Technical Analysis for US Dollar, S&P 500, Gold and Crude Oil - Stalls at 69.57 Monthly Resistance for Oil

US DOLLAR TECHNICAL ANALYSIS

Prices resumed its advance, touching the highest level in six weeks.

Near-term resistance is at 12037, the 76.4% Fibonacci retracement, with a

break above that on a daily closing basis exposing the March 13 high at

12149.

S&P 500 TECHNICAL ANALYSIS

Prices are in consolidation mode having set a record high last week. A

break below the 2100.00-6.50 area (trend line, 38.2% Fibonacci

retracement) exposes the 50% level at 2099.60.

GOLD TECHNICAL ANALYSIS

Prices are digesting losses after claiming a foothold below the $1200/oz

figure anew. A close below range support at 1178.09 exposes the 38.2%

Fibonacci expansion at 1169.31. Alternatively, a rebound above the 23.6%

level at 1193.38 targets trend line support-turned-resistance at

1203.60.

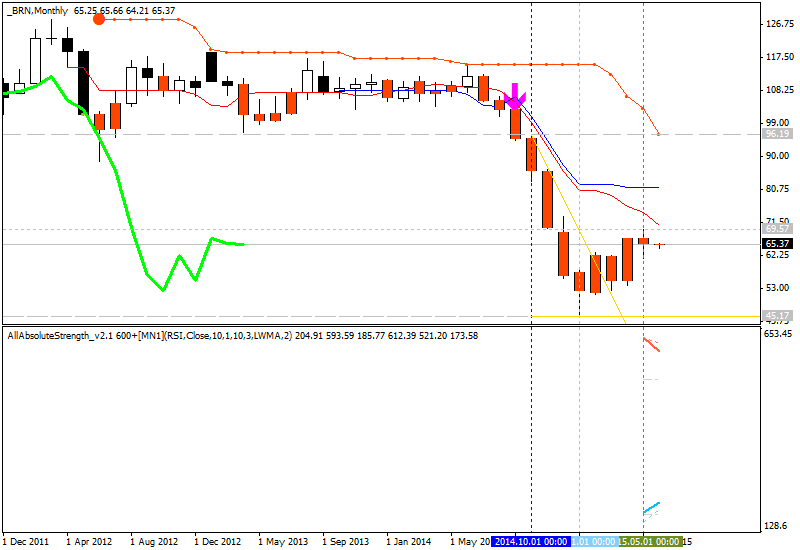

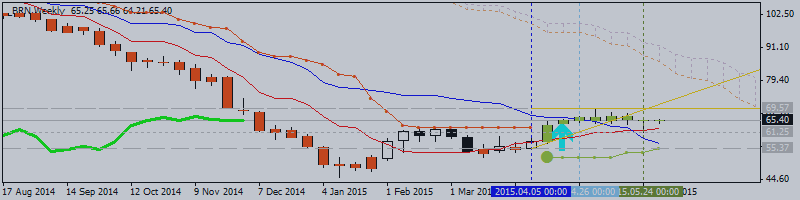

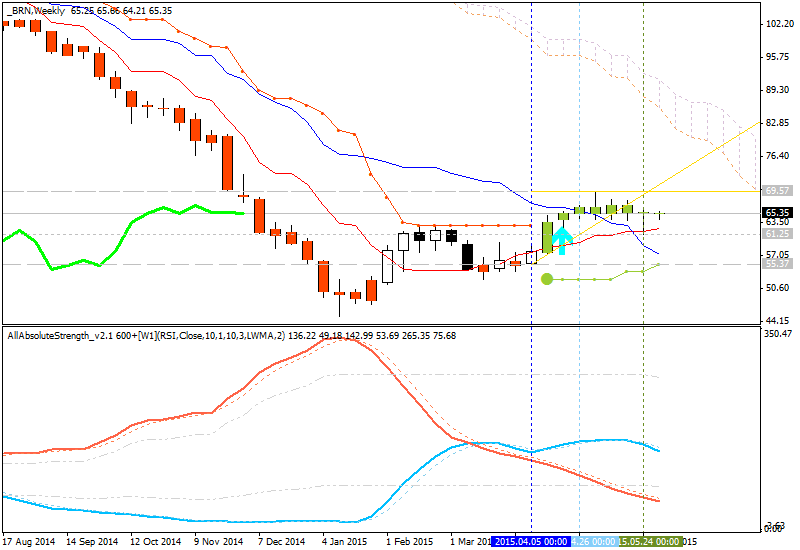

CRUDE OIL TECHNICAL ANALYSIS

Prices rebounded from support guiding the up move from lows set in mid-January. A push above downward-sloping resistance at 65.92 exposes the May 6 high at 69.60, followed by the 38.2% Fibonacci expansion at 70.57. Alternatively, a move below trend line support at 61.66 targets the 38.2% Fib retracement at 60.27.