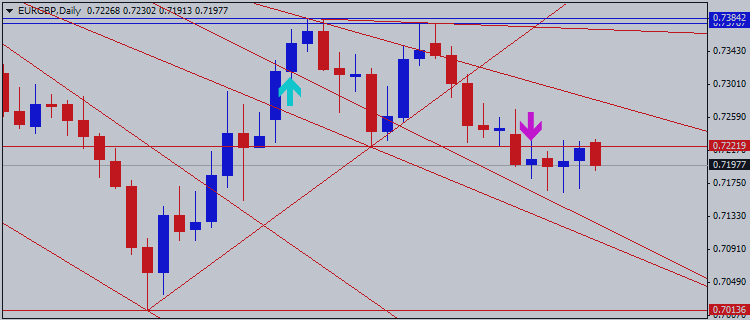

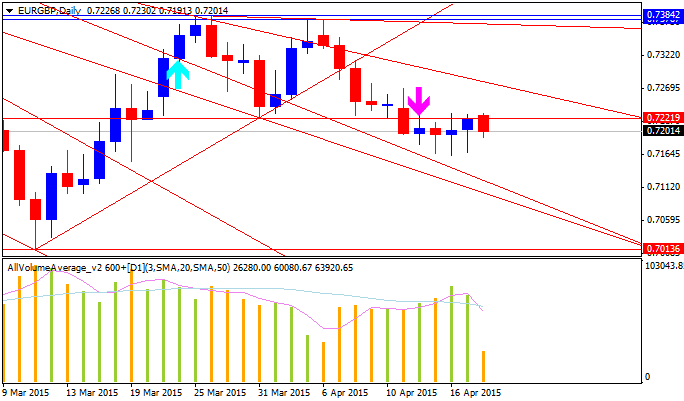

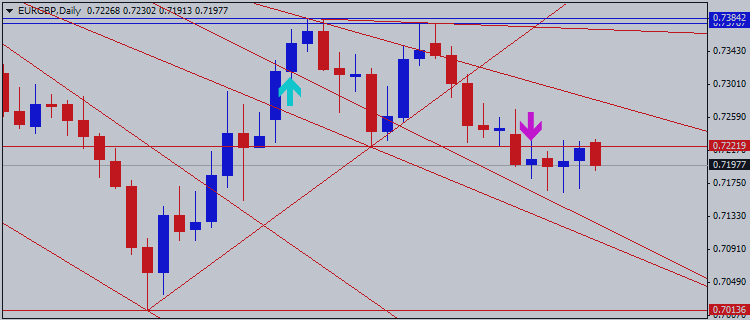

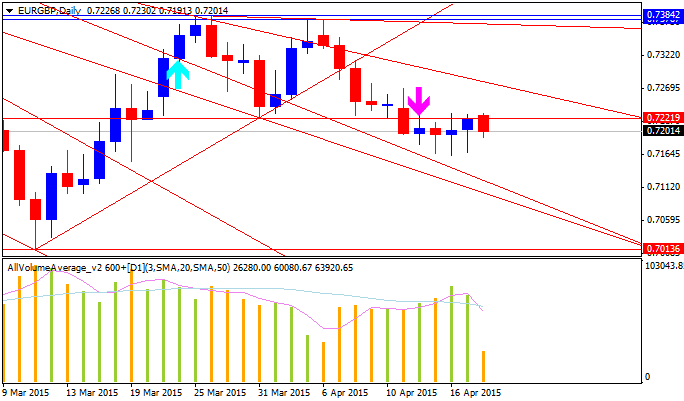

Technical Analysis EURGBP: the price is breaking 0.7221 for short with 0.7170 first take profit level

| Resistance | Support |

|---|---|

| 0.7239 | 0.7149 |

| 0.7392 | 0.7005 |

| 0.7509 | 0.6887 |

| Resistance | Support |

|---|---|

| 0.7239 | 0.7149 |

| 0.7392 | 0.7005 |

| 0.7509 | 0.6887 |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.21 17:10

ECB Mulls Tightening Noose Around Greek Banks (based on rttnews article)

The European Central Bank is exploring measures to reduce the Emergency Liquidity Assistance to Greek banks, reports said Tuesday, citing people with knowledge of the discussions. ECB Staff have suggested an increase in the haircuts banks take on the collateral they offer for emergency funding from the Bank of Greece, both Bloomberg and CNBC said.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.22 06:25

As DXY Consolidates, GBP/USD, EUR/USD Start To Rally - BofA Merrill (based on efxnews article)

While Bank of America Merrill Lynch didn't expect the USD Index DXY to remain within its recent corrective range trade (currently consolidating between 99.92 & 96.58), BofA now thinks that this longer than anticipated consolidation has done no damage to the larger bull trend.

