Trading News Events: U.S. Non-Farm Payrolls - NFP to Expand 200+K for Eighth Time in 2014

7 November 2014, 12:17

3

338

What’s Expected:

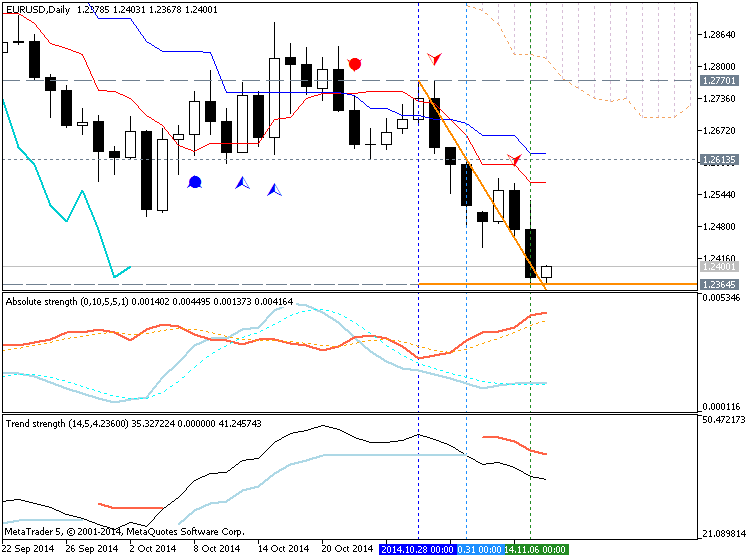

EUR/USD Daily Chart

September 2014 U.S. Non-Farm Payrolls

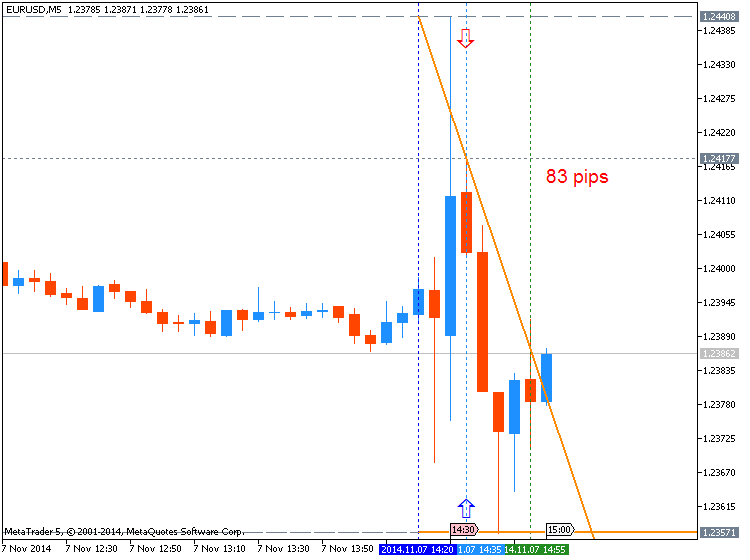

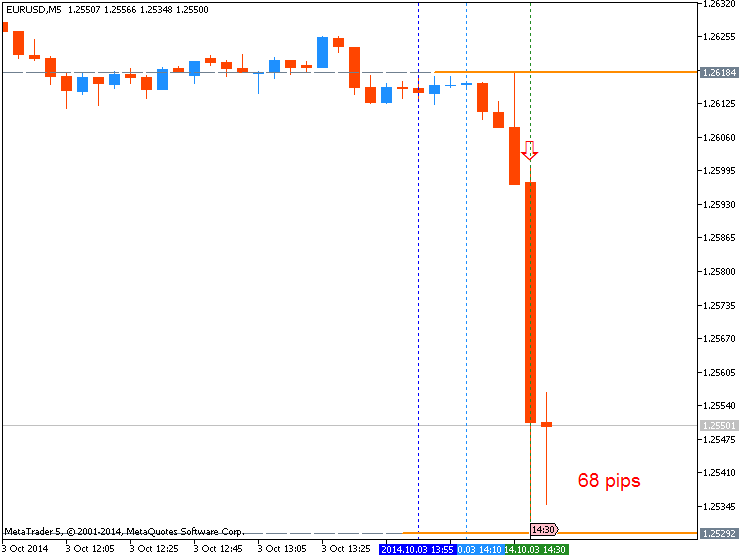

EURUSD M5 : 68 pips price movement by USD - Non-Farm Employment Change news event :

