- Gold Responds to Trendline

- Gold Climbs On Ukrainian Turmoil, Crude Oil Cautiously Recovers

Gold prices are slightly firmer this week with the precious metal

higher by 0.48% to trade at $1287 ahead of the New York close on

Friday. It’s been a lackluster month for gold traders and despite the

volatility ($49 or 3.75%) prices are just 0.35% higher for the month of

August. As we head into the open of September trade, the focus shifts

back onto the economic data front as bullion holds just above the

technically significant 200-day moving average.

As tensions in the Middle East and Ukraine continue to escalate, the

relative support they have offered gold has continued to wane as the

focus shifts back on to the outlook for monetary policy. With steady

improvement in US data, interest rate expectations have crept forward

keeping a bid under the greenback to the detriment of gold. As such,

heading into next week all eyes will be fixated on the economic docket

with ISM Manufacturing and Factory Orders on tap ahead of Friday’s

highly anticipated non-farm payrolls report.

The shortened holiday week kicks off with ISM data on Tuesday with the

consensus estimates calling for a print of 57.0 in August, down from

57.1 in July. Factory orders on Wednesday are seen much stronger with

calls for a 10.8% print for the month July, a stark contrast to the

1.1% read seen a month earlier. Highlighting the week’s event risk will

be the US employment report on Friday with August Non-Farm Payrolls

expected to come in at 225K, up from 209K in July as unemployment

downticks to 6.1% from 6.2%. As always, we’ll be closely eyeing the

changes in the labor force participation rate when trying to assess the

validity of the drop in the headline figure. Look for gold to come

under pressure the stronger the data is, with a miss on the print

likely to offer some relief to the battered metal.

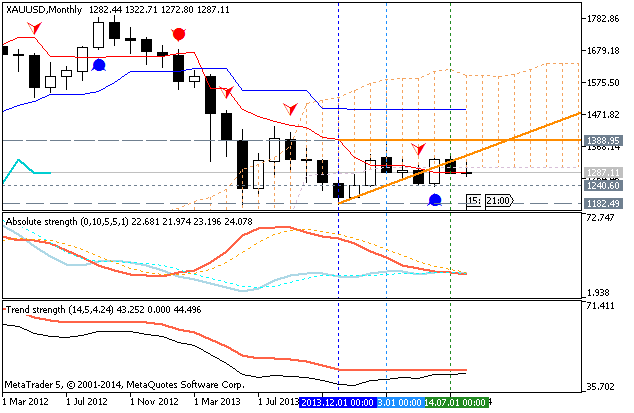

From a technical standpoint, gold remains vulnerable for further

losses as we open up September trade and while we will need to confirm

that bias with a break of the monthly opening range, our broader

outlook will remain tentatively bearish while below near-term

resistance at $1292. A break above this region targets more significant

resistance at the confluence of the 50-day moving average and channel

resistance dating back to the July high at $1306 and we will reserve

this level as our bearish invalidation threshold. Interestingly, gold

has alternated positive and negative monthly closes for the last seven

months and while we eked out a gain this month, suggests we should be

looking lower in September. Key support rests at the August lows and the

78.6% extension off the July high at $1271 with a break below this

level eyeing support objectives at $1258/60, $1251 and $1224. Look for

major event risk next week to offer a catalyst with central bank

interest rate decisions and the US employment report on Friday in focus.

The gold markets tried to rally most of the week, but as you can see the

$1300 level offered a bit too much in the way of resistance. With that,

we believe that the market continues to look soft the end sideways, so

we have no real interest in buying here. We don’t necessarily want to

sell either, because we can make a serious case for support at the $1250

handle. With that, we are essentially staying on the sidelines as far

as longer-term trades are concerned, as there is no real direction.