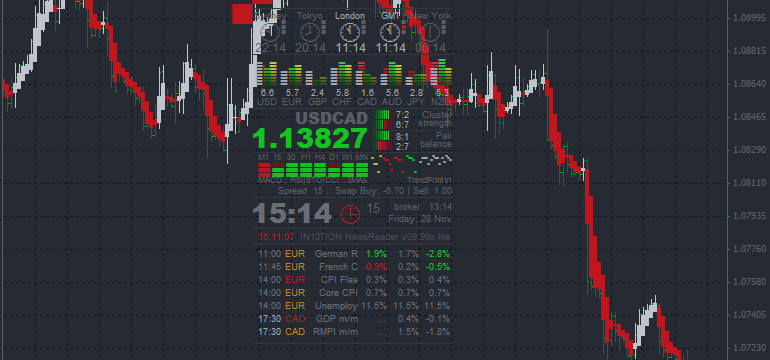

Canada’s 3Q Gross Domestic Product (GDP) report may generate a near-term

bounce in USD/CAD as the growth rate is expected to increase an

annualized 2.1% following the 3.1% expansion during the three-months

through June.

What’s Expected:

Why Is This Event Important:

A marked slowdown in economic activity may undermine the appeal of the

Canadian dollar as the Bank of Canada (BoC) remains reluctant to further

normalize monetary policy, and the USD/CAD may continue to track higher

in December as Governor Stephen Poloz continues to talk down interest

rate expectations.

How To Trade This Event Risk

Bearish CAD Trade: 3Q GDP Slows to 2.1% or Lower

- Need green, five-minute candle following a dismal GDP report to consider long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long USD/CAD with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need red, five-minute candle following the release to look at a short USD/CAD trade

- Carry out the same setup as the bearish loonie trade, just in the opposite direction

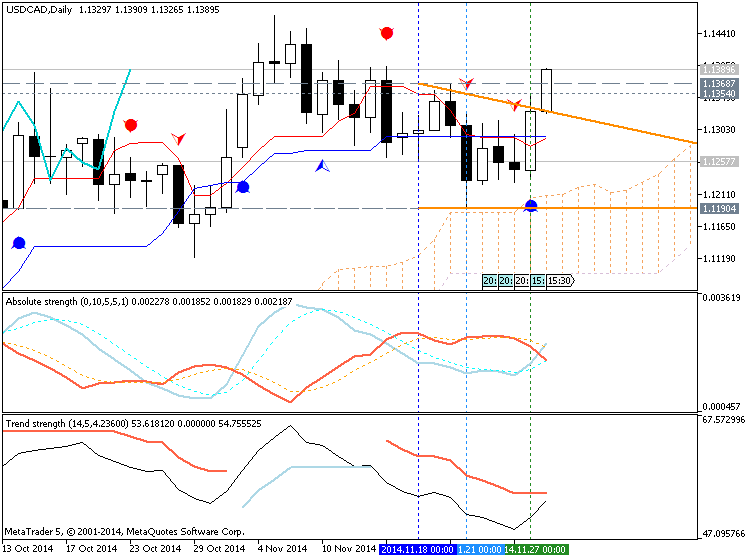

USD/CAD Daily Chart

- Need a break of the bearish trends in price & the RSI to revert back to the approach of looking for opportunities to buy-dips.

- Interim Resistance: 1.1370 (23.6% retracement) to 1.1380 (78.6% expansion)

- Interim Support: 1.1155 (78.6% retracement) to 1.1165 (23.6% expansion)

| Period | Data Released | Survey | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| 2Q 2014 |

08/29/2014 12:30 GMT | 2.7% | 3.1% | - 7 | + 30 |