Trading News Events: Canada CPI - Core Inflation to Uptick to Annualized 2.3%- Highest for 2014

What’s Expected:

Why Is This Event Important:

After unexpectedly cutting the benchmark interest rate at the

January 21 meeting, a marked slowdown in Canada price growth may put

increased pressure on the BoC to further reduce borrowing costs, and the

Canadian dollar remains at risk of facing more headwinds over the near

to medium-term as Governor Stephen Poloz keeps the door open to

implement additional monetary support.

Nevertheless, the pickup in economic activity may generate a

stronger-than-expected CPI print, and an uptick in the core rate of

inflation may spur a near-term correction in USD/CAD as the stickiness

limits the BoC’s scope to further reduce the benchmark interest rate.

How To Trade This Event Risk

Bearish CAD Trade: Weak CPI Print Drags on Interest Rate Expectations

- Need green, five-minute candle following a dismal CPI report to consider long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need red, five-minute candle following the release to look at a short USD/CAD trade

- Carry out the same setup as the bearish loonie trade, just in the opposite direction

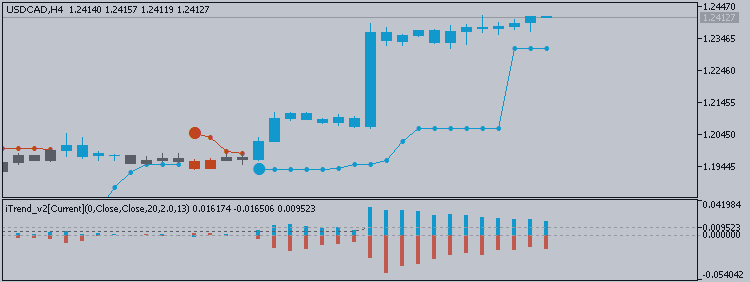

USD/CAD Daily

- Bullish RSI structure continues to favor the approach to buy-dips in USD/CAD especially as the oscillator pushes deeper into overbought territory.

- Interim Resistance: 1.2390 (161.8% expansion) to 1.2430 (1.618% expansion)

- Interim Support: 1.1990 (78.6% expansion) to 1.2000 pivot

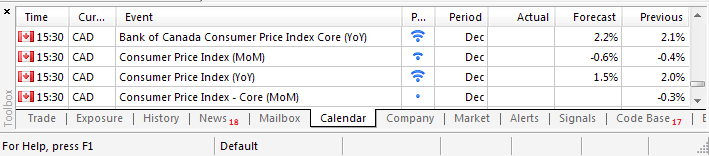

| Period | Data Released | Survey | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| NOV 2014 |

12/19/2014 13:30 GMT | 2.2% | 2.0% | -2 | +1 |

USDCAD M5: 28 pips price movement by CAD - CPI news event

Canada’s Consumer Price Index (CPI) slowed to an annualized rate of 2.0%

in November from 2.4% the month prior, while the core rate of inflation

slipped to 2.1% from 2.3% during the same period. Indeed, falling

energy prices attributed to a 1.7% decline in transportation costs, but

we may see Canadian firms continue to offer discounted prices in an

effort to draw greater demand. As a result, the Bank of Canada (BoC) may

further delay normalizing monetary policy, and Governor Stephen Poloz

may continue to endorse the accommodative policy stance over the near to

medium-term in order to encourage a stronger recovery. The market

reaction was short-lived as USD/CAD quickly slipped back below the

1.1625 region, and the pair continued to consolidate throughout the

North American trade as it ended the day at 1.1602.