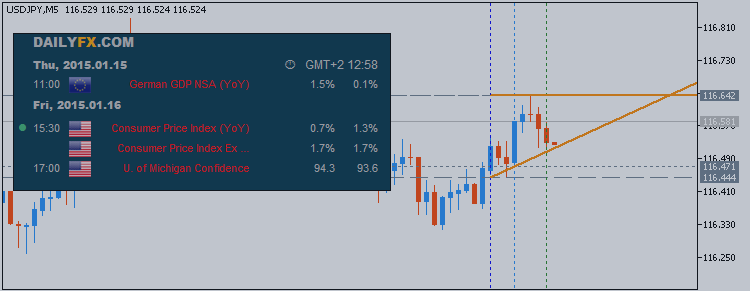

Trading the News: U.S. Consumer Price Index (CPI) to Mark Slowest Pace of Growth Since 2009

What’s Expected:

Despite expectations for a rate hike in mid-2015, the Fed may sound

increasingly cautious and preserve its highly accommodative policy

stance beyond schedule as the central bank struggles to achieve its

mandate for price stability.

Nevertheless, improved business confidence paired with the pickup in

economic activity may limit the downside risk for price growth, and the

stickiness in core inflation may heighten the appeal of the greenback as

a growing number of central bank officials show a greater willingness

to normalize monetary in 2015.

How To Trade This Event Risk

Bearish USD Trade: U.S. CPI Slips to Annualized 0.7% or Lower

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

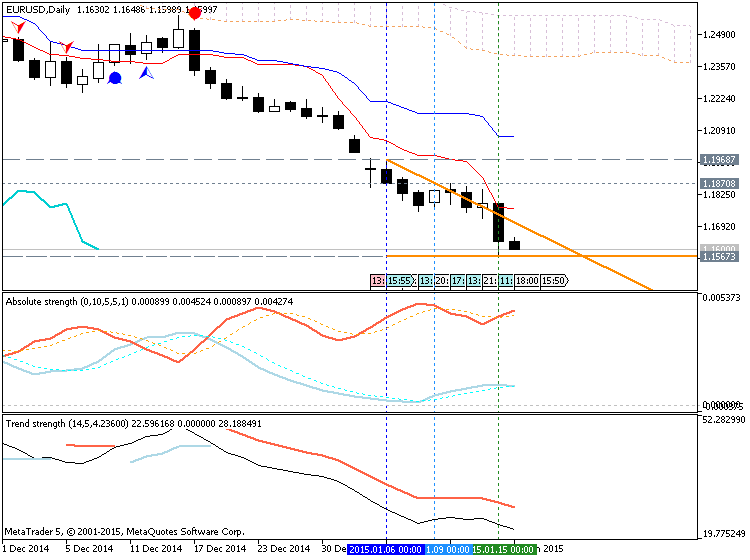

EUR/USD Daily Chart

- EUR/USD remains at risk for a further decline as long as the RSI pushes deeper into oversold territory.

- Interim Resistance: 1.1840-50 (50% expansion)

- Interim Support: 1.1500 pivot to 1.1565 (weekly low)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| NOV 2014 |

12/17/2014 13:30 GMT | 1.4% | 1.3% | -116 |

November 2014 U.S. Consumer Price Index

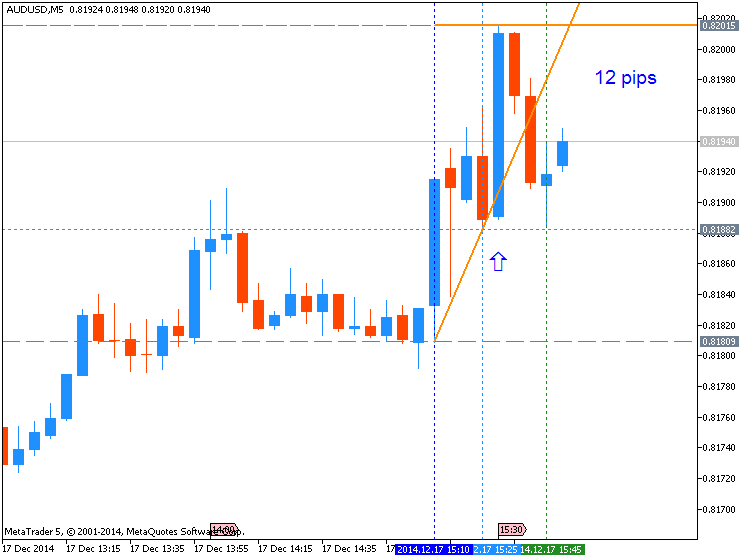

AUDUSD M5: 12 pips price movement by USD - CPI news event:

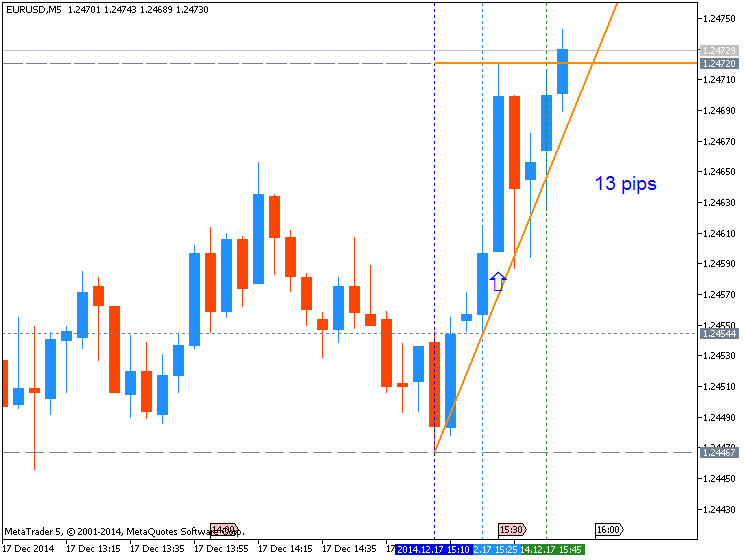

EURUSD M5: 13 pips price movement by USD - CPI news event:

The U.S. Consumer Price Index (CPI) slowed to an annualized rate of 1.3%

from 1.7% in October on the back of falling energy prices, with the

core rate of inflation narrowing to 1.7% from 1.8% during the same

period. Indeed, subdued price pressures raise the risk of seeing the Fed

further delay its first rate hike, but it seems as though the central

bank will normalize monetary policy in 2015 as the committee anticipate

the drop in oil prices to have an positive impact on the real economy.

Despite the initial tick higher in EUR/USD, the dollar remained

resilient against its European counterpart as the pair slipped below the

1.2400 handle during the North American trade to end the day at 1.2343.