USDCHF Weekly Outlook 2015, July 05 - 12: ranging for crossing 23.6% Fibo level at 0.9421

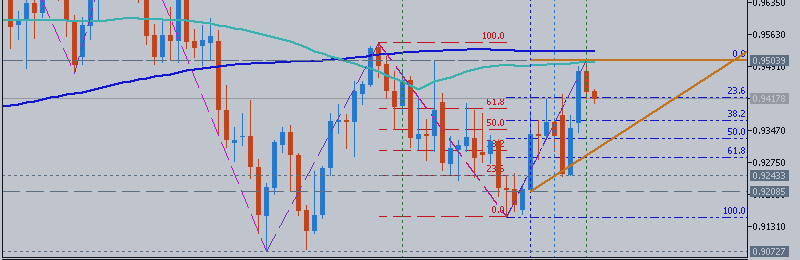

W1 price is located near 200 period SMA

and 100 period SMA with ranging between 23.6% Fibo resistance level at 0.9612 and 38.2% Fibo support level at 0.9214 trying to cross Triangle pattern together with 23.6% Fibo resistance level from below to above.

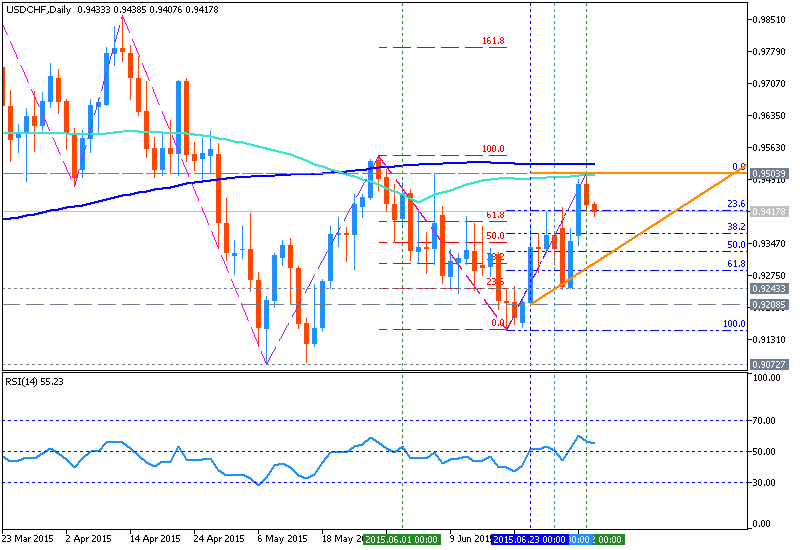

D1 price is located below 200-day SMA

and 100-day SMA for the primary bearish with secondary ranging between Fibo resistance level at 0.9503 and Fibo support level at 0.9150:

- The price is ranging between Fibo resistance level at 0.9503 and Fibo support level at 0.9150 crossing 23.6% Fibo support level at 0.9421 from above to below;

- 200-day SMA

and 100-day SMA are located above and near the price together with Triangle pattern which make the reversal of the price movement from the primary bearish to the bullish condition to be more likely during the week;

- "Prices are too close to resistance to justify entering long from a risk/reward perspective. On the other hand, the absence of a defined bearish reversal signal suggests that taking up the short side is premature. With that in mind, we will remain flat for now."

If D1 price will break Fibo resistance level at 0.9503

from below to above together with 200-day SMA

and 100-day SMA so we may see the reversal of the price movement to the primary bullish condition.

If the price will break Fibo support level at 0.9150 from above to below so the price will continue the movement in bearish condition without ranging.

If not so the price will be ranging between between support level at 0.9150 and resistance level at 0.9503.