What is Leverage and Margin? (MT5 Step-by-Step + Tiny Example)

What is Leverage and Margin? (MT5 Step-by-Step + Tiny Example)

Summary

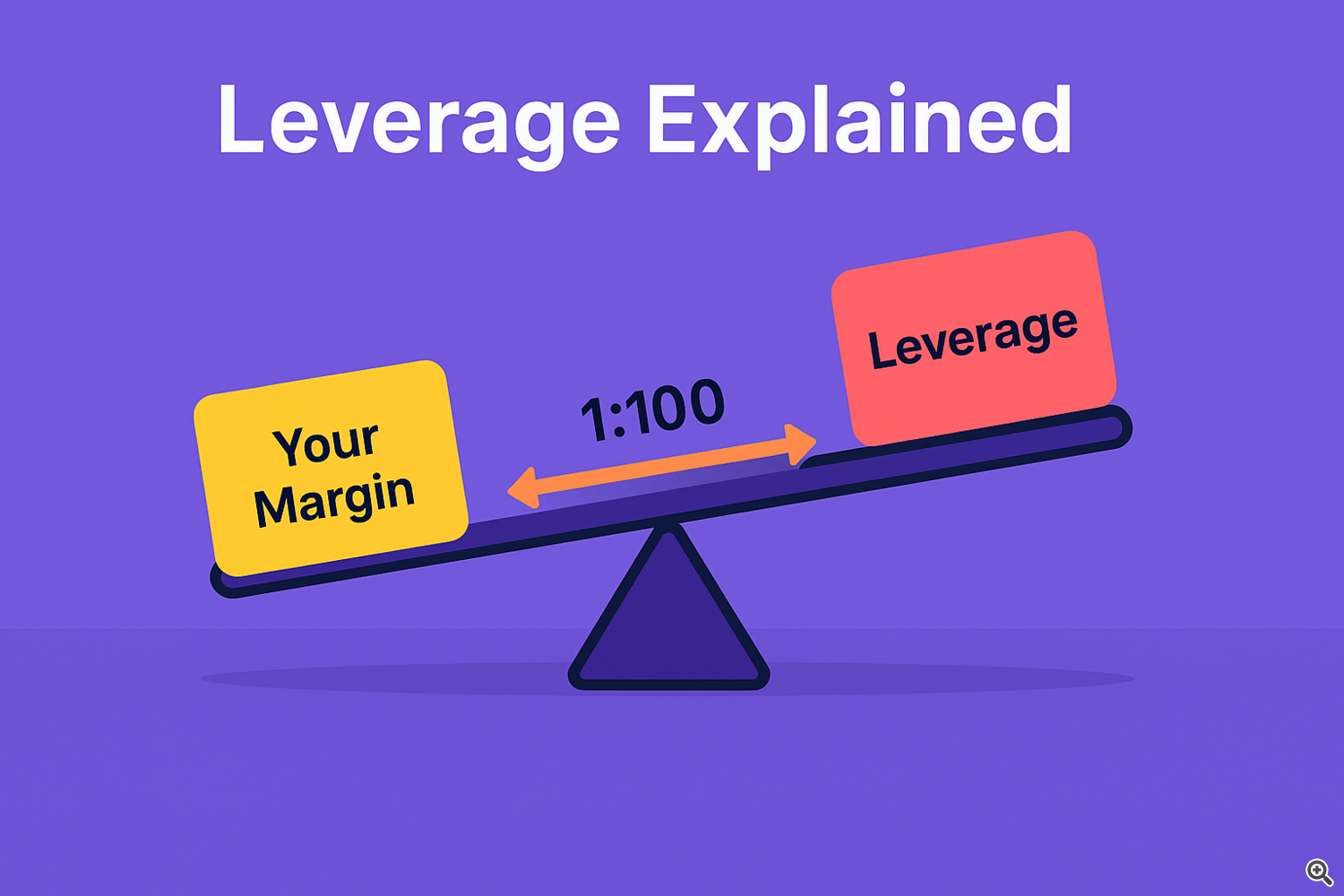

Leverage lets you control a large position with a small deposit.

Margin is that deposit — the money your broker sets aside to keep your trade open.

In MT5, knowing your leverage and margin helps you manage risk and avoid margin calls.

Key Takeaways

-

Leverage = Position Size ÷ Your Capital Used

-

Higher leverage = bigger trades, but also bigger risk.

-

Margin is the money locked by your broker when you open a trade.

-

If your losses get too big, a margin call can close your trades.

-

MT5 shows your margin and free margin live in the Terminal window.

A – The Idea in Simple Words

Leverage is like a loan from your broker that lets you trade more than you have.

If you have $100 and leverage 1:100, you can control $10,000 in the market.

Margin is the part of your money that is locked as a guarantee for that trade.

The rest of your balance is called free margin — money you can still use for new trades or to absorb losses.

Too much leverage can wipe out your account quickly if the market moves against you.

B – MT5 Steps to Check Leverage and Margin

-

Open MT5 and log in to your account.

-

Go to the Terminal window (Ctrl+T).

-

Click the Trade tab.

-

Look for:

-

Balance (total funds)

-

Equity (Balance ± open trade profits/losses)

-

Margin (money locked for open trades)

-

Free Margin (Equity – Margin)

-

Margin Level (% = Equity ÷ Margin × 100)

-

Your account leverage is set by your broker — you can check it in your account details.

