On Wednesday the euro traded weaker in Asia as a fresh deadline was set for Greece to submit new proposals. News on account surplus in Japan boosted the yen.

EUR/USD traded at 1.1014, rising 0.01%.

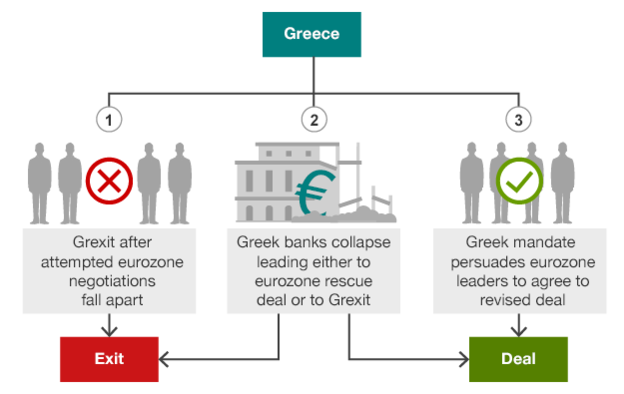

Greece has a five-day deadline to submit detailed reform proposals to international creditors in exchange for a bailout, or risk the "bankruptcy" of both the country and its banking system, European Council President Donald Tusk and Commission President Jean-Claude Juncker cautioned Tuesday.

"The final deadline ends this week," Tusk said after emergency talks in Brussels.

In Brussels, Greece has been given an ultimatum: either there will be a deal or Greece and its banks face the prospect of going bust on Monday, BBC reported.

French President Francois Hollande said: "It's not just the problem of Greece - it's the future of the European Union" that is at stake.

Greece's Prime Minister Alexis Tsipras said he was targeting at a "socially just and economically viable agreement".

"The process will be fast. It starts in the coming hours with the aim of concluding it by the end of the week, at the latest," he added.

Greece's PM is expected to address the European Parliament in Strasbourg later on Wednesday.

Source: BBC News

Overnight, the greenback remained broadly higher versus rivals, after data showed that in May the U.S. trade

deficit expanded less than expected and as demand for the shelter dollar remained underpinned amid continuous Greek jitters.

A day earlier, the U.S. Bureau of Economic Analysis said that the U.S. trade deficit rose to $41.87 billion in May from $40.7 billion in April, whose figure was revised from a previously reported deficit of $40.88 billion. Economists had expected the deficit to broaden to $42.6 billion in May.

In Japan, the current account touched a surplus of 1.881 trillion yen, better than the 1.542 trillion yen seen. The bank lending in June rose 2.5% year-on-year, a slight dip from a 2.6% gain in May.

The local currency reacted with a sharp rise with USD/JPY plunging 0.78% to 121.58.