NFP Expectations for April - The next NFP event is set for this Friday April, 3rd at 8:30 am New York time

- NFP is historically a volatile event

- Last month’s miss caused the EURUSD to decline over 118 pips

- Expectations for this Friday sit at 248k

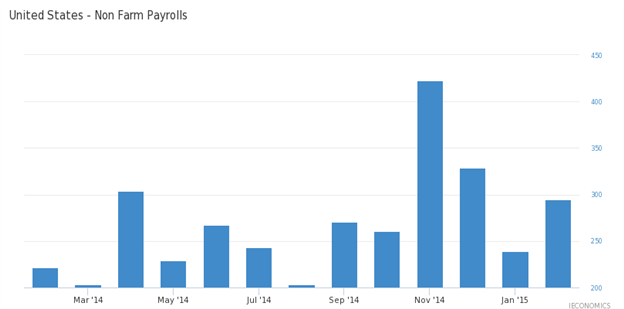

Below we can see a series of the 12 previous NFP totals graphically displayed. While these numbers have been mixed, it is important to see what effects they can have on the Forex market. So how can NFP affect the market, and what are the expectations for Friday’s event?

The previous NFP event transpired last month on March 6th. To review,

expectations were set at 235k, but on release the figures surprised the

market. As seen in the graph above, the total amount of new jobs outside

of the agricultural sector came in at 293k. This beat of expectations

quickly drove traders to accumulate the US Dollar against the majority

of major currencies.

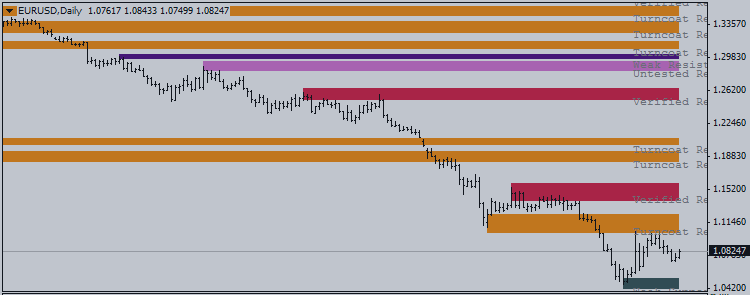

Below we can see the price action for the EURUSD during the March NFP

event using a 30 minute chart. Immediately after the announcement,

prices formed a new lower high for the week at 1.0988. This rise in

price only lasted seconds, as traders began to accumulate US Dollars on

the news. This caused prices to drop as much as 118 pips over the next

30 minutes. Not only did the EURUSD decline for the day, this event

caused the EURUSD to continue its trend and form a new monthly low in

the following trading week.

So what can we expect for Fridays trading?

The next NFP event is set for this Friday April, 3rd at 8:30 am New York time. After reviewing last month’s release, it makes sense for traders to be on their guard for unexpected volatility at this time. Currently expectations are set for 248k. Traders should primarily focus on whether or not NFP beats or misses expectations. By using last month as a model, a beat above expectations could cause another major US Dollar rally. Conversely, if prices miss expectations, it could signal a sell off for the US Dollar against other Major G8 currencies.