Encouraged Gifts Emerging Markets a Lifeline at Expense of Euro, Yen.

18 September 2015, 15:29

0

298

Developing markets have a companion in Janet Yellen.

Approach producers from Asia to Latin America can appreciate a relief from a 19 percent droop by their monetary standards over the previous year after the Federal Reserve kept rates close to zero on Thursday, stemming surges from these economies. Their partners in Europe and Japan aren't so lucky; regardless they're sitting tight for a U.S. rate rise that would lessen weight to support facilitating at home.

Yellen paid attention to calls from the World Bank and International Monetary Fund to abstain from destabilizing worldwide markets with the Fed's top notch increment in just about 10 years. Instability took off in August crosswise over money, security and securities exchanges in the midst of concern abating development in China would weigh on the worldwide economy, lifting the stakes for U.S. money related approach. Authorities are watching improvements in China and developing markets, Yellen said Thursday.

"The World Bank was asking the Fed not to raise rates, and a great deal of developing business sector nations at the G-20 were stating don't raise rates," said Greg Anderson, the worldwide head of remote trade method at the Bank of Montreal. "Be that as it may, for the European Central Bank and the Bank of Japan, their monetary standards reinforce when there's instability and they need frail coinage. The most ideal path for them to accomplish feeble monetary forms is for the Fed to trek."

Developing Problems

Change encompassing any ascent in U.S. getting expenses could prompt a "sizable drop" in capital streaming into creating countries, making considerable difficulties for strategy creators, the World Bank cautioned for the current week.

The Fed appears to have taken that on board, with Yellen taking note of that cash has effectively left these nations and saying authorities are examining dangers originating from China and other developing markets for signs they will influence the U.S. "China" or "Chinese" was said 11 times in the Fed's Beige Book discharged for the current month, with the Boston, San Francisco and Dallas locale refering to the Asian country's stoppage as debilitating interest for items including chemicals and cutting edge merchandise.

A gage of developing business sector coinage climbed 0.2 percent in European exchanging on Friday. The measure amplified its longest rally subsequent to April 2014 in the wake of touching the most minimal in over 10 years prior this month.

"For developing business sector national financiers, the Fed has given them some abundantly required breathing room," Jonathan Lewis, a foremost at New York-based Samson Capital Advisors, said Thursday. The firm administers $7.4 billion. "Putting off a Fed fixing gives these national investors space to be more accommodative, without their activities being counterbalanced by a more tightly Fed."

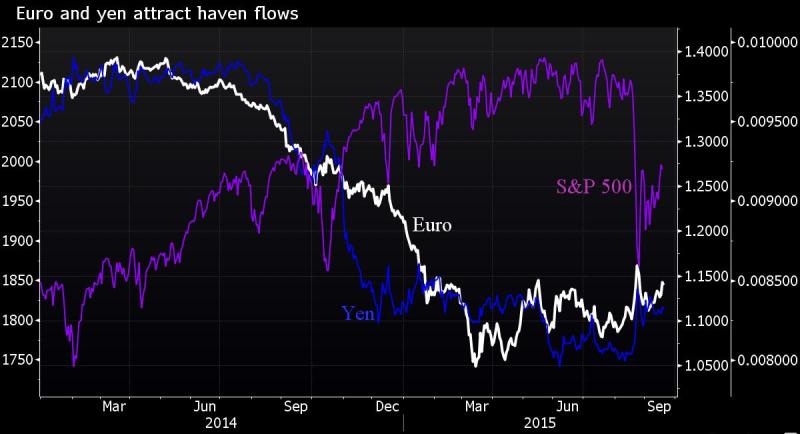

On the other hand, ECB President Mario Draghi and BOJ Governor Haruhiko Kuroda face a difficult task to reestablish shortcoming in the euro and the yen. In the wake of drooping in the first 50% of the year, the two coinage have gone about as places of refuge in the midst of the China and Fed instability, reinforcing more than any of their 10 created country peers in the course of the most recent three months, Bloomberg Correlation-Weighted Indexes show.

More grounded Yen

The time of a weaker yen is arriving at an end and the money may reinforce toward 115 for each dollar, Eisuke Sakakibara, who was nicknamed "Mr Yen" when he served as Japan's bad habit pastor of fund, said in a meeting in Tokyo Friday.

The euro propelled 1.3 percent to $1.1435 Thursday, while the yen climbed 0.5 percent to 120.01 for each greenback. The Bloomberg Dollar Spot Index fell 0.6 percent, its steepest slide subsequent to August, and expanded its decay on Friday. Europe's shared cash brought $1.1437 starting 9:02 a.m. London time, while the yen exchanged at 119.42.

"I'm not certain the ECB will be upbeat if the euro uptrend proceeds," said Sally Auld, head of altered salary and cash procedure for Australia at JPMorgan Chase & Co. in Sydney. "It's about containing drawback dangers to the expansion story for them and a more grounded euro doesn't assist with that."

Financial analysts from Goldman Sachs Group Inc. what's more, Citigroup Inc. were among those anticipating the BOJ will support jolt on Oct. 30 even before the Fed's choice not to raise U.S. rates.

Kuroda and his board left set up on Tuesday in Tokyo their project to build Japan's money related base at a yearly pace of 80 trillion yen ($668 billion). The senator over and over told journalists that strategy creators see a steady recuperation proceeding in the economy, while additionally saying the national bank wouldn't dither to ease if there was some peril of costs not ascending to its 2 percent target.

"Cash is going out of the U.S. dollar in light of the fact that the Fed isn't raising rates, yet it will stream into less unsafe monetary forms like euro and yen," said Imre Speizer, a senior business sector strategist at Westpac Banking Corp. in Auckland. "National banks like the ECB and Bank of Japan will be sitting tight for the smoke to clear and see what cash patterns develop throughout the weeks ahead as to suggestions for their own particular approaches."