Royal Bank of Scotland - 'EUR/USD goes lower multi-month but in a choppy range over the next few weeks'

RBS is thinking that EURUSD will be in more ranging condition for the next few weeks:

- "The last minute agreement with Greece ought, in theory, play EUR/USD negative by allowing negative front-end rate spreads to be a bigger FX driver again. Also EUR negative, we believe, is the renewed fall in oil. For two to three months, markets have romanced the Euro area ‘reflation’ trade."

- "Conclusion: EUR/USD goes lower multi-month but in a choppy range over the next few weeks," RBS concludes.

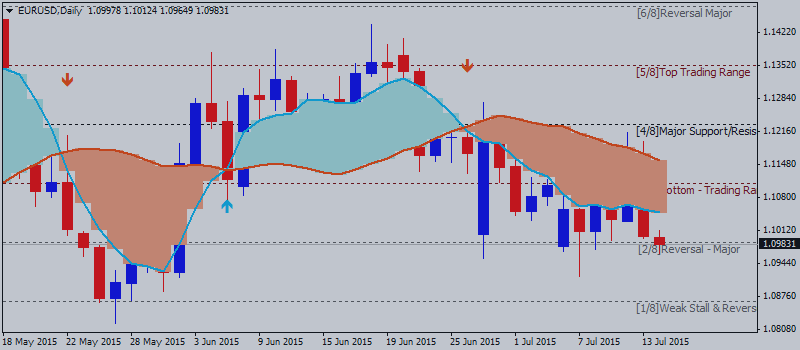

If we look at Ichimoku chart D1 timeframe so we can see the following:

- the price is located inside Ichimoku cloud for ranging market condition;

- Senkou Span A line (which is the border between primary bullish and the primary bearish on the chart) is located near and above the price and it means the primary bearish market condition;

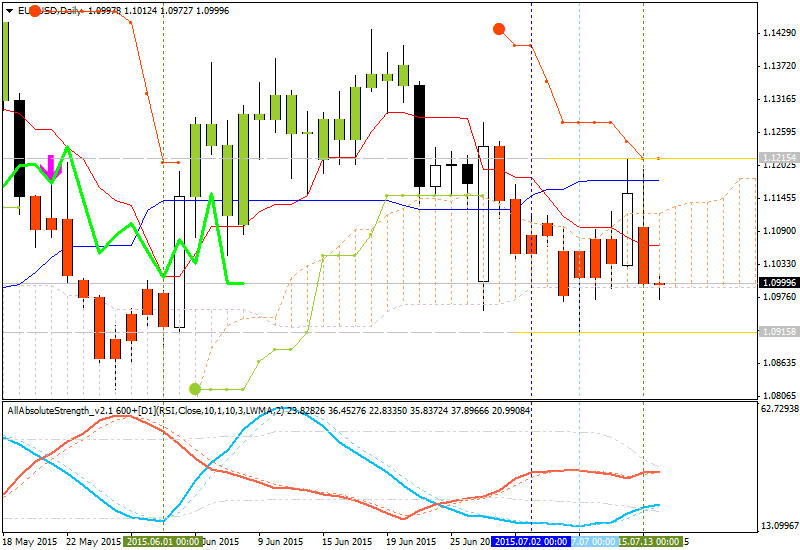

- AbsoluteStrength indicator in separate window is rising by bearish value (tomato colored line) and rising by bullish value (skyblue colored line) on the same time for ranging market condition to be continuing during the next few weeks.

- nearest support level is located in bearish arear of the chart: 1.0915 ;

- nearest resistance level is located in bullish area of the chart: 1.1215.

Thus, I can confirm: we will see the choppy/ranging market condition within the primary bearish during the next few weeks.