At the beginning of the week, silver, copper, platinum and palladium all dropped after on Sunday the People's Bank of China cut its interest rates for the third time since November. Efforts by China’s regulator failed to ease traders’ concerns over the country’s slow economic pace. Despite this, the macroeconomic research group predicts higher prices for certain metals by year-end, including a potential 40% surge in silver prices.

On Sunday China's central bank reduced both the benchmark lending and deposit rate by 25 basis points to 5.1 percent and 2.25 percent, respectively.

Although a number of analysts, including MarketWatch's Craig Stephen, consider China's economy keeps failing to find a bottom despite loosening monetary policy, Capital Economics remains upbeat on the economic outlook for China and the United States - the two biggest consumers of most commodities.

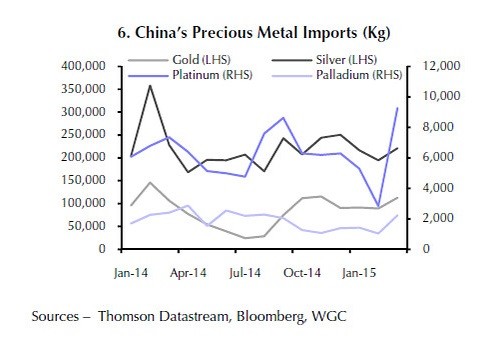

Moreover, it pointed out in a chart that China’s imports of gold, silver, platinum and palladium are growing.

So far, silver futures prices have already gained more than 4% and Capital Economics forecasts a year-end 2015 price of $23 an ounce for silver.

That would be a roughly 40% surge from the current prices on Comex. On Monday july silver SIN5 settled at $16.314 an ounce, down 15.1 cents, or 0.9%.

Separately, platinum and palladium were also pressured Monday after news that China’s passenger-car market

in April saw its weakest gain in more than a year. The country, known

as the world’s largest car buyer, sold 1.67 million passenger vehicles

last month, up 3.7% from a year earlier. Platinum and palladium

are used in vehicle emissions control devices known as catalytic

converters.

On Monday, July platinum PLN5 declined $16.20, or 1.4%, to $1,127.30 an ounce and June palladium PAM5 shed $21.90, or 2.7%, to $780.45 an ounce.

“China’s imports of platinum had been slowing since Sept. 2014, but March data show a partial recovery,” said Simona Gambarini, commodities economist at Capital Economics.

For platinum, Capital Economics forecasts a 2015 year-end price of $1,400 an ounce and $900 an ounce for palladium — about 23% higher than the current platinum price and roughly 12% higher than palladium’s current price.

China’s efforts to boost its economy hasn’t gone unnoticed either.

Separately, Caroline Bain, senior commodities economist at Capital Economics, said that signs point to Chinese authorities being committed to using “the powerful tools at their disposal to prevent a ‘hard landing’.”

That will “result in stronger demand for industrial raw materials, including copper, later in the year.” Capital Economics sees a year-end copper price of $7,200 per metric ton. There are 2,204.6 pounds in one metric ton so that is roughly equivalent to about $3.266 a pound, around 13% above current prices.

On Monday July copper HGN5 settled at $2.903 a pound, down 1.75 cents, or 0.6%, on Comex.