US DOLLAR TECHNICAL ANALYSIS – Prices paused to digest losses

after sliding to the weakest level in three weeks. Near-term support is

at 11834-9 area (May 20 close, 50% Fibonacci retracement), with a break

below that on a daily closing basis exposing the 61.8% level at 11790.

S&P 500 TECHNICAL ANALYSIS – Prices pulled back to test

rising trend line support set from late-March lows once again, a barrier

reinforced by the 61.8% Fibonacci retracement at 2077.20. A break below

that targets the 76.4% level at 2063.00.

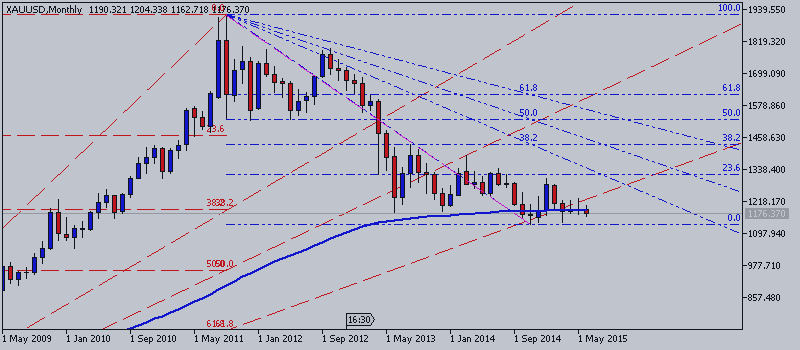

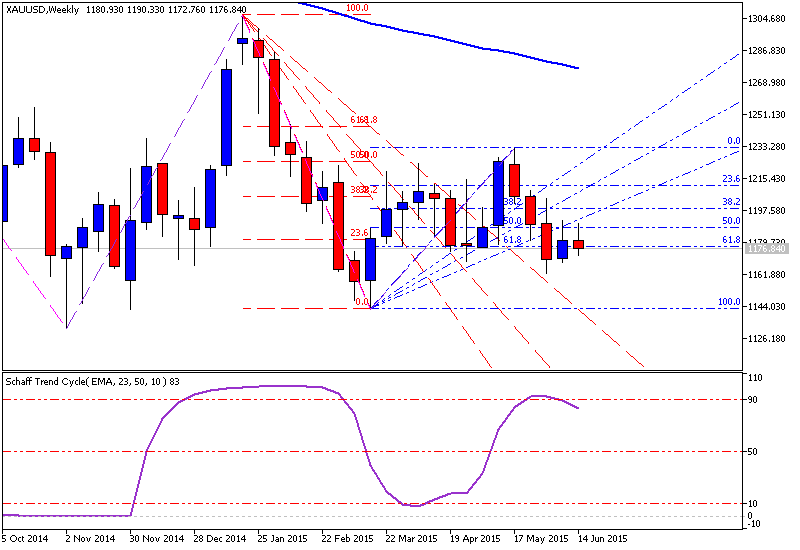

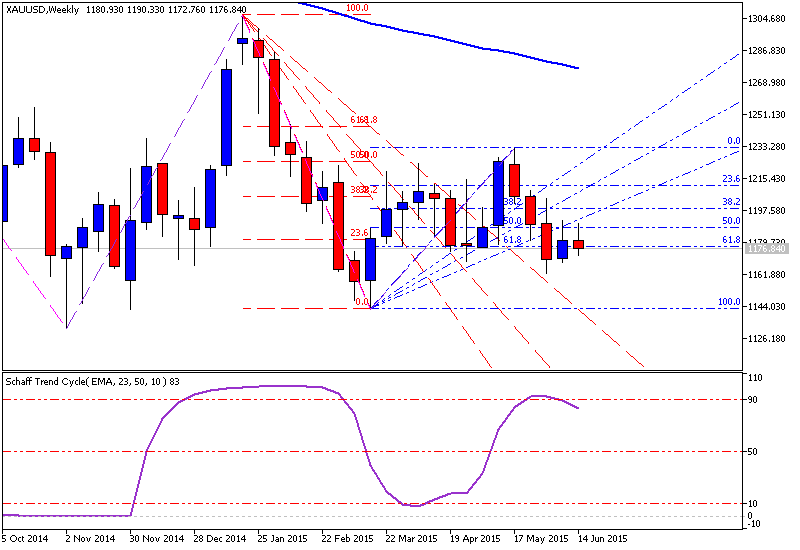

GOLD TECHNICAL ANALYSIS – Prices continue to tread water below

the $1200/oz figure. A break above the June 10 high at 1192.23 exposes

the 50% Fibonacci retracement at 1197.47.

CRUDE OIL TECHNICAL ANALYSIS – Prices may be resuming the

recovery launched from mid-January lows after completing a Flag

continuation pattern. Near-term resistance is at 66.69, the 23.6%

Fibonacci expansion, with a break above that exposing the 38.2% level at

70.25. Alternatively, a move below the 63.08-39 area (Flag top

resistance-turned-support at, rising trend line) targets the 38.2% Fib

retracement at 60.27.