Technical Pattern Analysis for US Dollar, S&P 500, Gold and Crude Oil - Near-term resistance for Gold is at 1232.30, the May 18 high.

US DOLLAR TECHNICAL ANALYSIS

Prices may be preparing to turn

lower anew following the formation of a Bearish Engulfing candlestick

pattern. A daily close below the 14.6% Fibonacci expansion at 11773

exposes the 23.6% level at 11725.

S&P 500 TECHNICAL ANALYSIS

Prices are consolidating after

breaking range resistance and setting a new record high. From here, a

daily close above the 50% Fibonacci expansion at 2140.70 exposes the

61.8% level at 2159.30.

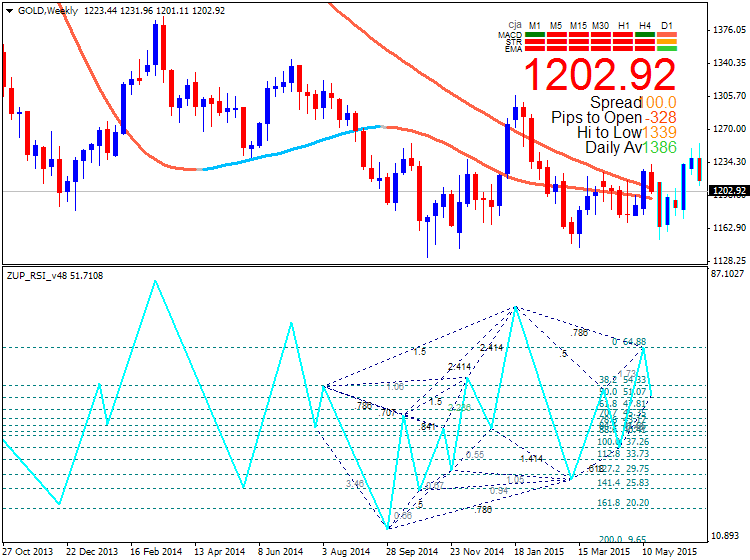

GOLD TECHNICAL ANALYSIS

Prices are consolidating after issuing

the largest daily decline in three weeks. A close below trend line

resistance-turned-support at 1205.90 exposes the 23.6% Fibonacci

expansion at 1193.38. Near-term resistance is at 1232.30, the May 18

high.

CRUDE OIL TECHNICAL ANALYSIS

Prices remain locked in a choppy

consolidation range below the $70/barrel figure. A daily close below the

23.6% Fibonacci retracement exposes the 38.2% level at 60.27.

Alternatively, a move above trend line resistance at 67.69 targets the

23.6% Fib expansion at 69.70.