"Absent a sustained break off 96.58/95.94 we look for a bullish resolution towards 103.85 (Triangle objective) ahead of 106.00 (long term upside target)," BofA argues.

It is a slightly different story for GBP/USD, according to BofA, as the setup here is for a more directional correction higher.

"In the sessions ahead we look for a push to 7m channel resistance at 1.5232 ahead of swing targets at 1.5350 and potentially beyond before the long term downtrend resumes for a push towards 1.35/1.40 (secular range lows), BofA projects.

Turning to EUR/USD, BofA advises bulls to watch the 55d average around 1.0992.

"While we remain long term EUR/USD bears, targeting 1.0283/1.000, in the near term the pair is stuck in a choppy corrective range between 1.0462 (Mar-16 low) and the 55d avg (now 1.0992)," BofA notes.

"Bulls need a sustained break of the 55d to point to a greater correction than anticipated, exposing the 1.1261/1.1534 February congestion zone," BofA advises

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.23 05:57

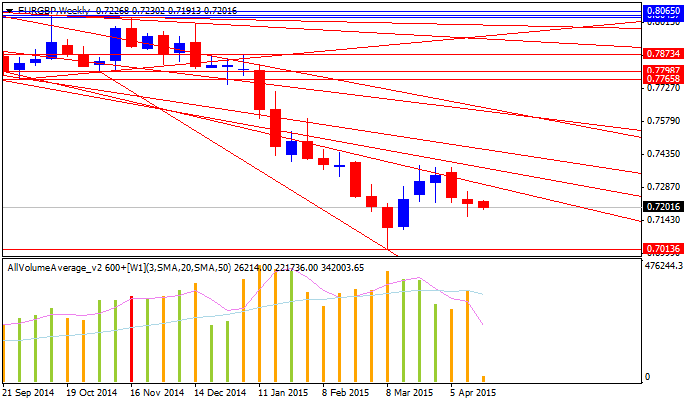

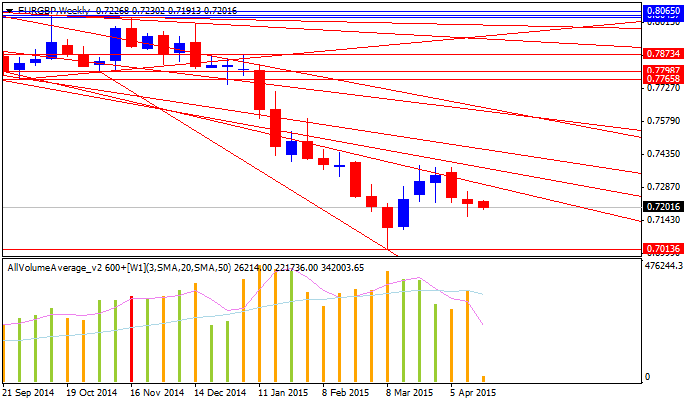

EUR/GBP: Breaks Down; EUR/USD: Excellent Selling Pattern - BofA Merrill (based on efxnews article)

EUR/GBP is resuming its larger downtrend, following the break of 0.7174/0.7166, notes Bank of America Merrill Lynch.

"We look for a test and break of the Mar-11 low at 0.7014, ahead of the 0.6900/0.6800 region. Bounces should not exceed the Apr-19 high at 0.7245," BofA projects.

Turning to EUR/USD, BofA notes that while the 1.0500-1.1000 range is still intact, its correction is turning increasingly in a 'Triangular' pattern.

A Triangular Correction, according to BofA, is a range defined by two contracting trendlines.

"This is one of our favorite patterns and should provide an excellent opportunity to go short for a move toward 1.0000 once the pattern completes," BofA argues.

"For

now, stay patient. Gains should not exceed the 55d at 1.0967, while a

break of 1.1053 points to a larger correction than anticipated," BofA advises.