Fundamental Weekly Forecasts for US Dollar, EURUSD, GBPUSD, USDJPY, AUDUSD and GOLD

US Dollar - "The possibility of major surprises from global central bankers or US NFPs has pushed 1-week FX volatility prices near multi-month peaks, and the next several days promise to force meaningful shifts across financial markets. The fact that the Euro rallied and the Dollar tumbled as the S&P 500 sold off led many to claim the Euro was a new "safe-haven" currency. We think the opposite is true, but any renewed market turmoil could in fact lead more traders to dump USD-long positions and force Euro rallies. It will be critical to watch how markets open the week and begin trading into the first days of the new month."

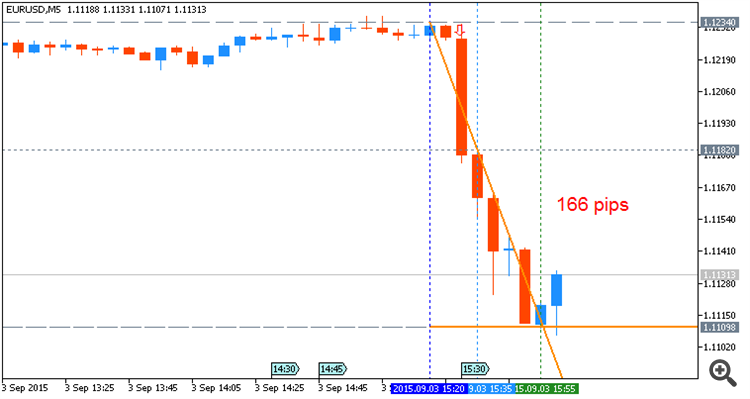

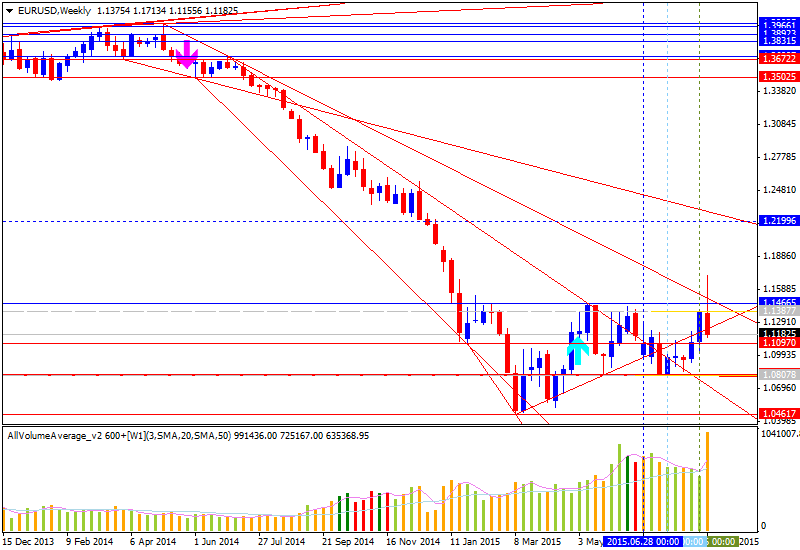

EURUSD - "In turn, the key event risk due out next week may produce a further decline in the euro-dollar, and signs of a greater divergence in the monetary policy outlook may ultimately produce a resumption of the long-term downward trend should the Fed remains on course to remove the zero-interest rate policy (ZIRP). Moreover, the euro-dollar may continue to give back the advance from late-July amid the recent series of lower highs & lows in the exchange rate along with the failure to hold above former resistance around 1.1180 (23.6% expansion) to 1.1210 (61.8% retracement)."

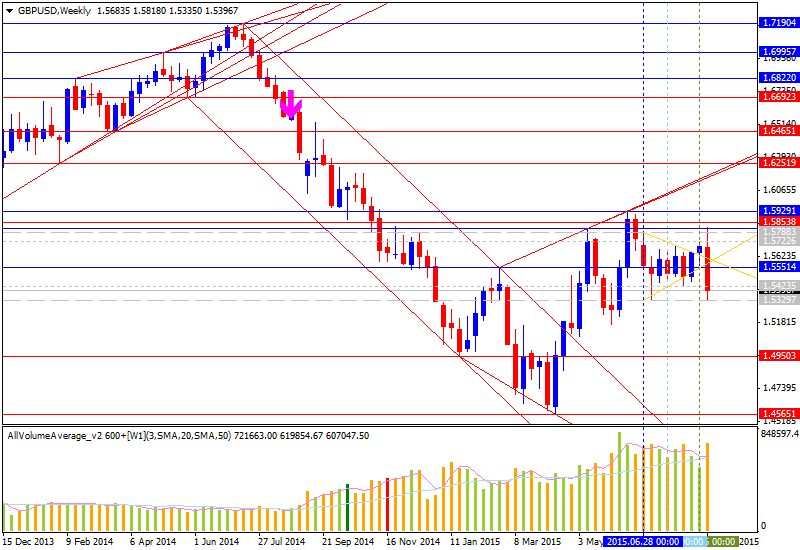

GBPUSD - "NFP on Friday will likely shape the weekly performance in GBPUSD; and the Bank of England rate decision in the following week could prove telling as to Monetary Policy Committee and Mr. Carney’s opinion on future rate hikes and policy trajectory given the multiple concerns for global weakness that are currently present."

