Sustained Liftoff Fears Spark Surging Demand for Higher Rate Hedges

16 September 2015, 22:44

0

206

Eurodollar prospects brokers are scrambling to minimize "Shock Risk."

Brokers on Tuesday seemed to choose that the dangers of the Federal Reserve astounding them with an unforeseen interest rate liftoff this week were excessively awesome.

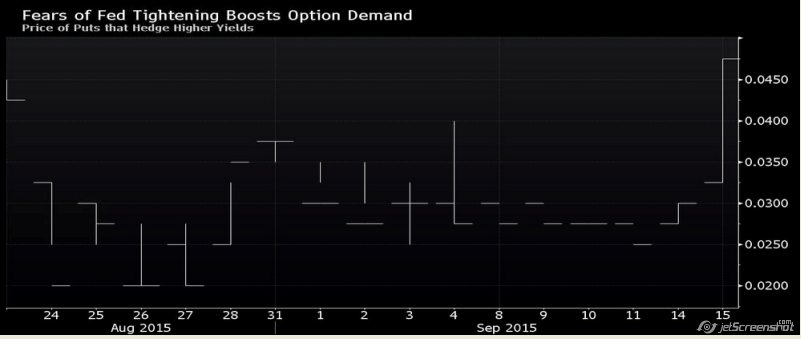

That set off a surge popular for choices - known as puts and demonstrated in the outline beneath - that benefit if yields inferred by Eurodollar prospects rise. These agreement, the world's most effectively exchanged of all currency market subordinates, are settled at close at the London interbank offered rate and have additionally for quite a long time been utilized to hypothesize on changes in Fed strategy. As the fates, which are cited in value terms, fall, their yields rise.

That choice interest came as financial specialists dumped two-year Treasury notes, because of the same worry about the begin of the first money related arrangement fixing subsequent to 2006. Yields on U.S. government obligation came to 0.80 percent on Tuesday, the most elevated Tuesday since 2011.

"This speaks the truth worry that without precedent for some years there is a risk the Fed will really trek," said Thomas Simons, government-obligation financial specialist in New York at Jefferies Group.https://www.mql5.com/en/signals/111434#!tab=history