Trading News Events: UoM Consumer Confidence - The Survey to Increase for Fifth Consecutive Month

Another uptick in the U. of Michigan Confidence survey may spur a

further decline in the EUR/USD amid growing speculation for a Fed rate

hike in mid-2015.

What’s Expected:

Why Is This Event Important:

Positive data prints coming out of the U.S economy should continue to

fuel interest rate expectations and heighten the bullish sentiment

surrounding the greenback as a growing number of Fed officials scale

back their dovish tone for monetary policy.

However, we the survey may disappoint as U.S. households face sticky

price pressures paired with the ongoing slack in the real economy, and a

dismal print may spur a larger correction in the greenback as it drags

on expectations for higher borrowing-costs.

How To Trade This Event Risk

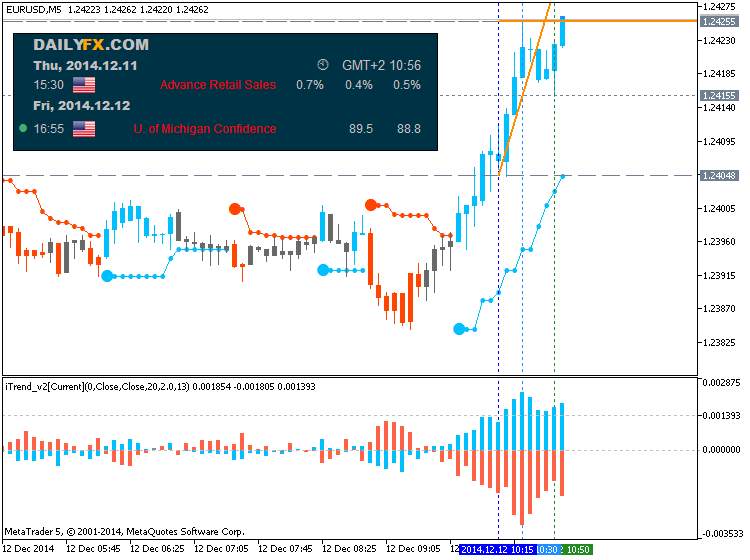

Bullish USD Trade: U. of Michigan Survey Climbs to 89.5 or Higher

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

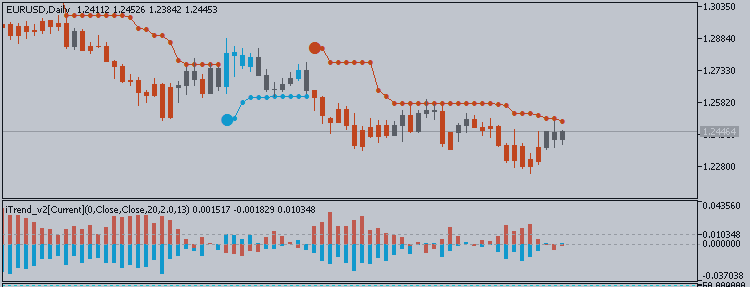

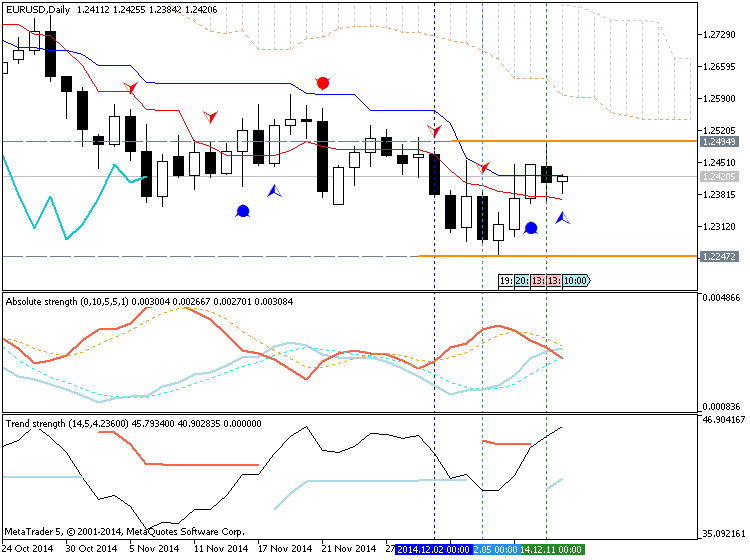

EUR/USD Daily Chart

- Failed attempts to close above 1.2450-70 may highlight near-term topping process for EUR/USD especially as the RSI largely retains a bearish momentum.

- Interim Resistance: 1.2600 pivot to 1.2610 (61.8% expansion)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| NOV P 2014 |

11/14/2014 14:55 GMT | 87.5 | 89.4 | +52 | +100 |