Why China - not Federal Reserve - keeps investors up at night

Barclays surveyed 651 of its clients globally to find out what they are afraid of, and also learn their thoughts on commodities, yields, currencies, and other questions about the market outlook.

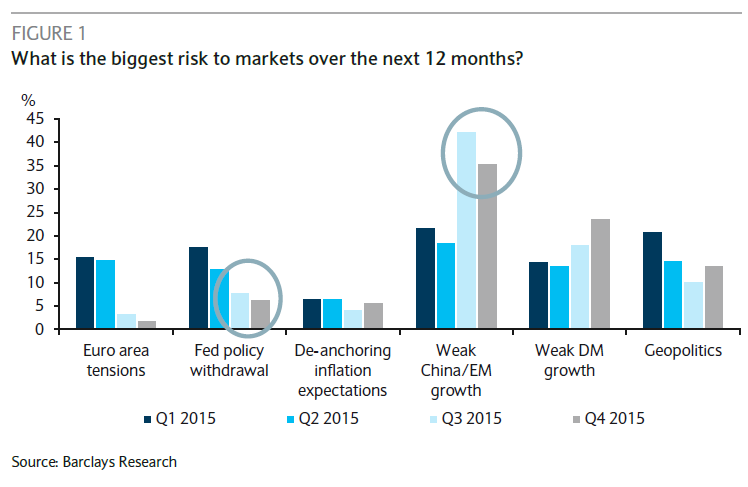

"Only 7 percent sees Fed normalization as the main risk for markets over the next 12 months, compared with 36 percent whose main worry is China," said Guillermo Felices, head of European asset allocation.

A number of investors who considered weakness in China and other developing economies to be the greatest risk to markets jumped in the third quarter, the period in which the Chinese government unexpectedly devalued the yuan.

The rise in worries over slowdown in China and the rest of the developing world coincided with a jump in the share of investors who think deflation is a larger risk to the markets than inflation.

Devaluation in China drove similar moves from other nations that had pegged their currencies to the U.S. dollar. All else being equal, this process engenders a stronger U.S. dollar and weaker commodity prices, thus exerting downward pressure on headline inflation rates.

Since Barclays' poll was carried out from Oct. 22-29, investors' reactions to the Fed's October 28 statement, which signaled December rate increase was still on the table, may not fully be reflected in its results.

Still, around 40 percent of those polled indicated that they expected the Fed to initiate its tightening phase before the year-end.

The majority of respondents think hiking borrowing costs will damage risk assets, though only for a short period.

Generally, the risk of Fed policy withdrawal is at a two-year low, suggesting complacency about the threat of higher rates.