Gold and silver have been some of the worst performing markets in the past few years. After experiencing a parabolic surge in 2011, precious metals, along with other commodities, have been in a steady downtrend as the Fed continues its march toward tighter monetary policy as the economy shows continued growth. The U.S. dollar’s sharp rally since the summer also contributed to gold and silver’s punishment, while lower oil prices have further weakened the case for inflation hedges.

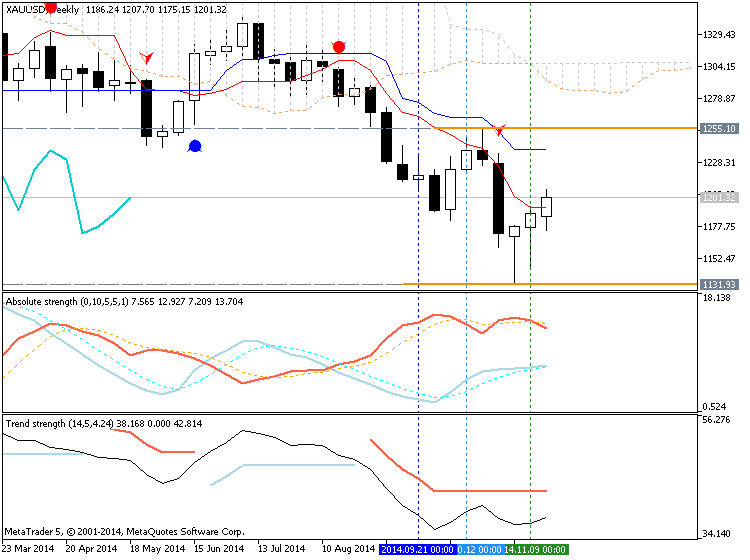

After experiencing a major technical breakdown one month ago when gold dropped below its long-held $1,200 support level, precious metals have been in a holding pattern as they wait for a catalyst to cause either a bearish follow-through move or a reversal of the breakdown signals. Gold is currently sitting right underneath its key $1,200 resistance level that it has attempted to break above several times in the past week to no avail.

If gold is unable to break back above $1,200, another wave of the

sell-off is likely to ensue.