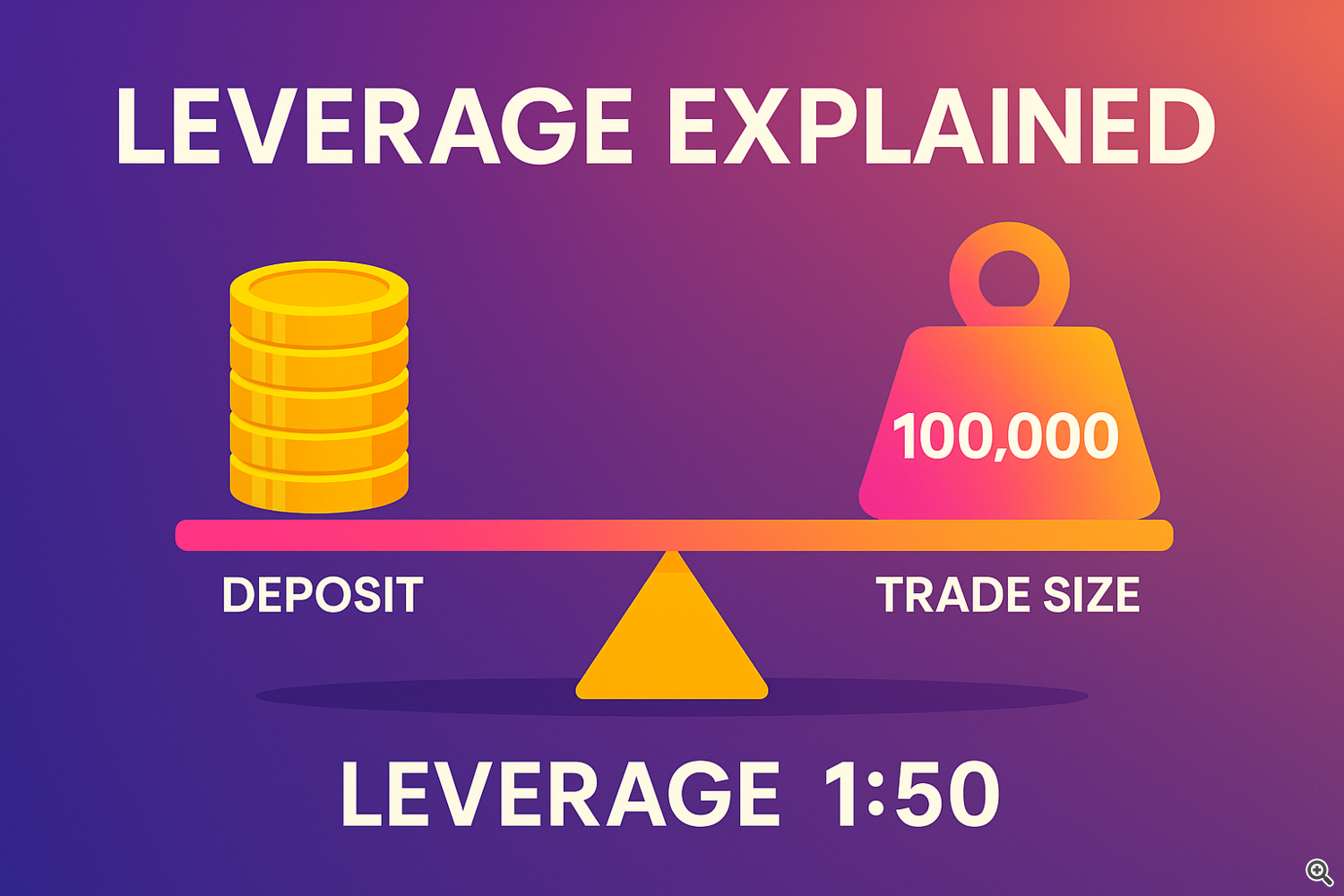

C – Quick Example with Numbers

You have:

-

Account balance = $1,000

-

Leverage = 1:100

-

You open 1 lot EURUSD (100,000 units)

Required Margin = 100,000 ÷ 100 = 1,000 EUR (~$1,000 USD)

| Term | Value |

| Balance | $1,000 |

| Position Size | $100,000 |

| Leverage | 1:100 |

| Margin | $1,000 |

Here, your entire balance is used as margin — no free margin left for more trades.

D – Common Mistakes & Fixes

-

Using too much leverage → Use smaller lot sizes to reduce risk.

-

Not checking free margin → Always keep some free margin to handle losses.

-

Confusing margin with fees → Margin is not a cost; it’s a locked deposit.

-

Ignoring margin level % → If it drops too low, you risk a margin call.

-

Trading multiple pairs without tracking margin → Can quickly over-leverage you.

E – If You Use My Tools (Optional)

Some of my MT5 indicators display margin level, free margin, and risk per trade directly on your chart.

Mini-Glossary

-

Leverage: A ratio showing how much larger your trades are compared to your capital.

-

Margin: Money set aside by your broker when you open a trade.

-

Free Margin: Equity minus margin — money still available for trading.

-

Margin Level: Equity ÷ Margin × 100.

-

Equity: Your balance plus or minus open trade results.

-

Balance: Total money in your account (no open trades).

-

Margin Call: Broker action when your margin level is too low.

Checklist

-

Know your account leverage.

-

Check margin before opening trades.

-

Keep free margin available.

-

Watch margin level % to avoid margin calls.

-

Use smaller positions if risk feels too high.