearish area of the chart and it is fully unlikely to see the bullish reversal in this and next year.

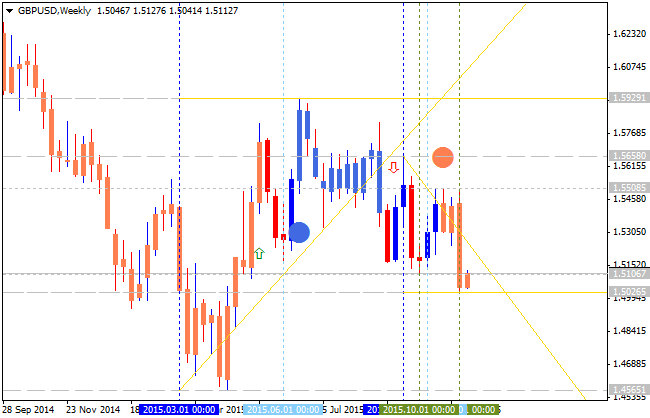

#2. Weekly price is below Ichimoku cloud. The prise broke Ichimoku cloud together with Senkou Span line which is the border between the primary bearish and the primary bullish on the chart. The price is located to be below the cloud in the bearish area of the chart with 1.5026 as the nexrest support level.

#3. Chinkou Span line crossed the price for breakdown. 'Chinkou Span crossing the price' signal is the most strong one for Ichimoku indicator. This line crossed the price from above to below which is indicating good possible breakdown in the near future.

#4. Nearest support is 1.5026 as the bearish breakdown level. if the price breaks this level from above to below so the next bearish targets will be the following: S1 Pivot at 1.4702 and key support level at 1.4565. So, this breakdown will be a big case with the about 300 pips price movement (from 1.50 to 1.47 for example).