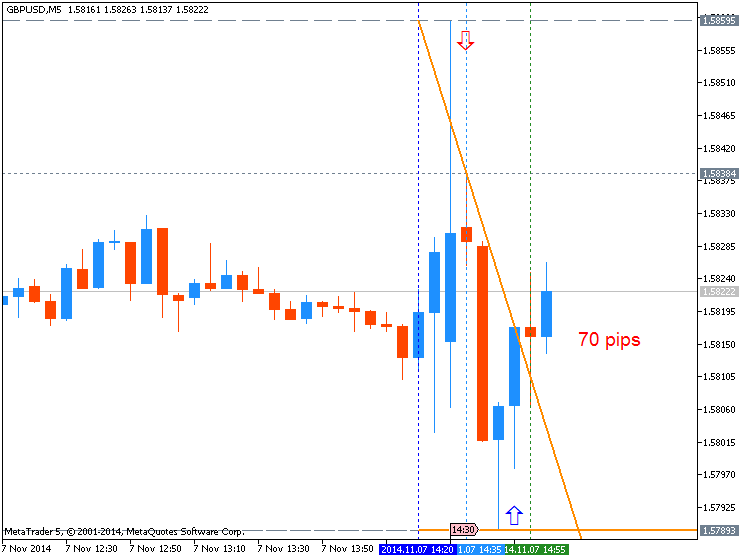

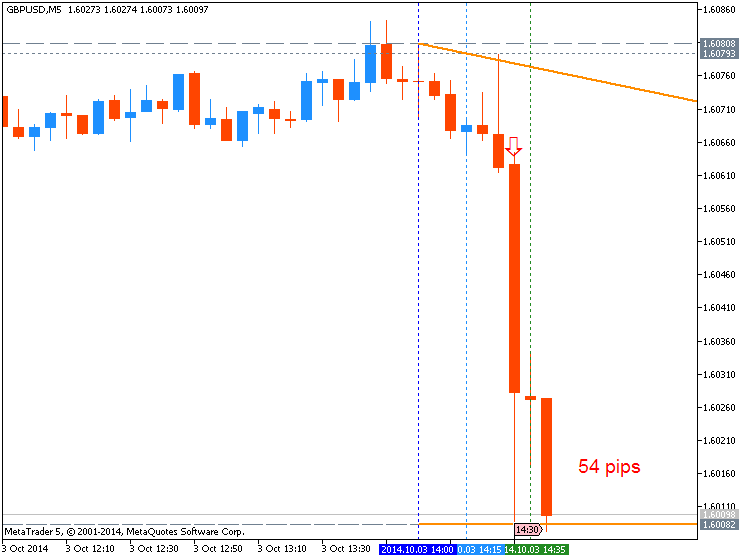

GBPUSD M5 : 54 pips price movement by USD - Non-Farm Employment Change news event :

