We can't predict the future - if it were possible fortune tellers would all win the lottery. They don't, we can't and we aren't going to try to. However, we can analyze what has happened in the past, weed through the noise of the present and try to discern the possible outcomes of the future.

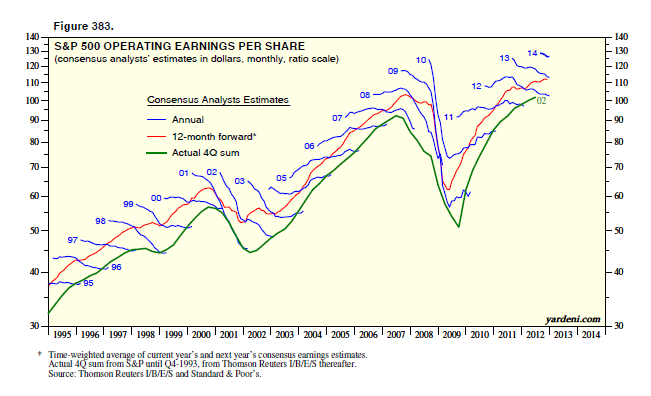

The biggest single problem with Wall

Street, both today and in the past, is that they consistently disregard

the possibility for unexpected, random events. In a 2010 study, by the

McKinsey Group, they found that analysts have been persistently overly

optimistic for 25 years. During that 25 year time frame Wall Street

analysts pegged earnings growth at 10-12% a year when in reality

earnings grew at 6% which, as we have discussed in the past, is the

growth rate of the economy. Ed Yardeni published the two following

charts which show that analysts are always overly optimistic in their

estimates.

The McKenzie study noted that on average "analysts' forecasts have been almost 100% too high" and this leads investors to making much more aggressive bets on the financial markets. Wall Street is a group of highly conflicted marketing and PR firms. Companies hire Wall Street to "market" for them so that their stock prices will rise and with executive pay tied to stock-based compensation you can understand their desire. Currently, there is not ONE estimate for a negative return in 2015. (See Bob Farrell's Rule #9 at the end of this missive)

"Comparison is the cause of more unhappiness in the world than anything else. Perhaps it is inevitable that human beings as social animals have an urge to compare themselves with one another. Maybe it is just because we are all terminally insecure in some cosmic sense. Social comparison comes in many different guises. 'Keeping up with the Joneses,' is one well-known way.

If your boss gave you a Mercedes as a yearly bonus, you would be thrilled-right up until you found out everyone else in the office got two cars. Then you are ticked. But really, are you deprived for getting a Mercedes? Isn't that enough?

Comparison-created unhappiness and insecurity are pervasive, judging from the amount of spam touting various enlargement procedures for males and females. The basic principle seems to be that whatever we have is enough, until we see someone else who has more. Whatever the reason, comparison in financial markets can lead to remarkably bad decisions.

Comparison in the financial arena is the main reason clients have trouble patiently sitting on their hands, letting whatever process they are comfortable with, work for them. They get waylaid by some comparison along the way and lose their focus. If you tell a client that they made 12% on their account, they are very pleased. If you subsequently inform them that "everyone else" made 14%, you have made them upset. The whole financial services industry, as it is constructed now, is predicated on making people upset so they will move their money around in a frenzy. Money in motion creates fees and commissions. The creation of more and more benchmarks and style boxes is nothing more than the creation of more things to COMPARE to, allowing clients to stay in a perpetual state of outrage."