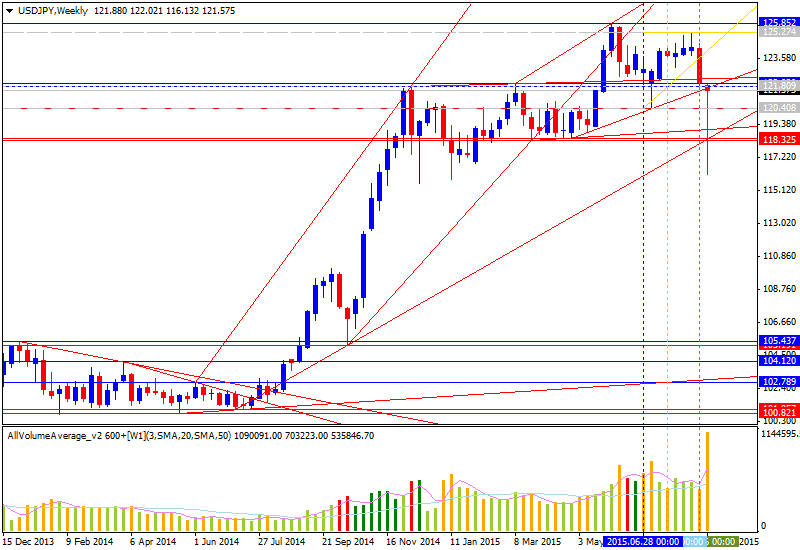

USDJPY - "Bank of Japan president Kuroda frustrated those hoping for immediate BoJ action by sticking to a hawkish tone in regarding economic developments, but his statements had little positive impact on JPY. The market’s reaction or lack thereof on Kuroda’s speech hints that JPY may remain focused on external asset market moves. Next week hosts a series of tier 1 data points from Japan such as Industrial Production on the 30th, Finalized Manufacturing PMI for August, YoY CapEX, and Yoy Monetary Base. However, as mentioned earlier, eyes will likely be directional bias in global asset markets."

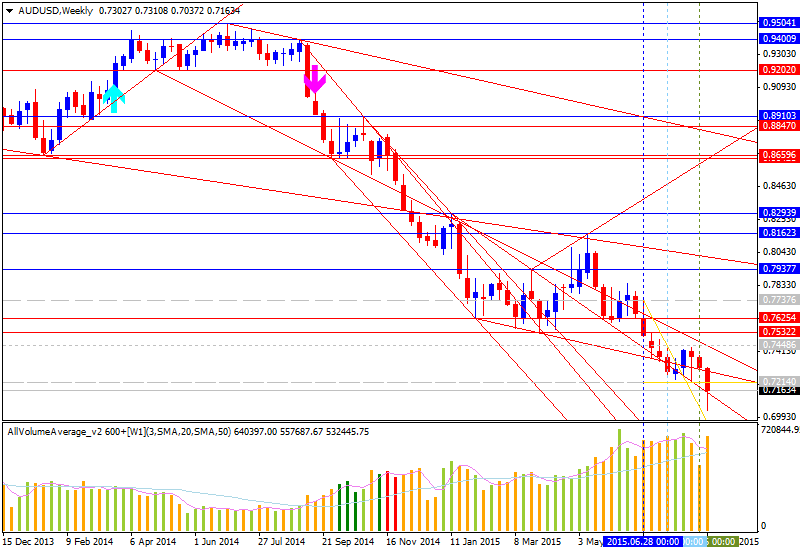

AUDUSD - "On balance, the reintroduction of near-term Fed tightening risk poses a two-pronged threat to the Aussie Dollar, first on the basis of an adverse shift in expected yield differentials and second via sentiment trends in the event that nearing stimulus withdrawal fuels risk aversion. An accommodative turn in RBA rhetoric stands to compound selling pressure. Needless to say, a surprise interest rate cut would only make matters worse. The currency stalled after spiking to a six-year low against its US counterpart early last week but downside follow-through may be just around the corner."

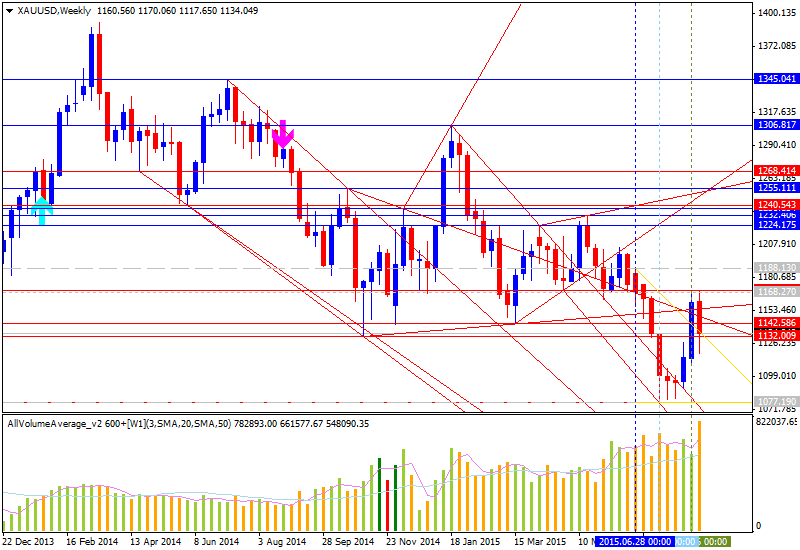

GOLD - "Interim support stands at 1.1120 backed by key support at 1095/98 where the monthly open converges on the low-week & low-day closes. A break below this level puts the resumption of the broader bear trend back in focus targeting the 1067. Resistance now stands at 1154 with a breach above 11170 needed to invalidate the broader downside bias. We’ll be looking for the monthly opening range to offer more clarity with NFPs on Friday likely to spur added volatility in bullion prices."