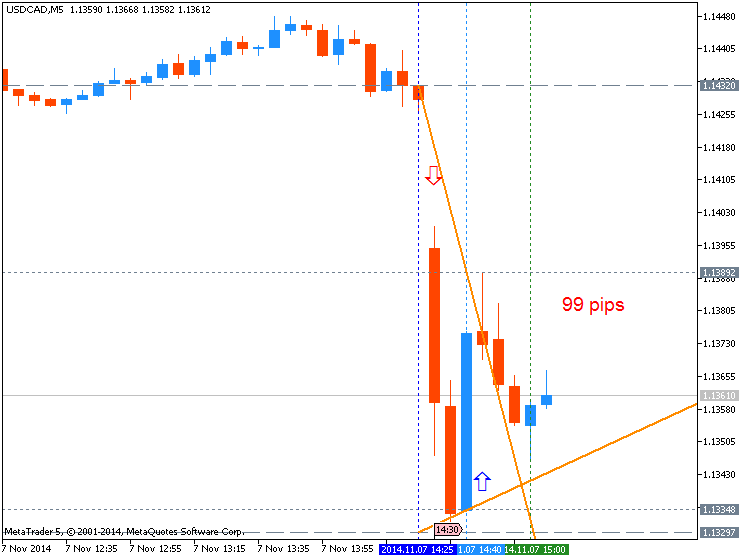

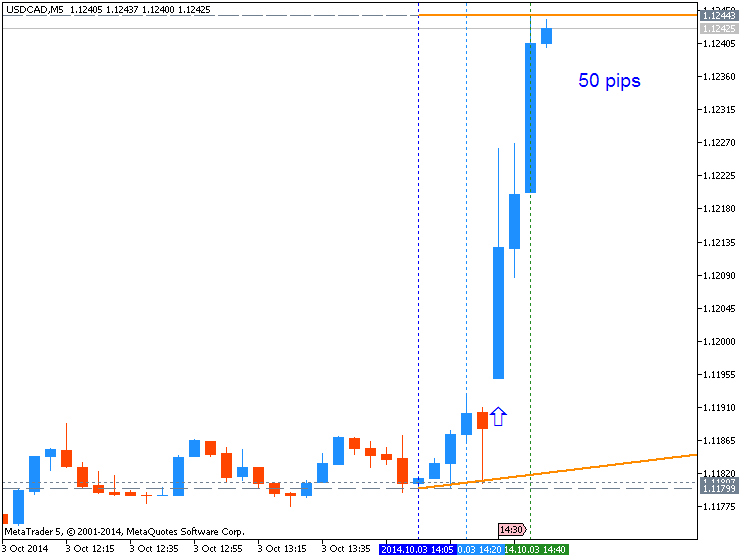

USDCAD M5 : 50 pips price movement by USD - Non-Farm Employment Change news event :

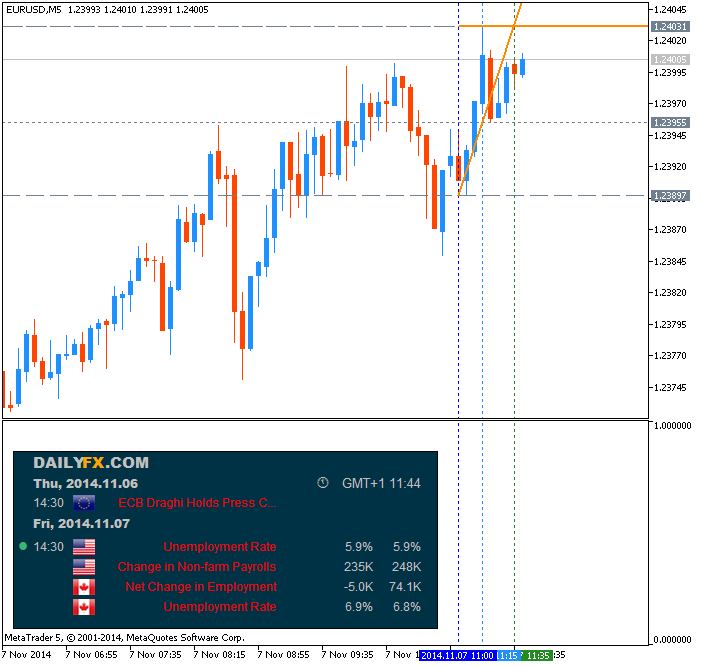

U.S. Non-Farm Payrolls (NFPs) increased 248K in September after expanding a revised 142K the month prior, while the jobless rate unexpectedly slipped to a six-year low of 5.9% from 6.1% in August. The uptick in hiring certainly highlights an improved outlook for the world’s largest economy, and the bullish sentiment surrounding the U.S. dollar may gather pace over the remainder of the year as the Fed is widely expected to halt its asset-purchase program at the October 29 meeting. Indeed, the better-than-expected prints spurred a bullish dollar reaction, with the EUR/USD slipping below the 1.2550 handle to hit a fresh yearly low of 1.2501.

Why Is This Event Important:

At the same time, Average Hourly Earnings are also expected to uptick to

an annualized 2.1% from 2.0% in September, and stronger employment

paired with growing wage pressures should heighten the bullish sentiment

surrounding the greenback especially as the Federal Open Market

Committee (FOMC) moves away from its easing cycle.

How To Trade This Event Risk

Bullish USD Trade: NFPs Exceed Market Expectations

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar position, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

EUR/USD Daily Chart

- Will continue to look for lower highs/lows as the RSI retains the bearish momentum carried over from the end of 2013.

- Interim Resistance: 1.2580 (78.6% retracement) to 1.2625 (61.8% expansion)

- Interim Support: 1.2290 (100% expansion) to 1.2320 (38.2% expansion)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| SEP 2014 | 10/03/2014 12:30 GMT | 215K | 248K | -76 | -83 |

EURUSD M5 : 68 pips price movement by USD - Non-Farm Employment Change news event :

GBPUSD M5 : 54 pips price movement by USD - Non-Farm Employment Change news event :

USDCAD M5 : 50 pips price movement by USD - Non-Farm Employment Change news event :

U.S. Non-Farm Payrolls (NFPs) increased 248K in September after expanding a revised 142K the month prior, while the jobless rate unexpectedly slipped to a six-year low of 5.9% from 6.1% in August. The uptick in hiring certainly highlights an improved outlook for the world’s largest economy, and the bullish sentiment surrounding the U.S. dollar may gather pace over the remainder of the year as the Fed is widely expected to halt its asset-purchase program at the October 29 meeting. Indeed, the better-than-expected prints spurred a bullish dollar reaction, with the EUR/USD slipping below the 1.2550 handle to hit a fresh yearly low of 1.2501.