EUR/USD

In the event that you take after my past compositions (a specialized Survey of the weekend), I demonstrated that the level was imperative in 1.1121 scale Every day, where truly the EUR/USD has ever tried this level when it bounce back from 1.0808 and the other way around sets ever tried this level when pulback from 1.1713 and 1.1465/35.

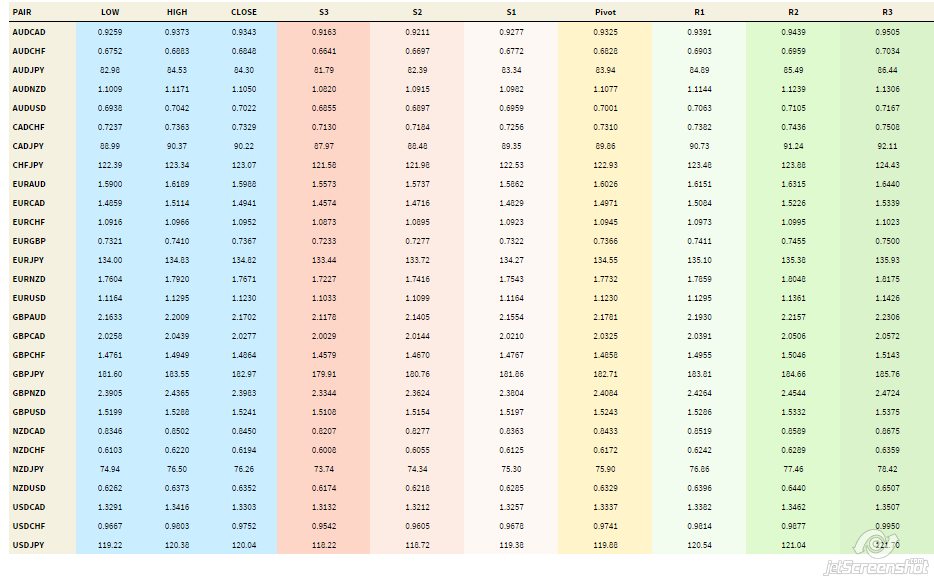

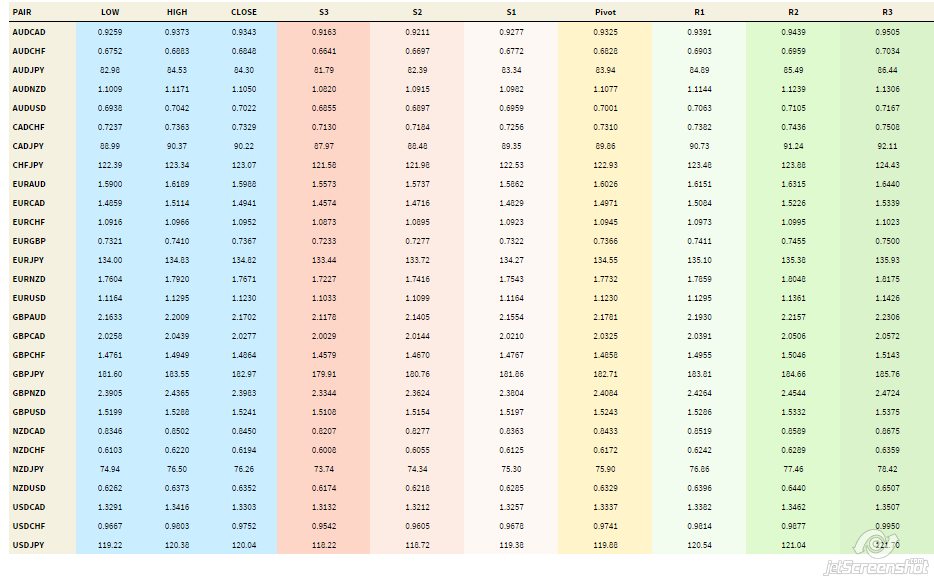

And as the signs then I describe the standard Pivot Point-Support-Resistance in the table below:

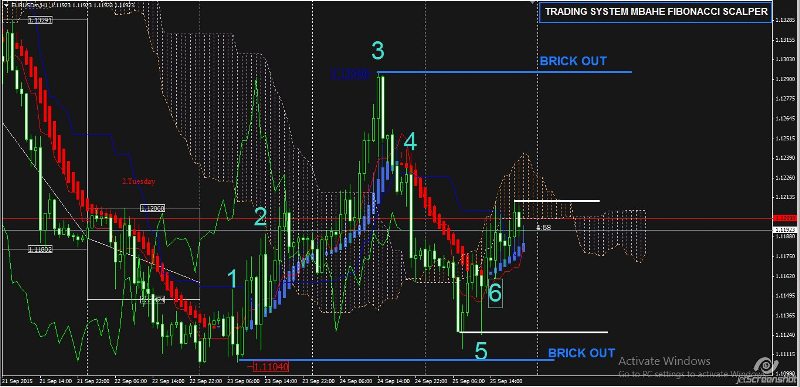

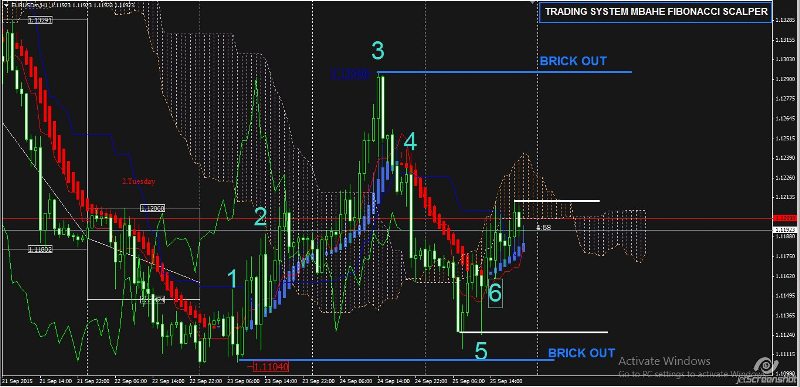

For more details, perhaps we can both listen to the Daily chart image like below:

To be noted is that 1.1121 shaped from level Kumo on Ichimoku pointer. That is the reason I truly preferred these pointers, other than in view of its properties a Pattern Devotee, is on the grounds that some natural (level Kijun-sen, Tenkan-sen, or Kumo Senkou-compass A/B) is equipped for going about as a R/S element taking into account past verifiable information development. This not just apply on the Every day time period just, H4 H1 furthermore, where the Kijun-sen/Tenkan-sen/Kumo that tends to move level for the most part portrays some imperative R/S states of value development some time recently, despite the fact that it's not precisely as well but rather at any rate the Ichimoku marker fit for mapping R/S while all the while going about as a pointer of a Pattern Supporter.

Obviously it would be more finished in the event that we additionally comprehend Value Activity, which regularly give a sign of speedier or flags instead of a marker of any supporters/apparatuses. Value activity or activity cost not simply flame example (immersing, harami, tweezer top/base, pin bar/spike light, triangle, wedge, et cetera) additionally the value activity against R/S level and against the supporting pointers (Ichimoku). I myself would rather pay consideration on value activity basically on the H1 graph for intraday exchanging subsequent to doing the mapping R/S on a Day by day and after that the H4. Albeit numerous likewise Ichimokers (Ichimoku clients) who saw the value activity on a littler time span, for instance, M15.

Volume marker as I would like to think is likewise vital as extra devices. In any event for a notion's essence of the business sector when the Volume is expanded on the upside/drawback are likewise regularly infers the arrangement of flame example or value activity. Perhaps for more subtle elements, how about we be just as mindful to the accompanying picture underneath, which demonstrates the market's hesitance to move under 1.1121:

Description: https://www.mql5.com/en/blogs/post/650303

1. a bearish Light with expanded volume, however was not able to get through the following flame under static 1.1104 intraday support

2. a bullish Flame (proclamation Draghi) with expanded volume, it got through the light above Tenkan-sen and Kijun. Solid sign for quick exit from the offer position.

3. Flame bullish with expansion in volume however then took after by bearish light, both framing the Tweezer Top. An in number sign for prompt way out from a purchase

4. a bearish Flame framed after the announcement of Janet Yellen, however not took after by critical volume spike

5. the U.S. Gross domestic product information Discharge, the volume is expanded however the end light H1 is spike flame with a long lower shadow. An in number sign to leave offer

The depiction above gives a diagram that purchasers so far still keeps on reacting to the dynamic backing from a scope of Day by day (level Kumo 1.1121) until after Friday's Yellen articulation yesterday.

From the photos the Every day time period( (spike lower shadow light) and reaction to purchasers on the H1 time span over, the EUR/USD is in this manner still would be hazardous for upside value move above 1.1121 Tenkan-sen are managing Day by day 1.1281 and High 24 September (1.1294). https://www.mql5.com/en/signals/111434#!tab=history