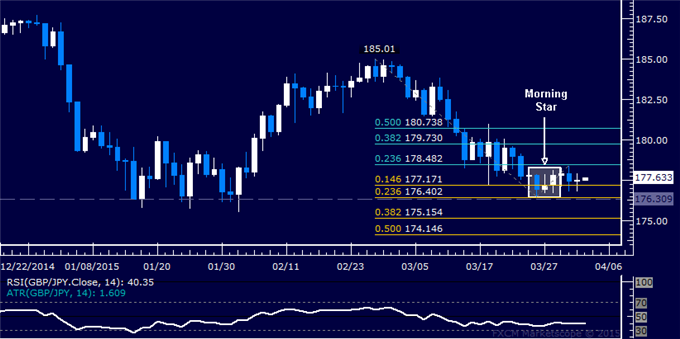

GBPJPY Technical Analysis: British Pound may have set a bottom against the Japanese Yen after producing a bullish Morning Star candlestick pattern

4 April 2015, 21:11

0

718

The British Pound may have set a bottom against the Japanese Yen after producing a bullish Morning Star candlestick pattern. Near-term resistance is at 178.48, the 23.6% Fibonacci retracement, with a break above that on a daily closing basis exposing the 38.2% level at 179.73. Alternatively, a reversal below the 14.6% Fib expansion at 177.17 clears the way for a challenge of the 176.31-40 area (23.6% threshold, triple bottom).

- GBP/JPY Technical Strategy: Flat

- Support: 177.17, 176.31, 175.15

- Resistance: 178.48, 179.73, 180.74

Prices are wedged too closely between near-term support and resistance levels to justify taking a trade on a long or short side from a risk/reward perspective. With that in mind, we will continue to stand aside until a more attractive opportunity presents itself.